AI Boosts Insurtech Financing Amid Deepfake Risks, Report Says

Wednesday, August 7th, 2024 Fraud Insurance Industry Risk Management TechnologyGlobal financing for insurance technology (insurtech) firms surged by 40% in the second quarter, reaching $1.27 billion, thanks to significant investments in AI-focused businesses. This boost in funding, reported by reinsurance broker Gallagher Re, underscores the growing reliance on artificial intelligence to automate tasks and reduce costs in the insurance sector. However, the rise of AI also brings challenges, such as the risk of deepfake fraud and the potential exclusion of certain customers by AI models.

Despite a peak in global insurtech funding at $16 billion in 2021, the market has cooled due to shrinking valuations. Nonetheless, AI remains a hot area, with about 33% of total insurance tech funding in Q2 directed toward AI-focused insurtechs. AI is particularly valuable in insurance pricing and underwriting, but Gallagher Re’s report cautions against fully delegating underwriting to AI, highlighting limited success in such cases and emphasizing the need for human involvement.

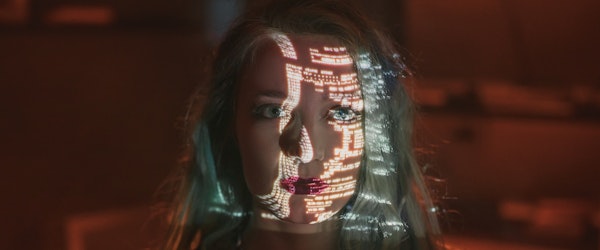

The report also warns of the risks associated with deepfakes—realistic but fraudulent images and videos—that could be used to file fraudulent claims. While AI can enhance risk assessments and lead to individualized pricing, this shift could make some customers uninsurable. Additionally, AI’s ability to obscure the truth poses a significant challenge for the industry. However, AI also has the potential to detect and mitigate its own risks, including identifying deepfakes.