Maximizing AI Benefits in Claims Handling

Tuesday, December 19th, 2023 Claims Pages Staff Improving Claims Efficiency Through TechnologyPart One: Understanding AI's Role in Claims Handling

As we delve into the world of AI and its implications for claims handling, it's essential to first understand what AI entails. At its core, AI refers to the simulation of human intelligence in machines programmed to think and learn like humans. This technology has the potential to significantly alter how claims are processed, managed, and resolved.

One of the primary benefits of AI in claims handling is its ability to process large volumes of data at unprecedented speeds. In the context of insurance claims, this means quicker claims processing, more accurate risk assessment, and enhanced fraud detection. AI systems can analyze data from various sources, including past claims, policyholder information, and external databases, to make informed decisions. This not only speeds up the claims process but also reduces the likelihood of human error, ensuring more accurate outcomes.

Another significant advantage of AI in this field is its predictive capabilities. By analyzing patterns and trends in historical data, AI can predict future claims occurrences, enabling insurers to prepare and respond more effectively. This predictive analysis is particularly useful in anticipating and mitigating risks, leading to a more proactive approach in claims management.

However, implementing AI in claims handling isn't without its challenges. One of the primary hurdles is the integration of AI systems into existing claims management processes. This integration requires significant investment in technology, training, and changes to operational procedures. Claims professionals need to be equipped with the skills to work alongside AI systems, which may involve a steep learning curve for some.

Furthermore, the reliance on data quality is paramount in AI's effectiveness. AI systems are only as good as the data they process. Inaccurate or incomplete data can lead to erroneous conclusions, negatively impacting claims decisions. This places a significant emphasis on maintaining high-quality data inputs, a task that can be challenging given the vast amounts of data handled in claims processing.

As we move deeper into the realm of AI, it's also crucial to consider the ethical implications of using such technology. Questions around privacy, data security, and the potential for bias in AI algorithms need to be addressed. Ensuring that AI systems are transparent and accountable is essential in maintaining trust between insurers, claims professionals, and policyholders.

Part Two: Diverse Applications of AI in Claims Handling

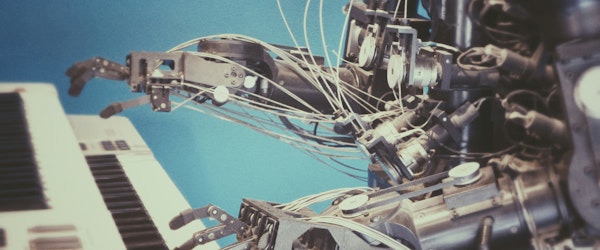

The applications of AI in claims handling are diverse and continuously evolving. One of the most prominent uses is in automating routine tasks. AI-powered chatbots and virtual assistants, for instance, can handle initial claim intakes, customer queries, and provide status updates, thereby freeing up human adjusters to focus on more complex aspects of claims management. This not only increases efficiency but also improves customer satisfaction by providing quick and accurate responses.

Another significant application is in fraud detection. AI systems, with their ability to analyze vast amounts of data and recognize patterns, are incredibly adept at identifying potentially fraudulent claims. They can scrutinize claims against a database of known fraud indicators and flag any suspicious activities for further investigation. This not only helps in reducing fraudulent payouts but also aids in maintaining the integrity of the insurance process.

AI is also transforming the way claims are assessed and processed. Advanced image recognition technologies can evaluate photographs of damaged property or vehicles, providing quick and accurate damage assessments. This can significantly reduce the time taken to process claims, as well as the costs associated with sending human assessors to evaluate damages in person.

However, the deployment of AI in these areas is not without challenges. One of the major challenges is ensuring the accuracy of AI algorithms. While AI can process data at an unprecedented rate, the decisions it makes are only as good as the data it's trained on. Biased or incomplete datasets can lead to inaccurate outcomes. This necessitates continuous monitoring and updating of AI models to ensure they remain accurate and fair.

Moreover, there's the challenge of integrating AI systems into existing IT infrastructures. Many insurance companies operate on legacy systems that are not readily compatible with the latest AI technologies. Upgrading these systems can be costly and time-consuming. Furthermore, there's the challenge of ensuring that these systems can communicate with each other seamlessly, which is essential for the efficient functioning of AI applications.

The human aspect also presents a challenge. The introduction of AI in claims handling can be met with resistance from employees who may fear being replaced by machines. It's crucial for companies to address these concerns by emphasizing that AI is a tool to aid, not replace, human workers. Training and upskilling employees to work alongside AI is essential in ensuring a smooth transition and the effective use of technology.

The applications of AI in claims handling present a multitude of benefits, from efficiency gains to enhanced accuracy and customer satisfaction. However, realizing these benefits requires navigating the challenges of data accuracy, system integration, and human-machine collaboration.

Part Three: Preparing for the AI-Enhanced Future in Claims Handling

The integration of AI into claims handling is not a distant future scenario; it's a rapidly unfolding reality. To effectively harness the potential of AI, claims professionals need to be proactive in their approach to learning and adapting to new technologies.

Education and continuous learning are key. Claims professionals should seek opportunities for training in AI and related technologies. This could include formal education programs, online courses, workshops, and industry conferences. Understanding the basics of AI, machine learning, and data analytics is crucial, not only for using these technologies effectively but also for understanding their limitations and ethical implications.

Moreover, the role of claims professionals is likely to evolve. With AI handling routine tasks and data analysis, the focus of claims professionals may shift towards more complex decision-making, customer interactions, and fraud investigation. Skills such as critical thinking, emotional intelligence, and advanced problem-solving will become increasingly important. Professionals who can combine their domain expertise with a solid understanding of AI will be invaluable in this new landscape.

Another critical aspect is the ethical use of AI. Claims professionals must be aware of and actively engage in discussions around the ethical implications of AI, such as data privacy, security, and bias. Ensuring transparency in AI decision-making processes and maintaining the trust of policyholders is paramount. This includes being able to explain the basis of AI-driven decisions and addressing any concerns policyholders may have about the use of their data.

Adapting to an AI-enhanced claims environment also means staying abreast of emerging trends and innovations. The field of AI is dynamic, with continual advancements. Keeping up with these changes and understanding how they can impact claims handling will be crucial for staying competitive and providing the best service to policyholders.

Collaboration will play a key role in this transition. Claims professionals should work closely with technologists, data scientists, and other stakeholders in the design and implementation of AI systems. This collaborative approach ensures that the systems developed are not only technologically sound but also aligned with the practical realities of claims handling.

In conclusion, the integration of AI into claims handling presents an exciting opportunity for claims professionals. It offers the potential for greater efficiency, accuracy, and customer satisfaction. However, maximizing these benefits requires a thoughtful approach to the adoption of AI. By embracing continuous learning, adapting to evolving roles, engaging in ethical considerations, staying updated with emerging trends, and collaborating across disciplines, claims professionals can lead the way in harnessing the power of AI in claims handling. As we move forward, it's clear that AI will be a key driver in shaping the future of the insurance industry, and those who are prepared will be at the forefront of this transformation.

Deepen your understanding of technology in claims management by exploring our comprehensive series. Each article offers detailed insights and practical strategies to enhance your approach to claims efficiency. From embracing automation and AI to mastering data management and digital customer engagement tools, our series covers the essential elements of technological advancements in claims handling. Elevate your skills and knowledge in this pivotal area, ensuring your success in the fast-paced world of claims management.