AI in Claims: The Battle Against Fraud’s High-Tech Evolution

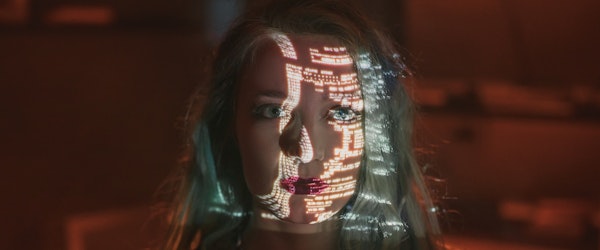

Monday, December 30th, 2024 Fraud Litigation Risk Management TechnologyGenerative AI is revolutionizing the insurance claims process, offering powerful tools for efficiency and fraud detection. However, it also poses a double-edged sword as fraudsters harness the same technology to manipulate claims data. Industry experts like Shane Riedman of Verisk describe this dynamic as an ‘arms race’ where both insurers and criminals constantly adapt to evolving AI capabilities.

Nicos Vekiarides, CEO of Attestiv, highlights that while settling claims with photo evidence brings efficiency, it also opens the door to altered images and deepfakes. Insurance companies are urged to adopt sophisticated detection tools to combat these risks. For example, Sam Krishnamurthy of Turvi emphasizes that traditional methods of fraud detection are insufficient in the face of rapidly advancing deepfake technology, necessitating robust, analytics-driven programs.

Insurers face additional responsibilities to integrate these solutions effectively, balancing fiduciary duties to policyholders and regulatory requirements. Darcy Rittinger of CoverGenius points out that regulatory incentives and legislative support could accelerate the adoption of cutting-edge detection tools, ensuring that insurers remain equipped to protect their clients from AI-driven fraud threats.