Rising Distracted Driving Trends: Insights from Arity’s Henry Kowal

Friday, April 26th, 2024 Risk & InsuranceSmartphone use behind the wheel surges, prompting a deep dive into the data with Arity’s expert.

The Premier National Overspray Claims Management Company

Sponsored Overspray Removal Specialists, IncOverspray Removal Specialists, Inc. provides service to insurance companies, TPAs, contractors, chemical refineries, power plants, military bases, universities, schools, auto dealerships, businesses, and individuals throughout the nation, Puerto Rico, and Canada.

Roofing Professionals Discuss Challenges and Solutions for Longer-Lasting Roofs

Apr 25th Reddit Catastrophe Insurance Industry PropertyRoofing experts explore why long-lasting roof systems are rare and discuss various materials that could extend roof longevity.

Recent Provider Listings

Recent Claims News

Upcoming Events

Technology Listings

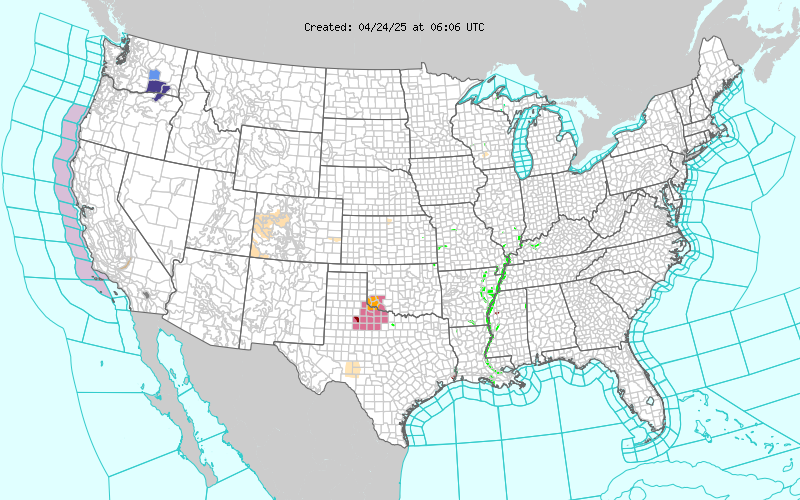

Recent Alerts & Warnings

Legal Perspectives on Complex Coverage Issues in Commercial Insurance

Unpack the legal complexities of commercial insurance coverage with a focus on recent case studies and judicial rulings. Learn about the legal frameworks that shape policy interpretations and dispute resolutions in the face of intricate coverage scenarios.

Revolutionizing Catastrophe Response with Mid-America Catastrophe Services

Discover how Mid-America Catastrophe Services combines decades of field-tested experience with cutting-edge technology to transform catastrophe claim management. This article explores their unique approach to ensuring timely, accurate, and empathetic claim resolution in the face of disaster, highlighting the synergy between traditional expertise and innovative practices for unmatched service delivery.

Emerging Trends in Health Coverage Disputes Amid Technological Advancements

Investigate how technological innovations are influencing health coverage disputes. This article highlights key trends and challenges in managing claims that involve new medical technologies and treatments, offering insights into fair and efficient dispute resolution.

The Challenges of Claim Adjustments in Shared Economy Insurances

Address the unique challenges faced by insurers in the shared economy sector. From ride-sharing to home-sharing, understand the complexities of claim adjustments and the need for dynamic policy frameworks in this rapidly evolving industry.

The Best Pros Network

Press Releases

Upcoming Webinars

Career Opportunities

Website Updates

Adjuster Update

Be sure to update your contact information to insure your access to all of the resources that we provide, as well as correspondence relating to the continuing education and career events across the country.

Update Your AccountTestimonials

"As a surplus lines brokerage, I constantly refer agents and customers that call in to Claims Pages for the forms, vendors, and resource tools to assist in everyday insurance handling."

Southern Insurance Underwriters

View More QuotesIndustry Stats

Have you ever wondered how many severe thunderstorms are required to cause $17B in annual losses? Will you ponder the total number of claims adjusters in the country and which companies employ the most?

Browse Our Stats