Nurse Practitioner Accused of $31K Insurance Fraud in Staged Burglary

Authorities say a Carmel-based practitioner filed a suspicious insurance claim weeks after starting a policy and falsely reported luxury items stolen.

November 3

Fraud

Property

Risk Management

Indiana

NASCAR Champion Kyle Busch Sues Pacific Life for $8.5M Over Alleged Life Insurance Deception

NASCAR champion claims Pacific Life misrepresented a retirement-focused Indexed Universal Life policy, leading to a multi-million-dollar loss.

November 3

Insurance Industry

Life & Health

Litigation

Risk Management

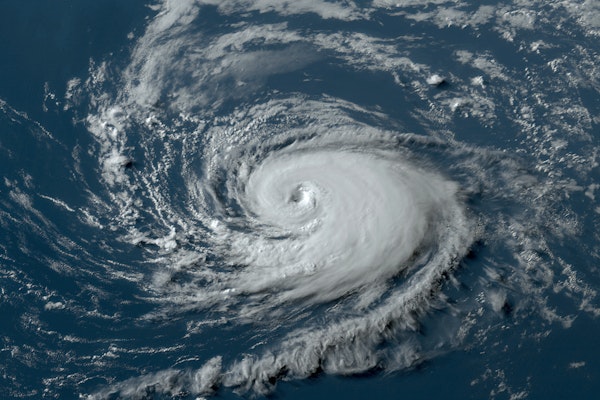

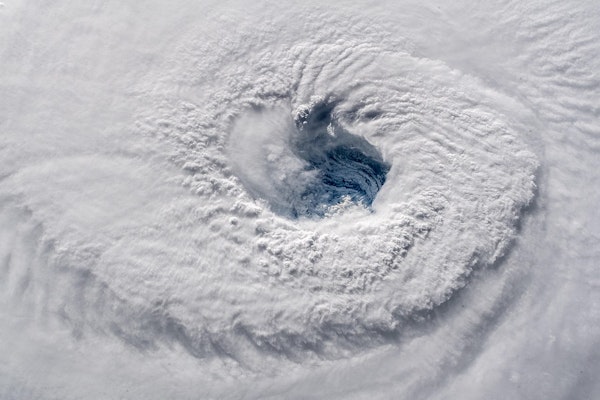

Verisk Projects Up to $4.2B in Insured Losses from Hurricane Melissa in Jamaica

With insurance take-up rates below 20%, Hurricane Melissa’s record-setting impact on Jamaica exposes significant coverage gaps. Verisk and Aon warn of rising insured and economic losses.

November 3

Catastrophe

Insurance Industry

Liability

Property

Risk Management

Declining Public Trust in Healthcare Challenges Medical Malpractice Defense

Distrust in hospitals and physicians is reshaping jury perceptions, complicating healthcare litigation, and elevating risk for claims professionals.

November 3

Liability

Life & Health

Litigation

Risk Management

Lab Monkeys Escape After Mississippi Crash Raises Biohazard Concerns

After a truck crash in Mississippi released rhesus macaques from Tulane’s research program, conflicting reports and a lack of transparency raise public health and ethical concerns.

November 3

Catastrophe

Legislation & Regulation

Liability

Life & Health

Weird

Mississippi

Freight Brokers Targeted in Sophisticated Cyber Cargo Theft Schemes

Hackers are exploiting logistics tech to bid on and steal real freight shipments, costing companies millions and disrupting supply chains.

November 3

Auto

Fraud

Risk Management

Technology

Underwriting Gets Faster and Smarter with AI and API-Driven Tools

MGA underwriters are turning to AI, APIs, and automation to speed up quotes, reduce busywork, and adapt to increasingly complex risks like crypto, EV infrastructure, and IoT.

November 3

Insurance Industry

Risk Management

Technology

Underwriting

AI Lawsuits Drive D&O Insurance Shifts as Regulators Target Misleading Claims

Rising AI-related shareholder suits, fraud cases, and regulatory actions are pressuring D&O insurers to reassess risk, raise premiums, and scrutinize disclosures.

November 3

Fraud

Insurance Industry

Litigation

Risk Management

Gen Z Shuns Insurance Careers Despite Seeking Stability

Gen Z values stability, but the insurance industry’s image as rigid, unethical, and uninspiring keeps them away. A new report shows what insurers must change to win them over.

October 29

Education & Training

Insurance Industry

Risk Management

Caterpillar’s AI Push Fuels New Insurance Risks in Autonomous Equipment

As Caterpillar evolves into a tech-driven service provider, insurers must rethink policies for autonomous systems, cross-border operations, and software-based liabilities.

October 29

Legislation & Regulation

Liability

Litigation

Risk Management

Technology

CyberCube Estimates $38M to $581M in AWS Outage Losses with Limited Insurance Impact

A brief but widespread AWS outage affected over 70,000 organizations, but insurers expect minimal loss exposure due to short duration, reimbursements, and modeled risk expectations.

October 29

Catastrophe

Insurance Industry

Technology

$18 Million Verdict: NCAA Found Negligent in Former College Player’s Head-Injury Suit

A jury in Orangeburg County, South Carolina awarded $18 million to former college football player Robert Geathers and his wife Debra after finding that the NCAA was negligent in failing to warn him of the long-term effects of repeated head trauma.

October 29

Insurance Industry

Liability

Life & Health

Risk Management

South Carolina

Catastrophic Hurricane Melissa Poised for Historic Category 5 Landfall in Jamaica

Hurricane Melissa is bearing down on Jamaica as a Category 5 storm, set to make what may become the island’s strongest landfall on record. Melissa has sustained winds well above 157 mph, is moving very slowly, and will trigger an extreme combination of storm surge, torrential rainfall, flash flooding and landslides.

October 28

Catastrophe

Insurance Industry

Property

2025 Home Insurance Severity Hits 7-Year High

Wind, hail, and water-related claims pushed severity up 9% in 2024, with catastrophe claims reaching a 7-year high of 42%. Adjusters must navigate rising costs, inflation pressures, and shifting risk patterns.

October 27

Catastrophe

Insurance Industry

Property

Risk Management

Fragmented Claims Funds Drain Insurer Liquidity and Delay Payments

Outdated fund management slows claims payments, erodes profits, and hurts customer retention across the insurance value chain.

October 27

Catastrophe

Insurance Industry

Technology