Workers Compensation Report Highlights Profitable Year in 2023

NCCI’s State of the Line report reveals a profitable year for workers compensation in 2023, with underwriting gains, premium growth, and declining claim frequency contributing to industry success.

October 21

Insurance Industry

Risk Management

Underwriting

Workers' Compensation

2024 U.S. Home Trends Report Reveals Impact of Hail and Catastrophes on Insurance Costs

The latest LexisNexis U.S. Home Trends Report shows increasing home insurance loss costs, driven by hail and catastrophic claims, while some weather-related perils saw declining severity in 2023.

October 21

Catastrophe

Insurance Industry

Property

Risk Management

Natural Catastrophe Losses in 2024 Near Average Amid Escalating Late-Season Storm Risks

Insured losses from global natural catastrophes exceeded the 10-year average, driven by frequent storms and floods, while total economic losses for 2024 remained slightly below average.

October 17

Catastrophe

Insurance Industry

Property

Risk Management

Florida

North Carolina

Tennessee

Virginia

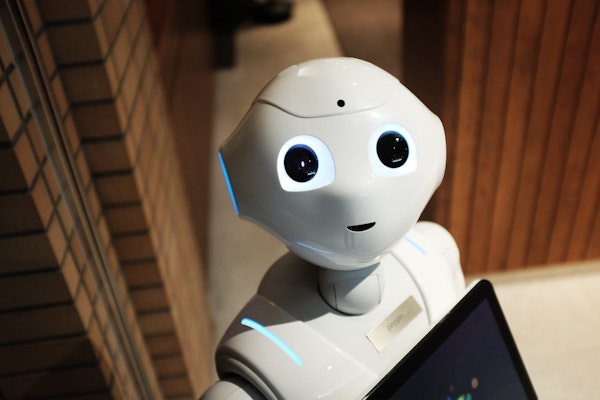

How AI and Cloud Technology Drive Agile Claims Transformation

AI, cloud computing, and data-driven platforms offer insurers an agile way to modernize claims processes, enabling incremental improvements while enhancing customer experience and reducing costs.

October 15

Insurance Industry

Risk Management

Technology

Hurricane Milton’s Impact on Florida Buildings Matches or Exceeds Hurricane Helene’s

ICEYE’s initial data suggests that Hurricane Milton has caused damage to as many as, or more than, 150,000 buildings in Florida, a count that rivals Hurricane Helene’s impact. Early loss estimates range from $15 billion to $40 billion.

October 14

Catastrophe

Insurance Industry

Property

Technology

Florida

AI’s Role in Solving the Underwriting Talent Shortage

With the insurance industry facing a major talent gap, AI and generative AI can enhance underwriting efficiency by mimicking the expertise of top professionals, leading to better policies and profitability.

October 14

Insurance Industry

Risk Management

Technology

Underwriting

Federal Incentive Cuts in High-Risk Areas Improve Flood Resilience, Study Finds

A recent study highlights how removing federal subsidies from climate-vulnerable areas can reduce development, increase flood resilience, and generate savings, while emphasizing the challenges of balancing housing demand with disaster risk.

October 14

Catastrophe

Insurance Industry

Legislation & Regulation

Risk Management

California

New York

Oklahoma

Tornado Sends Industrial Dumpster Onto Roof in Palm Beach Gardens Neighborhood

A powerful tornado, part of Hurricane Milton’s aftermath, caused significant damage in Palm Beach Gardens, Florida, including launching an industrial dumpster onto a home’s roof.

October 11

Catastrophe

Insurance Industry

Property

Risk Management

Florida

How Generative AI Is Transforming the Insurance Industry

Generative AI has the potential to revolutionize the insurance industry by streamlining operations, enhancing customer service, and improving risk management. However, insurers must address ethical, regulatory, and data challenges to fully unlock its benefits.

October 11

Fraud

Insurance Industry

Risk Management

Technology

Colorado

Catastrophe Bond Investors Dodge Severe Losses Following Hurricane Milton

After Hurricane Milton weakened before landfall, investors in catastrophe bonds are facing losses well below earlier estimates, with single-digit hits predicted instead of the feared 15%.

October 11

Catastrophe

Insurance Industry

Property

Risk Management

Florida

Texas

Florida’s Property Insurance Market Strengthens After Major Hurricanes

Despite recent hurricane challenges, Florida’s property insurance market is showing resilience, with reforms leading to rate reductions, new insurer entries, and declining reinsurance costs in 2024.

October 11

Insurance Industry

Legislation & Regulation

Property

Risk Management

Florida

New Emergency Rule Boosts Claims Transparency for Florida Insurance Consumers

Florida’s CFO Jimmy Patronis has introduced an emergency rule to improve the claims adjustment process, requiring adjusters to disclose changes to damage estimates and provide detailed explanations for any modifications, ensuring transparency for insurance policyholders.

October 11

Catastrophe

Insurance Industry

Legislation & Regulation

Property

Florida

Perrier Faces Contamination Crisis as Water Source Suffers Fecal and Pesticide Pollution

Perrier, a leading luxury water brand, faces a contamination crisis after fecal matter and banned pesticides were found in its wells. With production halted and millions of bottles destroyed, Nestlé’s management of the iconic brand is under scrutiny.

October 11

Insurance Industry

Legislation & Regulation

Property

Risk Management

Former Insurance Agent Convicted for Fraud After Stealing Nearly $200,000 in Premiums

A former insurance agent from Mission Viejo has been convicted on 90 counts of insurance fraud, theft, and elder abuse after stealing nearly $200,000 in premium payments and leaving 32 clients without coverage.

October 11

Fraud

Insurance Industry

Litigation

Property

California

Second Umpire Alleges Retaliation in Lawsuit Against MLB

A second minor league umpire claims wrongful termination in a lawsuit against Major League Baseball, alleging retaliation after he reported being sexually assaulted by a female colleague.

October 11

Insurance Industry

Legislation & Regulation

Litigation

Workers' Compensation

Arizona

New York

Recent Claims News

Fraud

Legislation & Regulation

Risk Management

Auto

Fraud

Litigation

Insurance Industry

Risk Management

Underwriting

Recent Provider Listings

Serving Dallas & Surrounding Areas

Texas

Accident Reconstruction Services

Emergency Disaster Response Services

Fire & Water Damage Restoration

Serving Florida Statewide

Florida

Accident Investigations

Insurance Fraud Investigations

Surveillance