Cyber Insurance Claims Spike With Major Attacks, But Ransomware Costs Down Sharply From 2020

While ransomware remains a plague on organizations around the world, a new report from commercial insurance firm Corvus indicates that ransomware costs are being cut considerably due to better preparedness.

November 18, 2021

Technology

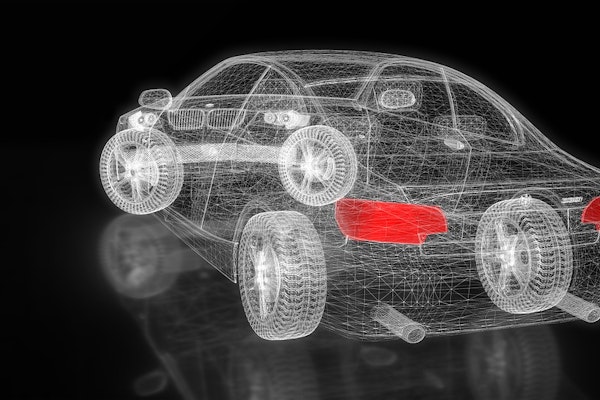

Touchless Auto Claims: One Year On

Just a bit more than a year ago, a driver made a phone call to their insurance company — and made history. How? Well, the insurance claim that followed was the first-ever completely touchless claim — in that it was entirely carried out by a trained artificial intelligence (AI).

November 16, 2021

Auto

Technology

The Importance Of Explainable AI

Explainable AI is evolving to give meaning to artificial intelligence and machine learning in insurance. The XAI (explainable AI) model has the key factors, which are explained in the passed and not passed cases.

November 12, 2021

Technology

Leveraging Technology To Navigate The Future

The evolving risk landscape suggests that global insurance premiums could reach USD 10 trillion by 2030, with climate change predicted to result in a tenfold rise in economic losses over the next 30 years, according to a new report from Bain & Company.

November 11, 2021

Technology

How To Reduce Risks For Mobile Workforces

Insurance agents and adjustors are often away from their desks attending to customer needs and inquiries in the field. Typically, property insurance adjustors are some of the first on the scene after a natural disaster or personal property emergency.

November 11, 2021

Risk Management

Technology

How Do You Measure Up?

Insurance carriers have invested in core systems to help streamline their internal claims-handling processes. As a result of improvements in these internal processes, data is more readily available for analysis.

November 10, 2021

Subrogation

Technology

Pandemic Lockdown Speeds Insurance Digitization Growth

The global pandemic accelerated many technological advances that were already underway in the insurance industry, changes that are likely to pick up speed as COVID-19 recedes, according to Rohit Verma, CEO, Crawford & Co.

November 10, 2021

Technology

5 Tips For Finding An RPA Solution

Robotic process automation (RPA) can be used to automate manual, high-volume and repetitive data tasks — especially those where human touch does not add value. Think of all the needlessly manual data entry involved in your underwriting and claims processes.

November 9, 2021

Technology

CCC Launches Touchless, Straight-Through Processing Product For Auto Claims

CCC Intelligent Solutions has launched a photo-based estimating service that uses artificial intelligence (AI) and ‘insurer-driven’ rules to generate what it calls ‘detailed and actionable’ line-level repair estimates in a matter of seconds.

November 5, 2021

Auto

Technology

ITL Focus: Telematics

In all my years covering all manner of technology, telematics may have caught me off-guard the most. When I first wrote about Progressive’s auto telematics program, Snapshot, in 1998, it seemed like a slam dunk.

November 4, 2021

Technology

Vehicle Values, STP Drive Record-High Auto Insurance Claims Satisfaction

The nationwide surge in used vehicle prices has given an unexpected boost to auto insurance customers who experience a total loss---their vehicles might be worth more than they thought.

November 2, 2021

Auto

Technology

The Future Is (Almost) Here

We drive in interesting times. A paradigm shift in driving technology hovers on the horizon, and it might end the era of human drivers.

October 28, 2021

Auto

Technology

Over $10B Invested Worldwide On Insurtech This Year

Global investment in insurance technology (insurtech) start-ups totalled $10.5 billion in the first nine months of 2021, a record high level for the period, reinsurance broker Willis Re said on Wednesday.

October 27, 2021

Technology

Long Live The Claims Adjuster!

There is tremendous momentum for leveraging technology in claims, but that does not mean the adjuster will become obsolete.

October 21, 2021

Technology

Insurtech Is Much More Than Just Hype

Two weeks ago, during an on-stage conversation in Las Vegas with Munich Re board member Lisa Pollina, Chubb CEO Evan Greenberg commented that insurtech’s promises of transformation are ‘just hype.’

October 19, 2021

Technology