Insurance Industry Grapples with Escalating Natural Disaster Risks

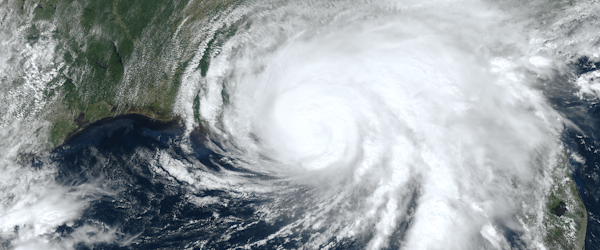

Wednesday, March 5th, 2025 Catastrophe Legislation & Regulation Property Risk ManagementThe insurance industry is at a crossroads as natural disasters become more frequent and severe, leading to mounting financial losses. Traditional risk assessment and underwriting methods are proving inadequate, leaving insurers struggling to maintain profitability and coverage availability. With restrictive state regulations, dwindling reinsurance options, and increasing claims from wildfires and severe convective storms, some insurers are exiting high-risk markets altogether.

In California, recent wildfires have caused catastrophic losses, raising concerns about insurance affordability and accessibility. Meanwhile, severe convective storms have quietly become the most costly peril for insurers, causing multiple insolvencies and rating downgrades. The lack of viable reinsurance options for these risks adds to the financial strain, making long-term sustainability a growing concern.

To address these challenges, the industry is turning to advanced risk modeling, parametric insurance, and other innovative solutions. Lessons from past crises, such as the creation of federal insurance programs for floods and terrorism, suggest that government intervention may become necessary. However, with improved risk assessment tools and novel risk transfer mechanisms, private insurers still have opportunities to adapt and continue providing coverage where it’s needed most.