Flood Forecasting Defended by NWS as Critics Question Impact of Staffing Cuts

After deadly Texas floods, the National Weather Service faces scrutiny over Trump-era staffing cuts, though experts say forecasts were timely and accurate despite leadership gaps.

July 7

Catastrophe

Legislation & Regulation

Risk Management

Technology

Texas

Auto Claims Profitability Improves Amid Rising Casualty Costs and Trade Issues

Insurance industry sees auto physical damage profitability recover, while casualty sectors grapple with increased medical inflation and social verdicts.

June 25

California

Colorado

Florida

Illinois

New Jersey

Why Florida, Texas, and California Lead the Nation in Lightning Insurance Claims

Florida, Texas, and California consistently rank highest for lightning-related insurance claims due to storm frequency, surge damage, and wildfire-triggered losses.

June 24

Catastrophe

Insurance Industry

Property

Risk Management

California

Florida

Texas

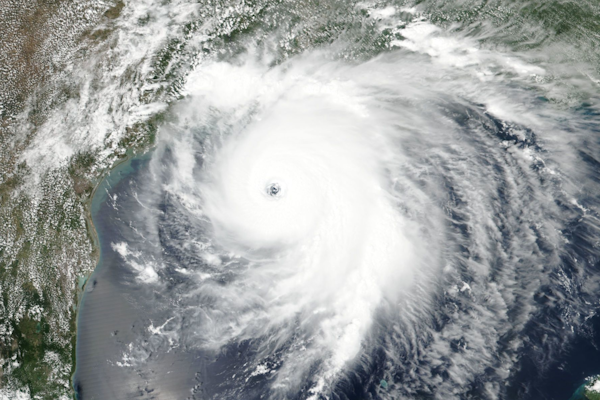

Colorado State University Predicts Above Normal 2025 Atlantic Hurricane Season

The 2025 Atlantic hurricane season is projected to be above-average with 17 named storms, nine hurricanes and four major hurricanes, increasing landfall risks along U.S. and Caribbean coasts.

June 19

Catastrophe

Insurance Industry

Property

Risk Management

Florida

Texas

Finding Common Ground in Professional Liability Defense Strategies

Early collaboration between carriers, insureds, and panel counsel in professional liability claims reduces defense costs, preserves policy limits, and strengthens renewal prospects through faster settlements.

June 19

Insurance Industry

Litigation

Risk Management

Underwriting

Louisiana

New York

Texas

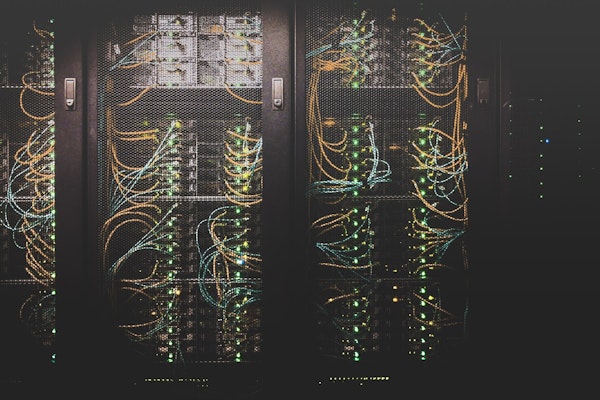

AI Agents Now Handle Insurance Policies from Quote to Claim with Sure’s New Protocol

Sure introduces its Model Context Protocol, enabling AI agents to autonomously quote, bind, and service insurance policies with integrated compliance and multi-carrier support.

June 11

Auto

Insurance Industry

Property

Technology

Texas

Scientists Chase Extreme Hailstorms Across the Plains to Uncover the Costliest Weather Threat

Researchers are diving into hailstorms across Texas, Oklahoma, and Kansas to better understand one of the U.S.’s costliest but most overlooked weather risks.

June 9

Catastrophe

Insurance Industry

Property

Risk Management

Colorado

Kansas

New Mexico

Oklahoma

Texas

How Georgia Can Tackle Rising Insurance Premiums and Loss Ratios

Georgia homeowners face surging premiums after back-to-back hurricanes. Lawmakers and insurers are exploring solutions to stabilize the market and protect consumers.

June 9

Catastrophe

Legislation & Regulation

Property

Risk Management

Alabama

Arkansas

Florida

Georgia

Louisiana

Severe Storms in US and Europe Trigger Massive Insured Losses

Severe storms across the US and Europe from late May to early June caused extensive hail, flood, and wind damage, with insured losses reaching into the billions.

June 9

Catastrophe

Insurance Industry

Property

Risk Management

Illinois

Iowa

Kansas

Missouri

Texas

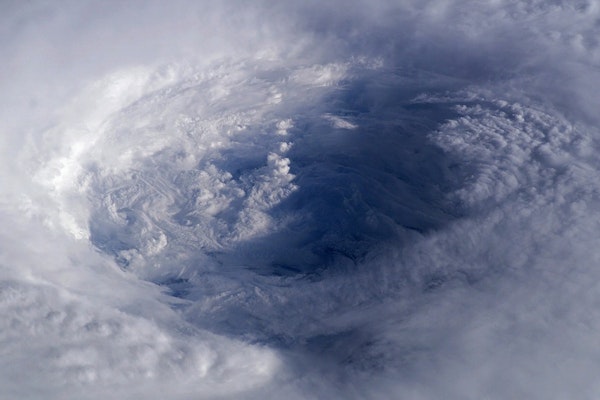

Storm Surge Risk Threatens Billions in Coastal Property Value Across 20 States

Over 6.4 million homes in coastal U.S. states face moderate or greater storm surge risk, with $2.2 trillion in potential reconstruction costs, according to 2025 Cotality data.

June 2

Catastrophe

Legislation & Regulation

Property

Risk Management

Alabama

Connecticut

Delaware

District Of Columbia

Florida

Early-Season Hurricanes: Where June Storms Typically Form and Why Activity Has Increased

Although June is typically a quiet start to Atlantic hurricane season, recent years show a rise in early storm activity, especially near the Gulf and Southeast U.S. coasts.

May 28

Catastrophe

Insurance Industry

Property

Risk Management

Alabama

Louisiana

Texas

Texas Faces Critical Flood Insurance Gap as Risk Rises Statewide

A new report by Neptune Flood highlights Texas’s escalating flood risk and the urgent need to close the state’s massive and growing insurance coverage gap.

May 21

Catastrophe

Insurance Industry

Legislation & Regulation

Property

Texas

Millions of Homes Unprotected as Climate-Driven Insurance Costs Soar

New research shows insurance protects against climate disasters, but millions of flood-prone homes remain uninsured as premiums climb beyond affordability.

May 20

Catastrophe

Legislation & Regulation

Property

Risk Management

California

Florida

Kentucky

Louisiana

New York

Escrow Officer Sentenced to Prison for Orchestrating $350K Title Fraud Scheme in Texas

A McAllen, Texas escrow officer was sentenced to 24 months in prison for wire fraud after falsifying real estate documents and defrauding lenders and buyers of over $350,000.

May 13

Fraud

Insurance Industry

Litigation

Property

Texas

Lawsuits Target Auto Insurers and Carmakers Over Secret Driver Data Collection

Major lawsuits are shedding light on how insurers and automakers collect, share, and monetize driver data—often without the consumer’s clear consent or knowledge.

May 1

Auto

Legislation & Regulation

Litigation

Technology

Florida

Texas