Texas Adjuster Admits to Multi-Million Dollar Insurance Fraud Targeting Georgia Church

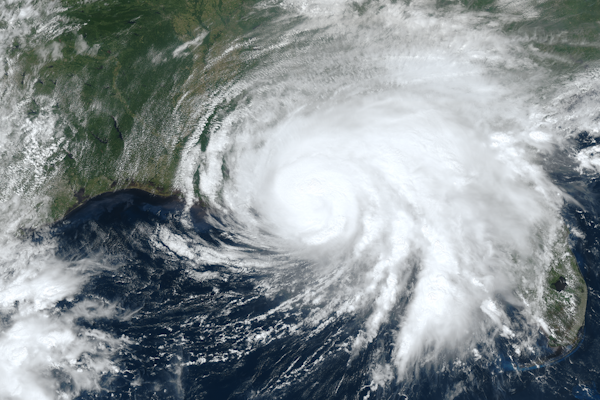

A Texas public adjuster already serving time for insurance fraud in Louisiana and Texas has pleaded guilty to defrauding a Georgia church and its insurer after Hurricane Michael.

March 31

Catastrophe

Fraud

Legislation & Regulation

Property

Georgia

Weather Balloon Cuts Threaten Forecast Accuracy Amid Severe Season

National Weather Service balloon launch reductions, blamed on Department of Government Efficiency (DOGE) staff cuts, threaten forecast accuracy during severe weather season, raising concerns for claims adjusters.

March 25

Catastrophe

Insurance Industry

Legislation & Regulation

Risk Management

Technology

Colorado

Maine

Nebraska

New York

South Dakota

Gen Z’s Mortgage Risk: Climate Change & Insurance Costs

Rising insurance premiums and climate-related disasters are forcing Gen Z to scrutinize weather patterns before buying homes, reshaping the American Dream.

March 25

Catastrophe

Insurance Industry

Property

Risk Management

Technology

Florida

Texas

Millions of Homes Across the US Remain Uninsured Despite Growing Disaster Risks

A LendingTree study reveals that over 11 million U.S. homes lack insurance coverage, with the highest rates in disaster-prone states and metros, leaving homeowners financially exposed.

March 24

Catastrophe

Insurance Industry

Property

Risk Management

How Lithium-Ion Batteries Amplify Risk During Natural Disasters

Lithium-ion batteries pose increasing fire and environmental risks during natural disasters, prompting insurers, governments, and consumers to rethink safety and response strategies.

March 24

Catastrophe

Property

Risk Management

Technology

California

Florida

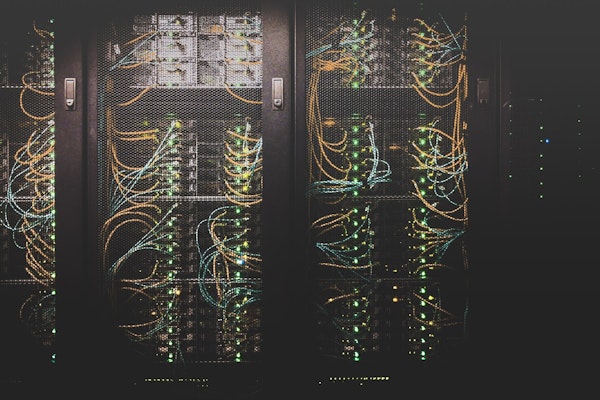

Construction Industry Faces Rising Insurance Risks Amid Data Center Boom and Labor Shortages

Global demand for data centers is driving construction growth, but rising costs, labor shortages, and climate risks are reshaping insurance pricing and underwriting strategies.

March 24

Catastrophe

Property

Risk Management

Technology

California

Kentucky Grants Temporary Registration for Unlicensed Adjusters After Severe Storms

Following tornadoes and severe storms on March 15, Kentucky is allowing unlicensed emergency adjusters to temporarily register and operate in three affected counties.

March 20

Catastrophe

Insurance Industry

Legislation & Regulation

Property

Kentucky

Tornado Strikes Florida TV Station During Live Broadcast

A tornado touched down near Orlando, Florida, striking a TV station during a live weather broadcast. Meteorologist Brooks Garner stayed on air as the storm passed over the studio.

March 11

Catastrophe

Insurance Industry

Property

Risk Management

Florida

Maryland Wildfires Decline in 2024, Falling Below Recent Averages

Maryland saw 165 wildfires in 2024, burning 953.4 acres. Arson was the leading cause, while the Eastern region had the most fires and acres burned. Learn more about key trends.

March 7

Catastrophe

Legislation & Regulation

Property

Risk Management

Maryland

Key Barriers to Closing the Insurance Protection Gap Identified in Industry Poll

A recent poll highlights the biggest obstacles to addressing the global insurance protection gap, with conflicting priorities, data gaps, and regulatory issues emerging as major challenges.

March 7

Catastrophe

Insurance Industry

Legislation & Regulation

Risk Management

California

Insurers Pay Nearly $7 Billion for Los Angeles County Wildfire Claims

Over 33,000 insurance claims have been filed following the Los Angeles County wildfires, with insurers paying $6.9 billion to date. California’s insurance commissioner has issued orders to expedite claim payments and prevent policy cancellations.

March 7

Catastrophe

Legislation & Regulation

Property

Risk Management

California

Insurance Industry Grapples with Escalating Natural Disaster Risks

As extreme weather events grow in frequency and severity, insurers must adapt through innovation, risk modeling, and new risk transfer strategies to remain viable.

March 5

Catastrophe

Legislation & Regulation

Property

Risk Management

California

AI Analysis Reveals $2.15 Trillion in US Property at Risk from Wildfires

A new AI-driven study by ZestyAI finds that $2.15 trillion worth of U.S. residential property is at high risk of wildfire damage, affecting millions of homes beyond historically fire-prone regions.

February 27

Catastrophe

Insurance Industry

Property

Underwriting

California

Colorado

Kentucky

North Carolina

South Dakota

How AI and IoT Are Transforming Risk Management

AI, IoT, and blockchain are revolutionizing risk management by enabling insurers to predict and prevent losses, reducing costs and improving safety through real-time data analysis.

February 26

Catastrophe

Insurance Industry

Risk Management

Technology

Heavy Snowfall Causes Roof Collapses Across Central New York

Oswego County officials report at least 26 roof collapses following record snowfall, prompting emergency measures and rescue efforts as structural risks continue to rise.

February 24

Catastrophe

Insurance Industry

Property

Risk Management

New York