Shoe Production PFAS Contamination Leads to $113M Settlement

Wolverine Worldwide operated a shoe making factory in Kent County, Michigan. As part of the shoe production process, chemicals were used to create waterproof material. These chemicals? Per- and polyfluoroalkyl substances.

November 14, 2022

Liability

Litigation

Eleventh Circuit Holds Buzz Words in Arbitration Demand Insufficient to Trigger Duty to Defend

On November 8, 2022, the Eleventh Circuit Court of Appeals agreed with the U.S. District Court for the Middle District of Florida that Mount Vernon Fire Insurance Co. did not have a duty to defend Global Travel International Inc. in an arbitration between Global Travel and Qualpay Inc. despite Global Travel’s best efforts to bring the claim within coverage.

November 11, 2022

Liability

Litigation

Florida

Courts Weigh in on Insurers’ Liability for an Insured’s Losses Stemming from a Data Breach

When a cybersecurity-related incident occurs, an insured should not automatically assume a standard commercial general liability (CGL) policy issued by an insurer will cover their losses, as CGL policies generally afford coverage to an insured for losses resulting from bodily injury and property damage.

November 8, 2022

Liability

Litigation

Insurers Refuse to Pick Up Bill for Billions in Opioid Claims

A multibillion-dollar bill is coming due for the U.S. opioid epidemic and insurers for some of the largest drug makers, distributors and pharmacies are refusing to help pay for it.

November 4, 2022

Liability

Litigation

Delaware

FedEx Appeals $366M Verdict in Racial Discrimination Case

FedEx Corp said it would ask a federal judge in Texas to throw out or reduce a jury’s $366 million damages award to a Black former employee who accused the company of disciplining and firing her after she complained about racial discrimination.

November 2, 2022

Liability

Litigation

Texas

California’s Mosquito Fire to Cost Utility PG&E $100M

PG&E Corp. recorded a $100 million third-quarter charge for a California wildfire that its equipment may have sparked last month in the Sierra Nevada mountains.

California’s biggest utility said the costs of the Mosquito Fire should be largely offset by insurance and other rate recoveries, according to a filing Thursday with the US Securities and Exchange Commission.

November 2, 2022

Excess & Surplus Lines

Liability

California

California’s biggest utility said the costs of the Mosquito Fire should be largely offset by insurance and other rate recoveries, according to a filing Thursday with the US Securities and Exchange Commission.

Seattle Homeowners Win Lawsuit After New Home Nightmare

Settling in a new home can take months, but how long should a new homeowner have to notice big problems and sue? The Washington Supreme Court weighed in this week.

October 31, 2022

Liability

Washington

State Negligence Broker Liability Claims Allowed by Supreme Court for Trucking Subrogation

Frequently, freight brokers attempt to deny subrogation claims for cargo damaged in transit on a truck by arguing that they are accorded broker status and do not have the same strict liability as a ‘Motor Carrier’ under The Carmack Amendment.

October 25, 2022

Liability

Subrogation

More Fatal Crashes Linked to Tesla’s Automated Technology

The National Highway Safety Administration released new data indicating that 10 people were killed in the United States in crashes involving vehicles that were using automated driving systems. The crashes all took place during a four-month period earlier this year between mid-May and September of this year.

October 20, 2022

Auto

Liability

Technology

Biometric Privacy Perils Grow After BNSF Loses Landmark Verdict

Illinois’ first jury verdict in a biometric privacy class action will likely encourage more litigation in the state and place pressure on businesses to settle those claims long before they reach trial, attorneys say.

October 19, 2022

Liability

Litigation

Illinois

Cellphone Data Analysis in Personal Injury Litigation

Ninety-seven percent of Americans now own a cellphone, and 85% of those own a smartphone, a mobile device that does a lot more than just make and receive calls. In fact, a smartphone can track every aspect of a person’s life, including sleep; eating and health trends; location and movement; and social and financial alerts.

October 19, 2022

Liability

Litigation

Technology

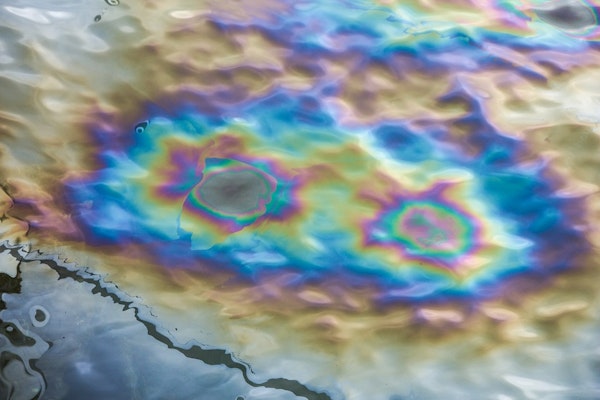

Amplify Energy Agrees to $50M California Spill Settlement

A pipeline operator has agreed to pay $50 million to thousands of Southern California fishermen, tourism companies and property owners who sued after an offshore oil spill last year near Huntington Beach.

October 19, 2022

Liability

Litigation

Subrogation

California

3 Ways Severe Weather Is Increasing Environmental and Pollution Liability

This August, as Death Valley experienced a 1,000-year rain event, all Steve Tagert could see were the pollution risks. In a matter of hours, nearly a year’s worth of rain poured from the sky.

October 18, 2022

Liability

After Climate Rulings, Insurers May Go On Coverage Offense

Two recently filed lawsuits, Aloha Petroleum Ltd. v. National Union Fire Insurance Co. and Everest Premier Insurance Co. v. Gulf Oil Ltd. Partnership, signal the beginning of litigation over liability insurance coverage for climate change-related lawsuits and damages.

Underlying Claims

Climate Change Contribution

Since 2017, state and local governments around the U.S. have been filing lawsuits against oil and gas companies for their contribution to climate change.[2]

The government entities allege that production and use of defendants’ fossil fuel products has created greenhouse gas pollution, which is causing global warming, sea level rise, and increased frequency and severity of extreme weather events, resulting in climate change-related injuries to the plaintiffs.

October 17, 2022

Liability

Litigation

Underlying Claims

Climate Change Contribution

Since 2017, state and local governments around the U.S. have been filing lawsuits against oil and gas companies for their contribution to climate change.[2]

The government entities allege that production and use of defendants’ fossil fuel products has created greenhouse gas pollution, which is causing global warming, sea level rise, and increased frequency and severity of extreme weather events, resulting in climate change-related injuries to the plaintiffs.

Cyber Liability Claims Skyrocketing -- Acuity

Wisconsin-based Acuity Insurance has reported an increased need for cyber liability insurance among both personal and business policyholders as cybercrime continues to grow. Between June 2021 and June 2022, Acuity Insurance saw cyber liability claims on its commercial insurance policies spike by more than 50%. For personal policies, Acuity reported a 90% increase in cyber claims in 2021 over 2020.

October 17, 2022

Fraud

Liability