Insurance Adjusters Rely on Printed Documentation for Field Work

Field Insurance adjusters face an interesting dilemma: they require dependable access to documentation, but the technology often fails to meet their needs.

March 5

Sponsored

Fair Housing Act Compliance and Insurance Standards Guide

This guide outlines the application of the federal Fair Housing Act (FHA) to property insurance underwriting and claims handling.

March 5

Sponsored

When Expectations Become the Standard

Exceeding expectations once is impressive but doing it consistently requires a cultural commitment. From training and mentorship to leadership modeling and peer accountability, claims organizations that embed client-centric values into daily operations create lasting differentiation and build reputations that attract and retain both talent and clients.

February 27

Claims Pages Staff

The Partner Behind the Promise

Delivering an exceptional policyholder experience requires more than good intentions—it demands the right systems, the right people, and the right partner. Aspen Claims Service’s Claims Plus Approach is built around the belief that every claim is an opportunity to exceed expectations, combining proactive communication, faster turnaround times, and a nationwide network of adjusters committed to putting policyholders first.

February 27

Aspen Claims

Measuring What Matters in Client Satisfaction

Cycle time and closure rates tell part of the story but not the whole picture. Adjusters and claims organizations that track meaningful satisfaction indicators, gather policyholder feedback, and act on insights can identify gaps in service delivery and continuously raise the bar on the client experience.

February 27

Claims Pages Staff

Proactive Communication as a Competitive Advantage

Silence during a claim is one of the fastest ways to erode policyholder trust. Adjusters who embrace proactive communication anticipate questions, provide updates before they are asked, and explain next steps clearly, transforming the claims experience from a source of stress into a demonstration of reliability.

February 27

Claims Pages Staff

Building a Claims Process Around the Policyholder

Traditional claims workflows were built for efficiency but not always for the people navigating them. By rethinking processes with the policyholder's perspective in mind, adjusters can eliminate unnecessary friction, improve communication touchpoints, and deliver outcomes that truly reflect client-first values.

February 27

Claims Pages Staff

The First Impression That Lasts

The first interaction a policyholder has with their adjuster often defines the entire claims experience. By combining empathy with clear communication from day one, adjusters can build trust, reduce anxiety, and set the stage for smoother resolutions that exceed expectations.

February 27

Claims Pages Staff

Supply Chain for Oil and Gas Industry: Trends and Innovations

The oil and gas supply chain used to be straightforward. All players (extraction, transport, refining) worked within strict frameworks, following clear scripts.

February 26

Sponsored

Buy WoW Carry and What It Typically Includes

Many players miss what a modern World of Warcraft carry actually bundles. When you decide to buy WoW carry, you’re rarely paying for a single boss kill.

February 18

Sponsored

How Continuing Education Software Supports Lifelong Skill Growth?

Learning does not stop after formal education. People need to adapt and grow throughout their lives. Continuing education software helps individuals keep up with new skills and knowledge.

February 13

Sponsored

How AI in Insurance Changes Claims Settlement and Appraisals

Insurance specialists struggle with messy datasets every day. AI in insurance is a massive headache for appraisers who cannot keep up with data.

February 6

Sponsored

Keeping Humans in Control of Predictive Tools

Predictive analytics works best when it supports judgment rather than replacing it. Clear governance, transparency, and practical workflow guardrails help ensure models are used responsibly and consistently. When adjusters understand what a score means and what it does not mean, the tools become a real advantage instead of a black box.

January 27

Claims Pages Staff

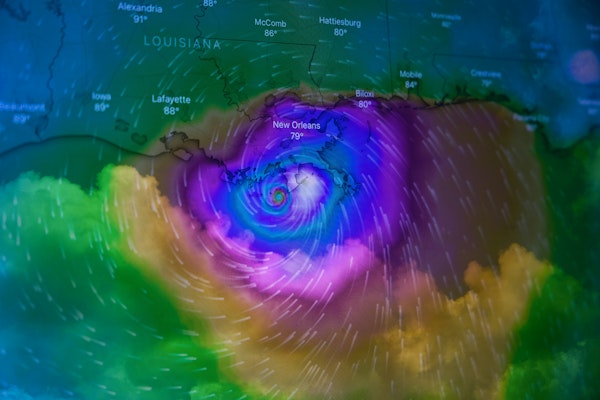

Forecasting Severity in Weather Driven Events

Weather events rarely arrive without warning, but claims operations still get caught flat-footed. By pairing weather data with historical claims outcomes, teams can better forecast where severity will concentrate and what resources will be needed. Adjusters benefit from better staging, clearer expectations, and fewer operational surprises.

January 27

Claims Pages Staff

Reducing Leakage by Predicting Claim Friction

Many of the most expensive claims follow familiar paths toward dispute, supplement, or prolonged cycle time. Predictive analytics can surface the conditions that increase friction such as documentation gaps, vendor patterns, or scope volatility. Catching those signals early helps adjusters protect accuracy and control cost without sacrificing fairness.

January 27

Claims Pages Staff