Progressive Faces Class Action Over Alleged Denial of Collision Insurance in Massachusetts

Monday, November 11th, 2024 Auto Insurance Industry Legislation & Regulation LitigationProgressive Direct Insurance Co. faces a class-action lawsuit in Massachusetts, where the insurer is accused of unlawfully denying collision insurance coverage to policyholders under a vague "binding restriction." The lawsuit, filed in Suffolk County Superior Court, claims Progressive failed to specify the legal basis for such refusals, which allegedly contradict Massachusetts state law. This law requires auto liability providers to make various physical damage coverages available, including collision, theft, fire, and comprehensive. State statute limits denial to six specific reasons, such as fraud, theft convictions, or high-theft-risk vehicles lacking anti-theft technology, none of which are said to apply to the drivers in this suit.

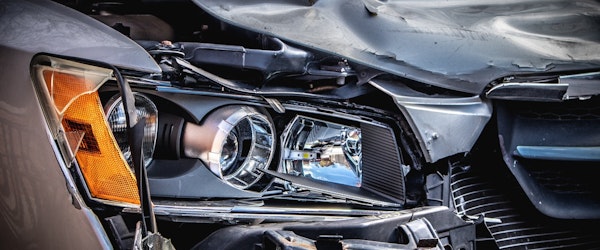

The case includes drivers like Danielle Gondola, a Massachusetts Progressive customer who claims her request for collision coverage was denied shortly after she took out her policy. Gondola’s vehicle was later totaled in an accident, but her collision claim was rejected by Progressive. The complaint argues that this denial of coverage potentially affects hundreds of drivers under Progressive’s "binding restriction" policy, impacting Massachusetts customers from November 2020 to the present.

The legal action follows Progressive’s recent announcement of strong financial gains, including an expanded underwriting margin and significant growth in policyholders. With Progressive’s current status as a leading auto insurer in Massachusetts, the case could have considerable financial implications and regulatory repercussions.