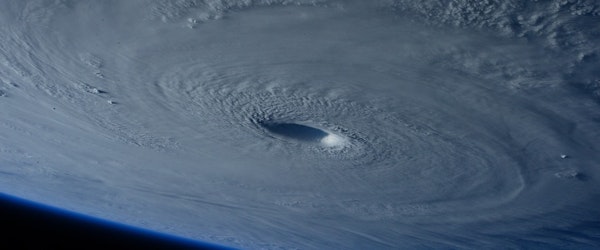

Parametric Reinsurance Contract Triggers For Hurricane Ian Damages

Wednesday, December 7th, 2022 Source: Insurance BusinessArbol, an insurtech platform underwriting climate and weather insurance, has delivered a $10-million parametric insurance payout to property and casualty (P&C) company Centauri Insurance, only weeks after the hurricane struck in late September.

This is the first known parametric insurance payout for damages related to Ian, according to Arbol. It was made less than three weeks after the Category 4 storm made landfall in Florida.

Arbol used a combination of ‘non-traditional and traditional sources of capital’ for the reinsurance payout.

‘We structured a parametric insurance contract that customized the triggers to meet the needs of [Centauri’s] standard home insurance portfolio,’ said Siddharta Jha, CEO of Arbol.

‘The parameters are based on hurricane track data, the wind speed of the hurricane as it passes through different local points in the state, and so on.’ Arbol has the capability to track hurricane data to a high accuracy, Jha said.