Storm Surge Risk Threatens Billions in Coastal Property Value Across 20 States

Over 6.4 million homes in coastal U.S. states face moderate or greater storm surge risk, with $2.2 trillion in potential reconstruction costs, according to 2025 Cotality data.

June 2, 2025

Catastrophe

Legislation & Regulation

Property

Risk Management

Alabama

Connecticut

Delaware

District Of Columbia

Florida

How P&C Carriers Can Successfully Modernize Core Systems in Today’s Digital Environment

Modernization of core systems is crucial for P&C insurers to reduce costs, improve customer experience, and keep pace with digital innovation—but success demands a strategic, business-led approach.

June 2, 2025

Insurance Industry

Property

Risk Management

Technology

How Artificial Intelligence Enhances Clinical Pharmacists’ Role in Workers’ Comp Care

Clinical pharmacists are using AI to enhance drug therapy oversight, reduce risk, and improve recovery outcomes for injured workers in complex workers’ compensation claims.

June 2, 2025

Life & Health

Risk Management

Technology

Workers' Compensation

CMS Expands Section 111 Reporting to Include Voluntary WCMSA Data for Workers’ Compensation Claims

Beginning April 4, 2025, CMS requires Responsible Reporting Entities to include available WCMSA data in Section 111 reports for workers’ compensation settlements involving Medicare beneficiaries.

June 2, 2025

Insurance Industry

Legislation & Regulation

Risk Management

Workers' Compensation

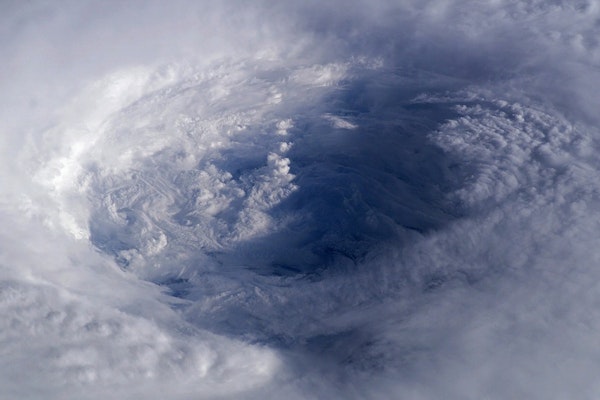

Early-Season Hurricanes: Where June Storms Typically Form and Why Activity Has Increased

Although June is typically a quiet start to Atlantic hurricane season, recent years show a rise in early storm activity, especially near the Gulf and Southeast U.S. coasts.

May 28, 2025

Catastrophe

Insurance Industry

Property

Risk Management

Alabama

Louisiana

Texas

Frustrating Claims Processes Drive Policyholders to Avoid Filing and Consider Switching Insurers

A new survey finds 22% of consumers skip filing claims due to complex processes, while 64% would switch insurers for a smoother digital experience.

May 28, 2025

Insurance Industry

Property

Risk Management

Technology

Connecticut Bans AI Claim Denials and Caps Rate Hikes in Sweeping Health Insurance Reform

Connecticut’s Senate Bill 10 curbs AI-driven claim denials, tightens rate hike rules, and expands patient protections, with major reforms taking effect October 1, 2025.

May 28, 2025

Insurance Industry

Legislation & Regulation

Life & Health

Technology

Connecticut

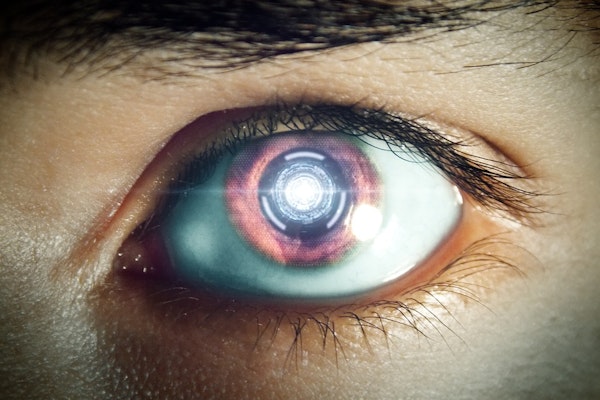

How AI Can Help Insurers Detect and Cut Down on Fraud

With advanced analytics and pattern recognition, AI could help P&C insurers save up to $160 billion annually by detecting both soft and hard fraud more effectively.

May 28, 2025

Fraud

Property

Risk Management

Technology

Louisiana Lawmakers Push Through Major Tort Reforms Targeting Legal System Abuse

Five tort reform bills passed in Louisiana aim to reduce legal system abuse, lower insurance premiums, and establish fairer standards for civil litigation and auto claims.

May 28, 2025

Auto

Insurance Industry

Legislation & Regulation

Litigation

Louisiana

New Insurance Operations Designation Targets Efficiency and Service Excellence

The Institutes has introduced the Associate in Insurance Operations designation to standardize training, enhance efficiency, and elevate service across insurance operations teams.

May 28, 2025

Education & Training

Insurance Industry

Risk Management

Technology

Why Intelligent Operations Are Now Essential for Insurance Carriers

As legacy systems strain under rising demands, insurers are turning to AI-driven operations to reduce costs, improve customer satisfaction, and future-proof their business models.

May 24, 2025

Education & Training

Insurance Industry

Risk Management

Technology

Texas Faces Critical Flood Insurance Gap as Risk Rises Statewide

A new report by Neptune Flood highlights Texas’s escalating flood risk and the urgent need to close the state’s massive and growing insurance coverage gap.

May 21, 2025

Catastrophe

Insurance Industry

Legislation & Regulation

Property

Texas

Cyber Threats Stabilize as Active Insurance Drives Down Claims and Losses in 2024

Coalition’s 2025 Cyber Claims Report shows stable claim trends amid rising cyber threats, with Active Insurance reducing claim frequency and boosting policyholder resilience.

May 21, 2025

Education & Training

Insurance Industry

Risk Management

Technology

What the NCCI AIS 2025 Revealed About the Future of Workers Compensation

The NCCI AIS 2025 conference revealed how workers comp is staying strong amid economic uncertainty, with trends in claim frequency, medical use, and emerging industry risks.

May 21, 2025

Insurance Industry

Risk Management

Technology

Workers' Compensation

AM Best Warns Insurers Could Face Risk Modeling Challenges After NOAA Ends Disaster Data Updates

AM Best says NOAA’s decision to retire its billion-dollar disaster database could hinder insurers’ ability to track secondary perils and price risk effectively.

May 21, 2025

Catastrophe

Insurance Industry

Risk Management

Technology