Scattered Spider Cyber Threat Targets US Airline and Transport Industries

The FBI issues urgent warnings as the Scattered Spider cybercriminal group pivots its attacks from UK retailers to airlines and transport organizations across the US.

June 30

Education & Training

Liability

Risk Management

Technology

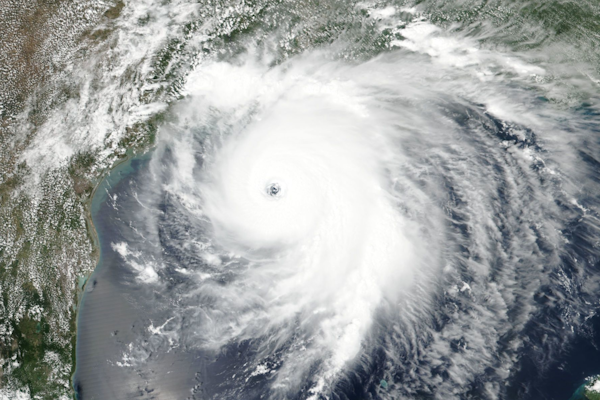

Loss of Military Satellite Data May Affect Hurricane Forecast Accuracy

Critical satellite data used for predicting rapid hurricane intensification will end June 30, potentially complicating forecasts during peak hurricane season.

June 30

Catastrophe

Property

Risk Management

Technology

Italian Executives Receive Lengthy Prison Terms for PFAS Pollution

Executives of a chemical plant in Italy face significant jail sentences after court finds them responsible for extensive PFAS contamination affecting drinking water.

June 30

Legislation & Regulation

Liability

Litigation

Risk Management

Cyber Risk and Technology Trends Reshaping Business Resilience in 2025

Executives’ cyber risk awareness is climbing, yet a misplaced confidence in cyber resilience persists amid escalating threats and geopolitical instability.

June 30

Legislation & Regulation

Liability

Risk Management

Technology

California

Modernizing Insurance Claims Payment Infrastructure for Greater Efficiency and Trust

Research reveals that fragmented back-end financial systems hinder timely claims payments and increase risks, highlighting the need for integrated, real-time solutions.

June 30

Education & Training

Insurance Industry

Risk Management

Technology

Auto Claims Profitability Improves Amid Rising Casualty Costs and Trade Issues

Insurance industry sees auto physical damage profitability recover, while casualty sectors grapple with increased medical inflation and social verdicts.

June 25

California

Colorado

Florida

Illinois

New Jersey

Federal Judge Rules Anthropic’s Book Use Fair but Piracy Still Faces Penalty

A San Francisco federal judge declares Anthropic’s AI book training fair use, yet rules storing millions of pirated copies illegal, setting stage for potential damages.

June 25

Legislation & Regulation

Litigation

Risk Management

Technology

California

How PFAS Influence Environmental Liability Risks in Construction Projects

Westfield Specialty’s Dennis Willette explores how PFAS contaminants shape environmental liability coverage in construction and why contractors need this insurance.

June 25

Legislation & Regulation

Liability

Property

Risk Management

Wildfires and Storms Drive Record Claim Severity in Early 2025 as Volume Hits Five-Year Low

Despite costly California wildfires and severe storms in Texas and the Midwest, property claim volume in Q1 2025 dropped to its lowest level in five years, Verisk reports.

June 24

Catastrophe

Insurance Industry

Property

Risk Management

AI and Value-Based Care Are Transforming Workers’ Comp Claims Management

Artificial intelligence and outcome-focused care models are streamlining workers’ compensation by improving triage, reducing costs, and prioritizing long-term recovery outcomes.

June 24

Life & Health

Risk Management

Technology

Workers' Compensation

Ohio

Why Florida, Texas, and California Lead the Nation in Lightning Insurance Claims

Florida, Texas, and California consistently rank highest for lightning-related insurance claims due to storm frequency, surge damage, and wildfire-triggered losses.

June 24

Catastrophe

Insurance Industry

Property

Risk Management

California

Florida

Texas

Insurance Leaders Highlight Litigation and AI Trends at JIF 2025 Forum

Insurance executives discuss navigating escalating litigation risks and embracing generative AI to enhance efficiency and rebuild consumer trust amid evolving uncertainties.

June 24

Insurance Industry

Legislation & Regulation

Litigation

Technology

Florida

Frustrating Digital Claims Processes Keep 20% of Consumers from Filing

A recent Insurity survey highlights the importance of blending digital convenience with human support to enhance policyholder satisfaction and claims experiences.

June 24

Auto

Insurance Industry

Property

Technology

Inside the Auto Glass Fraud Crisis

Auto glass scams are costing U.S. drivers billions, fueled by deceptive ‘free’ repairs and AOB schemes. Insurers and lawmakers are responding with pre-inspection programs and tougher penalties.

June 23

Auto

Fraud

Legislation & Regulation

Litigation

Florida

Kentucky

Three Arrested in California Farmhouse Arson and $200K Insurance Fraud Scheme

Federal, state and local investigators allege three men—including a municipal vice mayor and a school board trustee—set a Northern California farmhouse ablaze and filed false insurance claims to net $200,000.

June 23

Fraud

Insurance Industry

Litigation

Property

California