Personal Auto Insurance Sees Strongest Underwriting Year Since COVID Disruptions

The U.S. personal auto insurance sector posted a 95.3 combined ratio in 2024—its best underwriting result since COVID—driven by rate increases and improved loss ratios.

June 12

Auto

Insurance Industry

Legislation & Regulation

Litigation

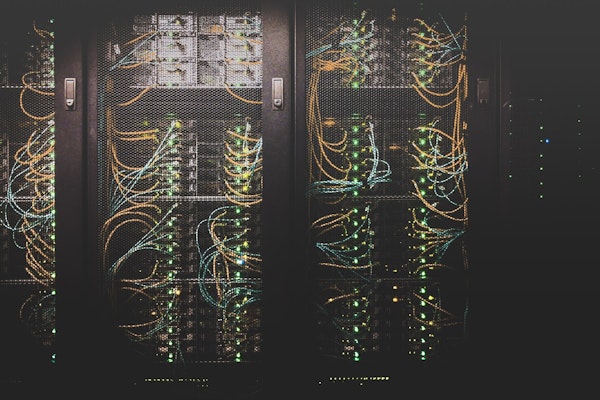

AI Agents Now Handle Insurance Policies from Quote to Claim with Sure’s New Protocol

Sure introduces its Model Context Protocol, enabling AI agents to autonomously quote, bind, and service insurance policies with integrated compliance and multi-carrier support.

June 11

Auto

Insurance Industry

Property

Technology

Texas

Disney and Comcast Sue AI Startup Midjourney Over Use of Copyrighted Characters

Disney and Comcast allege AI image platform Midjourney infringed on iconic characters like Darth Vader and Shrek, seeking $150,000 per violation in federal court.

June 11

Insurance Industry

Legislation & Regulation

Litigation

Technology

California

Natural Disasters and Legal Pressures Are Driving Up Homeowners Insurance Costs Nationwide

Homeowners insurance is becoming less affordable nationwide as natural disasters, legal system strain, and rising repair costs drive premiums higher, especially in disaster-prone states.

June 11

Catastrophe

Insurance Industry

Litigation

Property

Alaska

Florida

Louisiana

Maryland

Mississippi

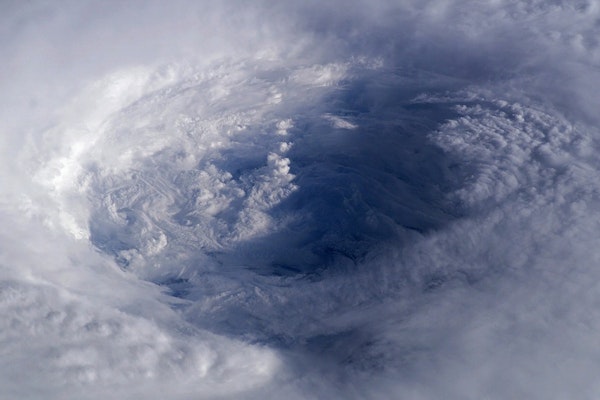

How the Insurance Industry Is Preparing for a Fierce 2025 Hurricane Season

After a season of compounding storms and inland flooding in 2024, the insurance industry is refining its storm strategies and readiness plans for a potentially active 2025.

June 11

Catastrophe

Education & Training

Insurance Industry

Property

Cyberattack Disrupts Operations at Whole Foods Supplier United Natural Foods

United Natural Foods, a key supplier for Whole Foods, took systems offline after unauthorized network activity, causing temporary disruptions in order fulfillment and distribution.

June 10

Insurance Industry

Property

Risk Management

Technology

Rhode Island

AI Acceleration Signals Big Opportunities for Insurers as Adoption Surges

Mary Meeker’s new 340-page AI report reveals explosive growth, accelerating adoption, and decreasing costs—pointing to major advantages for insurers leveraging the technology.

June 10

Fraud

Insurance Industry

Risk Management

Technology

Million-Dollar Health Claims Spike as Employers Struggle with Soaring Costs

A 29% rise in million-dollar medical claims over the past year is squeezing self-funded employers, with cancer remaining the top cost driver, Sun Life’s data reveals.

June 10

Insurance Industry

Life & Health

Risk Management

Workers' Compensation

Former Prosecutor Wins $3 Million Jury Award After Retaliation Allegations in California

A California jury awarded $3 million to former prosecutor Tracy Miller, who said she was forced from her role after defending colleagues reporting sexual harassment.

June 9

Insurance Industry

Legislation & Regulation

Liability

Litigation

California

Homeowners Take Legal Action Against USAA and AAA Insurers Over Los Angeles Wildfire Coverage Disputes

Lawsuits filed in Los Angeles County accuse USAA and AAA-affiliated insurers of underinsuring homes damaged in the January 7 wildfires, leaving policyholders unable to rebuild.

June 9

Catastrophe

Insurance Industry

Litigation

Property

California

Scientists Chase Extreme Hailstorms Across the Plains to Uncover the Costliest Weather Threat

Researchers are diving into hailstorms across Texas, Oklahoma, and Kansas to better understand one of the U.S.’s costliest but most overlooked weather risks.

June 9

Catastrophe

Insurance Industry

Property

Risk Management

Colorado

Kansas

New Mexico

Oklahoma

Texas

Colorado Advances Wildfire Insurance with Predictive Tech Models

Starting July 2026, Colorado will let insurers use advanced risk models for wildfire coverage, aiming to price policies more accurately amid rising climate threats.

June 9

Catastrophe

Legislation & Regulation

Property

Technology

California

Colorado

How Georgia Can Tackle Rising Insurance Premiums and Loss Ratios

Georgia homeowners face surging premiums after back-to-back hurricanes. Lawmakers and insurers are exploring solutions to stabilize the market and protect consumers.

June 9

Catastrophe

Legislation & Regulation

Property

Risk Management

Alabama

Arkansas

Florida

Georgia

Louisiana

Chinese Cyberattacks and User Mistakes Spark Growing Mobile Security Emergency

U.S. investigators warn that Chinese cyberattacks and user carelessness are turning smartphones into national security risks, exposing sensitive data and infrastructure.

June 9

Insurance Industry

Legislation & Regulation

Risk Management

Technology

Illinois

Michigan

Lawsuit Against Nationwide Challenges Mass Pet Insurance Cancellations

Nationwide faces legal backlash after canceling 100,000 pet insurance policies, with allegations of broken promises and a growing debate over ethics and contract law.

June 9

Insurance Industry

Life & Health

Litigation

Risk Management