Predicting What Distribution, Underwriting and Claims Will Look Like in the 2030 Insurance Value Chain

In 2030, the world will look, feel and function in new ways. But how will the insurance value chain be affected by the new technology, ideas and regulations that will exist in seven years?

July 14, 2023

Insurance Industry

Technology

Underwriting

Can a Connected Risk Ecosystem Really Stop Claims Before They Happen?

And while achieving an absolute zero claims status is impossible, moving to a reality where insurers, risk managers and policyholders work together to reduce the probability of loss is the goal of many predict-and-prevent risk management programs.

July 12, 2023

Risk Management

Technology

How AI is Shaking Up Insurance

Whether artificial intelligence will help the insurance industry work smarter, or whether it will mean massive job losses, or maybe represent something in between is yet to be seen.

July 11, 2023

Insurance Industry

Technology

Triple-I CEO on Podcast: We’re All Risk Managers

Economic turbulence, political unrest, climate catastrophes, and the aftermath of a global pandemic are just a few of the forces demanding that everyone -- homeowners, consumers, businesses, and policymakers, as well as risk-management professionals -- take responsibility for understanding and reducing the perils facing all of us, Triple-I CEO Sean Kevelighan said in a recent episode of the Predict & Prevent podcast.

July 11, 2023

Risk Management

Technology

Insurance Claims Litigation Surging with Digital Marketing And Tech Use

Insurance companies have lost control of their claims frequency and the use of technology enabled claims instigation practices to drive more claims through litigation has become a significant social inflationary threat to the industry... .

July 7, 2023

Litigation

Technology

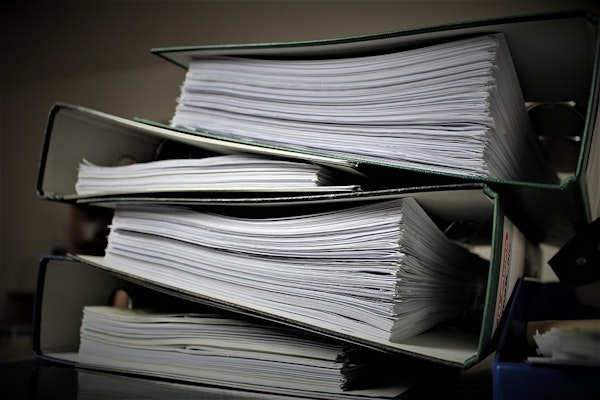

Streamlining Medical Record Reviews Via AI

Paperwork backlogs in insurance have evaded even the savviest of technology solutions. In particular, the processing of unstructured medical documents or cabinets filled with claims data was difficult to automate, so many have kept doing the work by hand.

July 5, 2023

Technology

Who’s at Fault When AI’s Driving a Cargo Ship?

It’s 2035 and a maritime court has convened to determine who’s at fault when a seagoing vessel made an error in passage planning -- a safety exercise that maps a voyage from start to finish, including harbour navigation and docking.

June 30, 2023

Liability

Marine

Technology

Why Becoming Data-Driven Is Crucial

With AI’s potential to dramatically change how businesses operate and make decisions, becoming data-driven has never been more important. However, as technology advances and the world becomes increasingly connected, organizations are finding it more and more difficult to become truly data-driven.

June 27, 2023

Technology

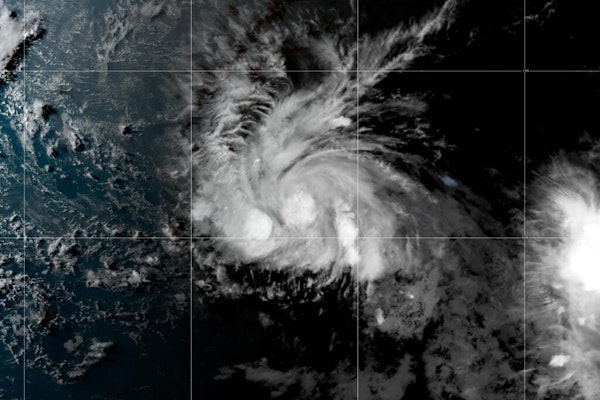

Predictive Model Anticipated Tropical Storm Bret’s Early Appearance

Tropical Storm Bret has formed in the central tropical Atlantic -- two months ahead of schedule for that part of the ocean. Fortunately, the technology and expertise were in place to anticipate this second named storm of the 2023 Atlantic hurricane season.

June 21, 2023

Risk Management

Technology

Underwriting

CLM Says: How Should Claims Departments View Generative AI?

Generative AI tools such as ChatGPT, which once seemed far off on the horizon, have arrived and are beginning to take shape. Industries, including construction and insurance, are contemplating whether, how, and to what extent they will incorporate this technology.

June 21, 2023

Insurance Industry

Technology

Gain the Upper Hand on Cybercrime

Cybersecurity Ventures estimates cybercrime will take a $10.5 trillion toll on the global economy by 2025. If it were measured as a country, the underground cybercriminal economy would be the third largest in the world after the U.S. and China.

June 20, 2023

Fraud

Risk Management

Technology

A New Frontier in ID Verification

Despite the industry’s stodgy reputation, insurance is often ahead of the curve, embracing new technologies that improve efficiency, enhance customer experience and increase profitability.

June 13, 2023

Fraud

Insurance Industry

Technology

Transformation of Jobs in the AI Era

With the rapid advancement of artificial intelligence (AI), concerns about job displacement have become prevalent. However, it is essential to understand that AI, including language models like ChatGPT, has the potential to enhance and transform job roles rather than replace them.

June 12, 2023

Technology

Man Sentenced to Prison for Staged Arson and Insurance Fraud

According to court documents, on September 23, 2020, Denis Vladmirovich Molla falsely reported to the Brooklyn Center Police Department that his camper had been intentionally set on fire. He claimed that he witnessed three unidentified individuals near his residence at the time of the incident, accompanied by an explosion.

June 12, 2023

Auto

Fraud

Technology

Minnesota

Ford’s EV Charging Deal With Tesla Ripples Through Industry

Ford Motor Co’s (F.N) decision to allow customers to use Tesla’s TSLA.O electric-vehicle charging network has sent ripples through the industry, raising questions about a national U.S. charging standard as well as the fate of charging startups that are struggling.

The deal, announced last month, would open more than 12,000 Tesla Superchargers to drivers of Ford vehicles in North America starting in 2024.

June 6, 2023

Auto

Technology

The deal, announced last month, would open more than 12,000 Tesla Superchargers to drivers of Ford vehicles in North America starting in 2024.