Triple-I CEO on Podcast: We’re All Risk Managers

Economic turbulence, political unrest, climate catastrophes, and the aftermath of a global pandemic are just a few of the forces demanding that everyone -- homeowners, consumers, businesses, and policymakers, as well as risk-management professionals -- take responsibility for understanding and reducing the perils facing all of us, Triple-I CEO Sean Kevelighan said in a recent episode of the Predict & Prevent podcast.

July 11, 2023

Risk Management

Technology

Hey, Claims Team, Nuclear Verdicts Got You Down? Partner with Legal to Get Ahead of Ballooning Costs

Talk to anyone in claims management, and they’ll tell you the same thing: This particular branch of the industry is here to help produce the best outcomes for policyholders.

July 11, 2023

Insurance Industry

Litigation

Risk Management

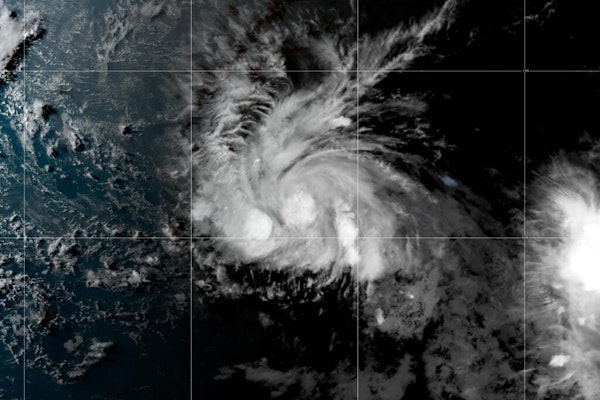

Predictive Model Anticipated Tropical Storm Bret’s Early Appearance

Tropical Storm Bret has formed in the central tropical Atlantic -- two months ahead of schedule for that part of the ocean. Fortunately, the technology and expertise were in place to anticipate this second named storm of the 2023 Atlantic hurricane season.

June 21, 2023

Risk Management

Technology

Underwriting

Gain the Upper Hand on Cybercrime

Cybersecurity Ventures estimates cybercrime will take a $10.5 trillion toll on the global economy by 2025. If it were measured as a country, the underground cybercriminal economy would be the third largest in the world after the U.S. and China.

June 20, 2023

Fraud

Risk Management

Technology

Managing Risks in Law Enforcement: Escalating Claims, Liability Awards, and Mental Health

Escalating claims alleging excessive force by police officers, rising liability awards and increased mental health concerns for officers are among the top risk management challenges for public entity risk managers, experts say.

June 15, 2023

Liability

Risk Management

Best Practices for Preparing a Business Interruption Claim

As they weather this year’s storm season, many businesses will experience property damage, often accompanied by business income losses. Most commercial general liability policies will provide business interruption coverage and extra expense insurance as an adjunct to property coverage.

June 14, 2023

Property

Risk Management

Biometric Data and Legal Liabilities

A recent lawsuit filed against Amazon for alleged violations of New York City’s Biometric Identifier Information Law highlights new risks for businesses that use customers’ biometric data in their operations. As similar laws begin to take effect in other jurisdictions, many other companies face potential liability.

June 5, 2023

Liability

Risk Management

A Predict & Prevent Approach Works When Tech Innovation, Underwriting and Risk Management Work Together

Unlocking the full potential of Predict & Prevent strategies takes teamwork. We need insurers, tech innovators, policymakers, customers and others working together to create, test and launch solutions that stop losses in their tracks. It’s an exciting idea, but how do we make it happen?

May 30, 2023

Risk Management

Technology

Underwriting

Opinion | Silo Deconstruction Underway

Talk to veterans in the risk management field -- the leaders, that is -- and you have a good chance of hearing about the dangers of silos.

May 24, 2023

Risk Management

A New Approach to Property Resilience

The history of the standards we use for how we build structures -- homes, apartments and commercial and manufacturing buildings -- has largely to do with regional authorities determining what criteria they need to meet to keep the occupants of the building safe.

May 19, 2023

Property

Risk Management

At RISKWORLD 2023: Training Is Vital For Active Shooter Survival

One week before their May 1st presentation at RIMS’ 2023 RISKWORLD event in Atlanta, Ike Jenkins and Marc Vincent updated their slides with the latest figures on U.S. mass shootings. By the time they’d checked into their hotels, the figures were already outdated.

May 9, 2023

Risk Management

Workers' Compensation

Addressing The Risk Of Greenwashing Claims

As part of a growing focus on ESG issues, regulators around the world have been focusing on exaggerated or unsubstantiated claims regarding sustainability, also known as ‘greenwashing.’

April 28, 2023

Risk Management

Beyond Fire: Triple-I Interview Unravels Lightning-Risk Complexity

Lightning is a more complex peril than it is often given credit for being, according to Tim Harger, executive director of the Lightning Protection Institute (LPI). In a recent interview with Triple-I CEO Sean Kevelighan, Harger discussed the importance of preparing for and preventing damage from this risk, which is second only to flooding when it comes to costly weather events.

People typically think about fire damage when they think about lightning. But Harger said, ‘Beyond the fire is the destruction of electrical wires and infrastructure that supports everything we do to communicate and to conduct business.’

April 25, 2023

Risk Management

People typically think about fire damage when they think about lightning. But Harger said, ‘Beyond the fire is the destruction of electrical wires and infrastructure that supports everything we do to communicate and to conduct business.’

Climate Change Is Creating A Huge Bubble In The U.S. Financial System

Homes constructed in flood plains, storm surge zones, regions with declining water availability, and the wildfire-prone West are overvalued by hundreds of billions of dollars, recent studies suggest, creating a housing bubble that puts the U.S. financial system at risk.

April 17, 2023

Catastrophe

Legislation & Regulation

Property

Risk Management

Predict & Prevent Will Shape Our Future, But Its Underlying Principles Have A Distinguished Past

As you can see throughout the March/April special issue of Risk & Insurance, as well as here on the risk website, there is growing momentum to find a better way to help individuals, businesses and society manage the severe risks they are facing: Predict & Prevent.

April 14, 2023

Insurance Industry

Risk Management