Insurance Industry Debates the Reliability and Future of Catastrophe Modeling

Monday, April 15th, 2024 Source: Insurance BusinessThe reliability of catastrophe modeling in insurance underwriting is under scrutiny as natural disasters drive unprecedented losses. Greg Case, CEO of Aon, emphasized in a recent interview the need for models that go beyond historical data to anticipate future catastrophe, cyber, and AI-related claims. This comes in light of the insurance industry facing over $100 billion in insured losses for the fourth consecutive year due to natural catastrophes, according to Aon’s report.

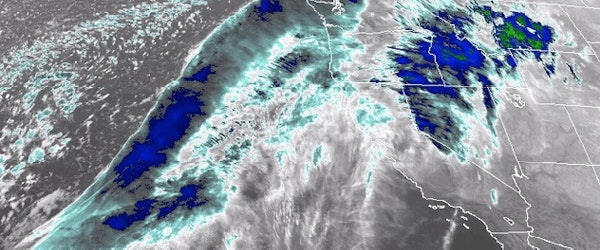

Experts argue that while catastrophe models are essential tools, they should not be the sole basis for underwriting decisions, especially for higher frequency and lower severity events like severe storms and wildfires. Chris Platania from Amwins highlighted the challenges in modeling such events accurately due to their increased frequency and evolving nature. He suggested that models need several years to refine their accuracy in capturing these risks.

Furthermore, Giovanni Garcia of Verisk discussed how current models incorporate thousands of scenarios to predict annual losses, yet there is still a significant gap between modeled outputs and actual losses. This discrepancy underscores the inherent limitations of predictive models, and the need for continual adaptation and enhancement, including the integration of advanced technologies like AI and machine learning.