New York Reports Surge in Workers’ Comp Fraud With $2.7M Identified in 2024

Workers’ comp fraud in New York rose nearly 30% in 2024, with 14 arrests and over $1.4 million in restitution returned to agencies, insurers, and employers.

April 18, 2025

Fraud

Insurance Industry

Legislation & Regulation

Workers' Compensation

New York

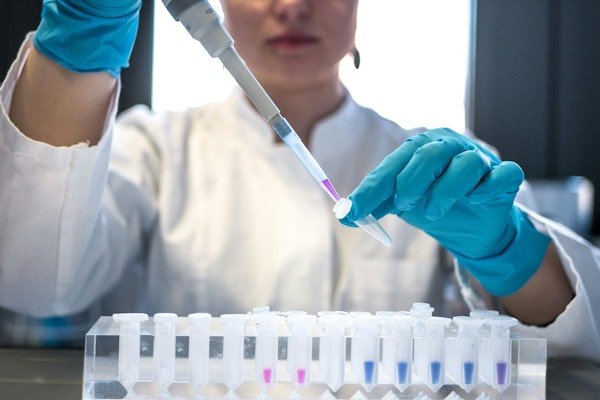

Fake Medical Labs Rake in $84K Using Stolen Insurance Info from Illinois Couple

A Des Plaines couple discovered over $84,000 in fraudulent lab charges on their health insurance, highlighting a growing scheme of phantom billing and data theft in healthcare.

April 18, 2025

Fraud

Legislation & Regulation

Life & Health

Technology

Illinois

Five People Face Felony Charges in $1.4 Million California Life Insurance Fraud Scheme

California officials charged five defendants, including former insurance agents, in a life insurance fraud scheme involving fake policies and stolen commissions totaling over $1.4 million.

April 15, 2025

Fraud

Insurance Industry

Life & Health

Litigation

California

How Agentic AI is Transforming Property Claims and Empowering Adjusters with Digital Coworkers

Agentic AI agents are reshaping property claims handling by helping adjusters automate routine tasks, reduce cycle times, and focus on customer-centric problem-solving.

April 15, 2025

Catastrophe

Insurance Industry

Property

Technology

How Rising Climate Risks Are Reshaping Insurance for Renewable Energy Projects Worldwide

As natural catastrophe and extreme weather losses escalate globally, insurers, developers, and financiers must rethink risk management to keep renewable energy projects insurable and bankable.

April 15, 2025

Catastrophe

Insurance Industry

Property

Risk Management

Missouri Man Sentenced to Prison for Staging Car Crashes and Defrauding Insurers

A Missouri man who staged nighttime auto accidents and faked injuries to collect insurance payouts has been sentenced to 18 months in federal prison and ordered to pay restitution.

April 15, 2025

Auto

Fraud

Insurance Industry

Litigation

Missouri

Liberty Mutual Fined $300,000 in Delaware Over False Insurance Discount Ads

Delaware regulators fined three Liberty Mutual companies $300,000 for advertising homeowners and auto insurance discounts not available to policyholders in the state.

April 15, 2025

Auto

Legislation & Regulation

Litigation

Property

Delaware

Buffalo Trace Distillery Begins Recovery Efforts After Kentucky River Flooding

Buffalo Trace Distillery in Kentucky is cleaning up and inspecting barrels after severe flooding, with plans to resume bottling and reopen its visitor center soon.

April 15, 2025

Catastrophe

Insurance Industry

Property

Risk Management

Kentucky

Why Climate Resilience Requires Both Parametric and Traditional Insurance Solutions

As billion-dollar weather disasters escalate, combining parametric and traditional insurance offers a faster, more adaptive recovery solution for policyholders across the U.S.

April 15, 2025

Catastrophe

Insurance Industry

Property

Technology

California

Florida

Louisiana

Mississippi

Florida Art Dealer Accused of Selling Fake Warhols in Alleged $240K Fraud Scheme

Two South Florida men face federal charges for allegedly conspiring to sell forged Andy Warhol artwork using fake invoices and fraudulent authentication documents.

April 14, 2025

Fraud

Insurance Industry

Litigation

Risk Management

Florida

New York

AI Weather Models Bring Hyper-Local Flood Forecasting to Insurance Industry

Advances in AI-powered weather models are helping insurers create hyper-local flood forecasts, allowing faster warnings and reducing risk from extreme weather events.

April 14, 2025

Catastrophe

Property

Risk Management

Technology

Cyberattack on Morocco’s Social Security Agency Exposes Sensitive Data in Escalating Regional Conflict

Hackers breached Morocco’s social security database, leaking personal and financial data on Telegram amid rising cyber tensions between Morocco and Algeria.

April 14, 2025

Insurance Industry

Legislation & Regulation

Risk Management

Technology

States Move to Regulate Third-Party Litigation Funding Amid Transparency Concerns

States across the U.S. are advancing bills to increase transparency in third-party litigation funding as concerns grow over rising insurance costs and legal system abuse.

April 14, 2025

Insurance Industry

Legislation & Regulation

Litigation

Risk Management

Arizona

California

Georgia

Kansas

Massachusetts

Climate Change and Supply Chain Disruptions Are Reshaping Business Interruption Insurance

As climate risks intensify and supply chain uncertainty grows, insurers and businesses are rethinking business interruption coverage and the risks of underreporting exposures.

April 14, 2025

Catastrophe

Property

Risk Management

Businesses Rank Civil Unrest as Top Risk as Global Political Tensions Escalate

With protests surging worldwide, civil unrest, terrorism, cyber-attacks, and state-sponsored sabotage are key threats businesses face, according to an Allianz report.

April 11, 2025

Catastrophe

Insurance Industry

Property

Risk Management