This Hurricane Season May See a Key FEMA Disaster Fund Run Out of Money

Many of the nation’s disaster organizations are exposed to perilous financial risks at the start of hurricane season, jeopardizing efforts across much of the U.S. to recover from catastrophes.

June 8, 2023

Catastrophe

Property

Florida

Louisiana

Texas

10 States Sue FEMA Over Higher Flood Insurance Rates

Ten states and dozens of municipalities are suing the Biden administration over rate hikes in the National Flood Insurance Program. That program offers coverage in high-risk flood areas and is administered by FEMA, the Federal Emergency Management Agency.

June 2, 2023

Legislation & Regulation

Litigation

Property

Florida

Idaho

Kentucky

Louisiana

Mississippi

Louisiana Consumers Take a Risk With Surplus Lines Upstart for Home Insurance

For nearly a decade, Denise Hancock always turned to a broker to find competitively priced home insurance. So when her insurer, United Property and Casualty, went under earlier this year, Hancock appealed to her longtime agent.

May 31, 2023

Insurance Industry

Property

Louisiana

Lawsuit Claims Texas Firm And Estimators Likely Conspired to Inflate Louisiana Damages

Houston law firm McClenny Moseley and Associates has been accused of a litany of questionable, and potentially illegal, practices in recent months. Now, a group of former employees of an estimating company say their former employers likely conspired with the firm to hike up the value of Hurricane Ida claims by exaggerating damages.

May 30, 2023

Fraud

Litigation

Property

Louisiana

Texas

Florida and Louisiana Take on Huge Debts for Hurricane Insurance Claims

In an emergency financial maneuver, the state-chartered insurance associations of Florida and Louisiana have been forced to borrow a combined $1.3 billion to cover insurance claims caused by worsening hurricanes.

May 22, 2023

Catastrophe

Insurance Industry

Property

Florida

Louisiana

Insurance Companies Would Set Their Own Rates Under Bill Approved by Louisiana House

The Louisiana House approved a bill Thursday that would let insurance firms set their own rates without approval from the state’s insurance commissioner -- one of several controversial insurance proposals on deck as lawmakers try to mend the state’s fractured marketplace.

May 15, 2023

Legislation & Regulation

Property

Louisiana

Louisiana Group Says Excessive Tort Costs Deprived State Of 50K Jobs

Data released Tuesday from the tort reform group Louisiana Lawsuit Abuse Watch says excessive civil court costs led to the loss of nearly 50,000 jobs in Louisiana and $3 billion in personal income losses.

May 11, 2023

Litigation

Louisiana

Insurance Fraud Scheme Costs Law Firm, Partners $2M

Louisiana’s Insurance Commissioner has imposed a fine of $2 million on Texas law firm McLenny Moseley & Associates (MMA) and its associated partners for hurricane-related insurance fraud.

May 4, 2023

Fraud

Legislation & Regulation

Litigation

Property

Louisiana

Texas

Florida And Louisiana State-Owned Insurers Must Borrow Millions To Pay Claims

The Gulf Coast insurance crisis has hit a new low as two state-chartered insurance associations are being forced to borrow hundreds of millions of dollars for the first time in three decades to pay the hurricane claims of insolvent insurers.

May 4, 2023

Catastrophe

Insurance Industry

Property

Florida

Louisiana

Louisiana Parish Sues FEMA Over NFIP Rate-Setting Model

St. Charles Parish in Louisiana has sued the Federal Emergency Management Agency (FEMA) over the new Flood Risk Rating 2.0 that went into effect in October 2021.

April 26, 2023

Legislation & Regulation

Litigation

Property

Louisiana

FEMA’s Risk Rating 2.0 Program Still Needs Work

Department of Homeland Security Secretary Alejandro Mayorkas recently announced at a congressional hearing that the new federal system for setting flood insurance premiums, Risk Rating 2.0, requires more adjustments than anticipated.

April 24, 2023

Legislation & Regulation

Property

Louisiana

Louisiana Ranks Highest Among Most Fatal Accidents Due To Distracted Driving

In Louisiana, 20 percent of fatal car crashes involve a distracted driver, according to a Forbes Advisor team. These fatal accidents usually occur when a driver is distracted by someone riding in the passenger seat, using a phone, or visual or manual distractions.

April 10, 2023

Auto

Louisiana

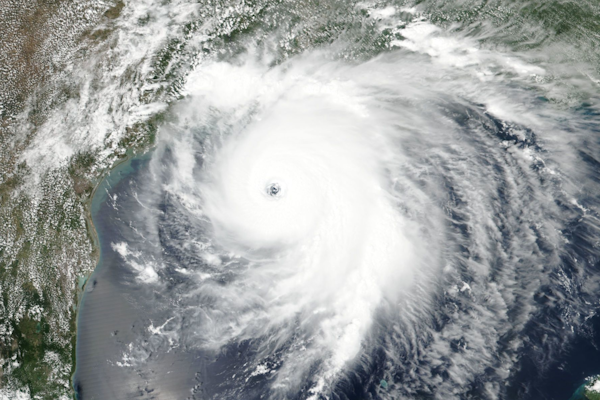

Hurricane Forecasting Improves, But Preparedness Still Paramount

Hurricane forecasting and warning systems have greatly improved in recent years, providing residents with valuable time to plan, but preparedness remains paramount in south Louisiana as another tropical storm season approaches, federal and state officials said at the start of a national conference in New Orleans on Monday.

April 6, 2023

Catastrophe

Property

Louisiana

Donelon Backs Insurance Reform Legislation, Critics Say Policyholders Will Suffer

Louisiana Insurance Commissioner Jim Donelon on Tuesday (April 4) unveiled a package of proposed new laws he wants the legislature to approve during the upcoming legislative session.

April 4, 2023

Legislation & Regulation

Litigation

Property

Louisiana

Louisiana’s Lawmakers Aim To Ease Regulations For Wary Insurers

State Sen. Kirk Talbot on Monday outlined several solutions the Legislature will consider this session to mend Louisiana’s battered property insurance market, including changes to some restrictions that he said have soured insurers on the state.

March 28, 2023

Legislation & Regulation

Property

Louisiana