Supply Chain for Oil and Gas Industry: Trends and Innovations

The oil and gas supply chain used to be straightforward. All players (extraction, transport, refining) worked within strict frameworks, following clear scripts.

February 26

Sponsored

Buy WoW Carry and What It Typically Includes

Many players miss what a modern World of Warcraft carry actually bundles. When you decide to buy WoW carry, you’re rarely paying for a single boss kill.

February 18

Sponsored

How Continuing Education Software Supports Lifelong Skill Growth?

Learning does not stop after formal education. People need to adapt and grow throughout their lives. Continuing education software helps individuals keep up with new skills and knowledge.

February 13

Sponsored

How AI in Insurance Changes Claims Settlement and Appraisals

Insurance specialists struggle with messy datasets every day. AI in insurance is a massive headache for appraisers who cannot keep up with data.

February 6

Sponsored

Keeping Humans in Control of Predictive Tools

Predictive analytics works best when it supports judgment rather than replacing it. Clear governance, transparency, and practical workflow guardrails help ensure models are used responsibly and consistently. When adjusters understand what a score means and what it does not mean, the tools become a real advantage instead of a black box.

January 27

Claims Pages Staff

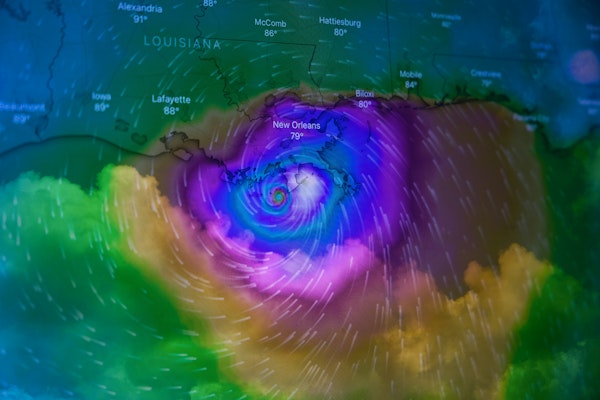

Forecasting Severity in Weather Driven Events

Weather events rarely arrive without warning, but claims operations still get caught flat-footed. By pairing weather data with historical claims outcomes, teams can better forecast where severity will concentrate and what resources will be needed. Adjusters benefit from better staging, clearer expectations, and fewer operational surprises.

January 27

Claims Pages Staff

Reducing Leakage by Predicting Claim Friction

Many of the most expensive claims follow familiar paths toward dispute, supplement, or prolonged cycle time. Predictive analytics can surface the conditions that increase friction such as documentation gaps, vendor patterns, or scope volatility. Catching those signals early helps adjusters protect accuracy and control cost without sacrificing fairness.

January 27

Claims Pages Staff

Smarter Triage With Predictive Scoring

Not every claim needs the same level of attention at the same time. Predictive scoring can help identify severity risk, complexity risk, and potential friction early so adjusters can triage smarter. The result is faster movement on routine files and earlier focus on claims likely to escalate.

January 27

Claims Pages Staff

Turning Claims Data Into Early Warning Signals

Claims data often reveals what is coming next if you know where to look. Frequency shifts, repeating loss drivers, and regional clustering can signal an emerging trend before volume spikes. Learning to read these signals helps adjusters prepare, prioritize, and reduce downstream surprises.

January 27

Claims Pages Staff

How Professional Tree Transplanting Protects Landscapes and Reduces Liability

Trees add beauty, structure, and long-term value to properties. Yet, when improperly placed or poorly maintained, they can become significant hazards, especially near buildings, driveways, power lines, or sidewalks.

January 26

Sponsored

Why Device Security Matters for Claims Professionals Handling Sensitive Information

Claims professionals find themselves in a unique position, having access to volumes of sensitive personal, financial, and medical data about their clients, which they alone possess. It naturally makes them a prime target for malicious intent.

January 26

Sponsored

Trends in South Carolina Homeowners Insurance Rates

Insurance companies operating in South Carolina are facing one of the toughest property-insurance environments in the country. While homeowners often see rising premiums as simple price increases, the reality is far more complex.

December 29

Sponsored

When Volume Spikes Your Partner Matters

Catastrophe response is a test of capacity, consistency, and trust. Aspen Claims Service was built to step in as an extension of your team with nationwide adjuster availability, strict service delivery guidelines, and proactive communication that keeps policyholders informed. When the storm creates an instant surge, our Claims Plus Approach helps you stay in control and protect the experience your policyholders remember.

December 20

Aspen Claims

Maintaining Policyholder Trust During Disasters

When communities are disrupted, policyholders look to adjusters for clarity and reassurance. Transparent communication, realistic timelines, and consistent follow-through help maintain trust during emotionally charged situations. Strong relationships can be preserved even in the most challenging claim environments.

December 19

Claims Pages Staff

Coordinating Field and Desk Teams Under Pressure

Disaster response depends on seamless coordination between field and desk adjusters. Clear communication channels and aligned expectations reduce delays and prevent conflicting decisions. Strong collaboration leads to faster resolutions and fewer policyholder frustrations.

December 18

Claims Pages Staff