Lab Monkeys Escape After Mississippi Crash Raises Biohazard Concerns

After a truck crash in Mississippi released rhesus macaques from Tulane’s research program, conflicting reports and a lack of transparency raise public health and ethical concerns.

November 3, 2025

Catastrophe

Legislation & Regulation

Liability

Life & Health

Weird

Mississippi

CyberCube Estimates $38M to $581M in AWS Outage Losses with Limited Insurance Impact

A brief but widespread AWS outage affected over 70,000 organizations, but insurers expect minimal loss exposure due to short duration, reimbursements, and modeled risk expectations.

October 29, 2025

Catastrophe

Insurance Industry

Technology

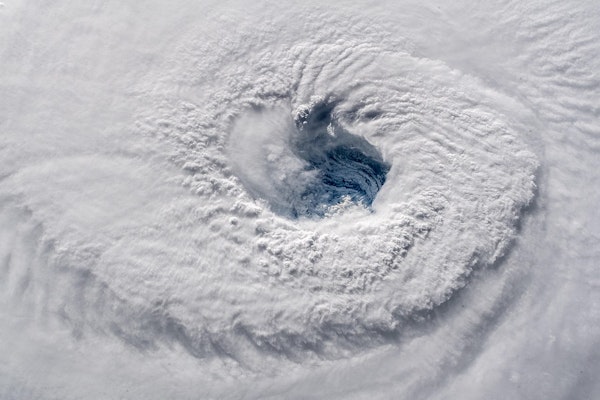

Catastrophic Hurricane Melissa Poised for Historic Category 5 Landfall in Jamaica

Hurricane Melissa is bearing down on Jamaica as a Category 5 storm, set to make what may become the island’s strongest landfall on record. Melissa has sustained winds well above 157 mph, is moving very slowly, and will trigger an extreme combination of storm surge, torrential rainfall, flash flooding and landslides.

October 28, 2025

Catastrophe

Insurance Industry

Property

2025 Home Insurance Severity Hits 7-Year High

Wind, hail, and water-related claims pushed severity up 9% in 2024, with catastrophe claims reaching a 7-year high of 42%. Adjusters must navigate rising costs, inflation pressures, and shifting risk patterns.

October 27, 2025

Catastrophe

Insurance Industry

Property

Risk Management

Fragmented Claims Funds Drain Insurer Liquidity and Delay Payments

Outdated fund management slows claims payments, erodes profits, and hurts customer retention across the insurance value chain.

October 27, 2025

Catastrophe

Insurance Industry

Technology

Wind, Water, Mudslide: Hurricane Melissa’s Triple Threat to Insured Assets in Jamaica

The Caribbean is under severe threat as Hurricane Melissa has rapidly intensified into a Category 5 hurricane and is projected to make landfall in Jamaica early this week. With maximum sustained winds around 160 mph and a crawl speed of approximately 3 mph, Melissa is poised to do unprecedented damage for the island.

October 27, 2025

Catastrophe

Insurance Industry

Property

Developing System in Caribbean Could Become Tropical Storm Melissa

Forecasters give the system an 80% chance of formation this week as it moves toward the Greater Antilles. No immediate Gulf Coast threat.

October 20, 2025

Catastrophe

Insurance Industry

Marine

Property

Risk Management

Why Stop-Loss Insurance Alone Won’t Control Catastrophic Claim Costs

As catastrophic medical claims rise, brokers must match stop-loss with aggressive claim management to protect self-funded plans.

October 20, 2025

Catastrophe

Insurance Industry

Life & Health

Climate-Driven Power Outages Projected to Surge for Vulnerable Coastal Communities

Projected cyclone-driven blackouts along the Gulf and Atlantic coasts could double by century’s end, with Hispanic and low-income communities facing the brunt of the impact.

October 17, 2025

Catastrophe

Property

AI-Powered Home ‘Digital Twins’ Aim to Revolutionize High-Risk Property Insurance

An MGA startup uses AI simulations to model catastrophe risks at the property level, targeting homes insurers often avoid. But what does it mean for claims handling?

October 17, 2025

Catastrophe

Property

Risk Management

Technology

California

Florida

USAA Faces $15M Final Judgment in Katrina Bad-Faith Case After Mississippi High Court Refuses Rehearing

The Mississippi Supreme Court has closed the door on an 18-year dispute, upholding nearly $15M in penalties against USAA for bad-faith claim handling after Hurricane Katrina.

October 16, 2025

Catastrophe

Legislation & Regulation

Litigation

Property

Mississippi

Western Caribbean Faces Heightened Hurricane Risk Through Late October

CSU researchers forecast above-normal Atlantic hurricane activity for mid to late October, with a focus on the western Caribbean.

October 16, 2025

Catastrophe

Property

Risk Management

Alabama

Florida

Louisiana

Mississippi

Texas

Why 2025’s Hurricane Season Has Been Quiet for U.S. Claims, So Far

The 2025 season has been quieter than recent years in terms of U.S. landfalls, but meteorologists say storm activity has still been near average. Coastal adjusters should stay alert through season’s end.

October 15, 2025

Catastrophe

Insurance Industry

Risk Management

Nor’easter and Alaska Storm Trigger Claims Risks With Fatalities, Flooding, and Power Outages

Back-to-back coastal storms disrupt infrastructure and displace residents, with early season indicators of increased catastrophe activity this fall.

October 14, 2025

Catastrophe

Insurance Industry

Marine

Property

Risk Management

Alaska

Massachusetts

New Jersey

New York

North Carolina

P/C Insurance Holds Steady in 2025 Despite Inflation, Tariffs, and Natural Disasters

Despite global uncertainty and catastrophe losses, the property/casualty insurance sector is on pace for a second profitable year. Adjusters should note shifts in underwriting performance across key lines.

October 10, 2025

Auto

Catastrophe

Insurance Industry

Property

Workers' Compensation

California