Estimating Claims Remotely? Uncover Potential Fraud In Digital Loss Images

Wednesday, April 22nd, 2020 Auto Fraud TechnologyThe COVID-19 outbreak has had a tremendous impact on every aspect of life in the United States. Like most companies, the insurance industry has had to drastically alter the way it does business.

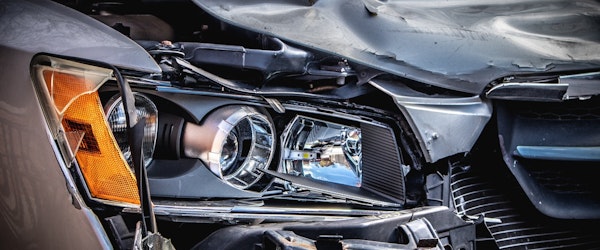

Claims adjusters are now working at home, relying on customer-submitted images and videos to inspect and appraise damages for the foreseeable future.

And even after the pandemic abates, the disruption the virus has caused will likely result in permanent shifts in the way carriers investigate claims.

Insurers have made great strides in recent years in adopting photo-based estimates as the industry has become more digital. Consider this: Photo estimates for auto claims increased tenfold from 2016 to 2017.

Consumers have also embraced the technology, as J.D. Power reports 42 percent of claimants submit vehicle loss images or videos to insurers.

Carriers have primarily used photo estimates for simple, low-value claims—such as auto glass losses or minor property damage—that they automatically pay if it’s under a certain threshold. But with stay-at-home orders in effect across much of the country, insurers are forced to expand to claims with larger loss values. And that can be a game changer.