Break the Doom Loop by Shifting from Conflict to Curiosity in Claims

Litigators and claims professionals can avoid prolonged disputes by shifting from adversarial thinking to a curious, problem-solving mindset focused on resolution.

March 27, 2025

Education & Training

Insurance Industry

Litigation

Risk Management

Why Homeowners Aren’t Buying Personal Cyber Insurance Despite Growing Risks

Despite rising cyber threats in connected homes, consumer adoption of personal cyber insurance remains low due to knowledge gaps, communication issues, and pricing concerns.

March 26, 2025

Education & Training

Property

Risk Management

Technology

Oregon Court Overturns Six-Figure Contingency Fee in Hartford Insurance Case

An Oregon appellate court has ruled against awarding attorney fees based on a percentage of recovery in an insurance settlement, emphasizing the importance of hourly rates.

March 25, 2025

Insurance Industry

Legislation & Regulation

Litigation

Property

Oregon

Segway E-Scooter Recall: Folding Mechanism Hazard Risks Rider Injury

A major recall of Segway e-scooters due to a faulty folding mechanism poses significant injury risks to riders. Learn how this impacts potential liability and claims.

March 25, 2025

Insurance Industry

Liability

Risk Management

Salvage

California

Weather Balloon Cuts Threaten Forecast Accuracy Amid Severe Season

National Weather Service balloon launch reductions, blamed on Department of Government Efficiency (DOGE) staff cuts, threaten forecast accuracy during severe weather season, raising concerns for claims adjusters.

March 25, 2025

Catastrophe

Insurance Industry

Legislation & Regulation

Risk Management

Technology

Colorado

Maine

Nebraska

New York

South Dakota

Gen Z’s Mortgage Risk: Climate Change & Insurance Costs

Rising insurance premiums and climate-related disasters are forcing Gen Z to scrutinize weather patterns before buying homes, reshaping the American Dream.

March 25, 2025

Catastrophe

Insurance Industry

Property

Risk Management

Technology

Florida

Texas

Millions of Homes Across the US Remain Uninsured Despite Growing Disaster Risks

A LendingTree study reveals that over 11 million U.S. homes lack insurance coverage, with the highest rates in disaster-prone states and metros, leaving homeowners financially exposed.

March 24, 2025

Catastrophe

Insurance Industry

Property

Risk Management

Texas Measles Outbreak Raises Alarms Nationwide as Infections Cross State Lines

Texas’ largest measles outbreak in decades has spread to New Mexico and Oklahoma, with experts warning it could become a national crisis without swift vaccination efforts.

March 24, 2025

Education & Training

Legislation & Regulation

Life & Health

Risk Management

Illinois

New Mexico

New York

Oklahoma

Texas

How Lithium-Ion Batteries Amplify Risk During Natural Disasters

Lithium-ion batteries pose increasing fire and environmental risks during natural disasters, prompting insurers, governments, and consumers to rethink safety and response strategies.

March 24, 2025

Catastrophe

Property

Risk Management

Technology

California

Florida

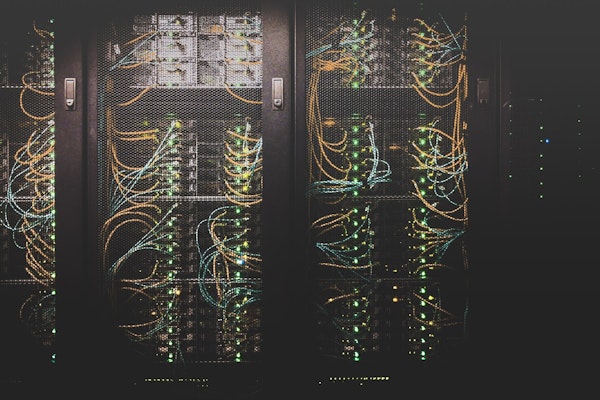

Construction Industry Faces Rising Insurance Risks Amid Data Center Boom and Labor Shortages

Global demand for data centers is driving construction growth, but rising costs, labor shortages, and climate risks are reshaping insurance pricing and underwriting strategies.

March 24, 2025

Catastrophe

Property

Risk Management

Technology

California

Root Insurance Pays $975K to Settle Data Breach That Exposed Driver’s License Info of Thousands in New York

New York AG Letitia James secured $975,000 from Root Insurance after a website vulnerability allowed hackers to steal over 44,000 New Yorkers’ driver’s license numbers.

March 24, 2025

Auto

Litigation

Risk Management

Technology

New York

Ohio

Kentucky Grants Temporary Registration for Unlicensed Adjusters After Severe Storms

Following tornadoes and severe storms on March 15, Kentucky is allowing unlicensed emergency adjusters to temporarily register and operate in three affected counties.

March 20, 2025

Catastrophe

Insurance Industry

Legislation & Regulation

Property

Kentucky

New York Attorney General Sues National General and Allstate Over Data Breaches

New York Attorney General Letitia James has filed a lawsuit against National General and its parent company, Allstate, alleging failures in protecting consumer data, leading to two cyberattacks that exposed thousands of driver’s license numbers.

March 11, 2025

Insurance Industry

Legislation & Regulation

Litigation

Technology

New York

Safelite Reaches $31 Million Settlement in Insurance Fraud Lawsuit

Safelite and a former employee reached a $31 million settlement in lawsuits alleging the company engaged in fraudulent billing practices for auto glass repairs and cleaning services.

March 11, 2025

Fraud

Insurance Industry

Legislation & Regulation

Litigation

California

Illinois

Tornado Strikes Florida TV Station During Live Broadcast

A tornado touched down near Orlando, Florida, striking a TV station during a live weather broadcast. Meteorologist Brooks Garner stayed on air as the storm passed over the studio.

March 11, 2025

Catastrophe

Insurance Industry

Property

Risk Management

Florida