Advancements in Data Analytics for Streamlining Claims Processes

Editorial Series January 2025 Vol. 2 Issue. 11Welcome to this month’s editorial series, "Advancements in Data Analytics for Streamlining Claims Processes." The role of data in claims management is evolving at a rapid pace, empowering adjusters with smarter tools, faster insights, and greater precision in decision-making. With the right analytics strategies, claims professionals can reduce inefficiencies, prevent fraud, and improve policyholder experiences—all while staying ahead in a competitive industry.

This series explores the cutting-edge methods that are transforming claims processing, from predictive modeling and automation to real-time reporting and fraud detection. Each article provides practical guidance on leveraging data to optimize workflows, minimize losses, and enhance accuracy.

Through expert insights and actionable strategies, we’ll show how adjusters can harness the power of analytics to work more efficiently and make confident, informed decisions. By integrating data-driven approaches into daily operations, claims professionals can elevate their effectiveness and drive meaningful improvements across the industry.

The Power of Data Integration Across Claims Systems

Real Time Reporting Driving Faster Claims Resolutions

Uncovering Fraud Before It Happens With Data Science

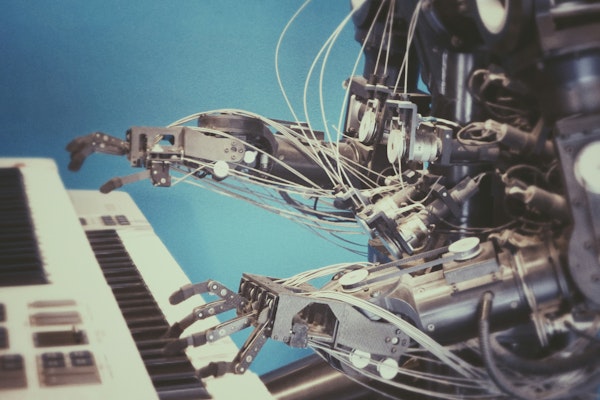

Automation Meets Intelligence in Claims Handling