Insurance Industry Expands AI Use but Faces Challenges in Scaling and Customer Trust

A new report reveals that while most insurers have adopted AI, fragmented deployment, data issues, and a trust gap hinder enterprise-wide scale and customer-facing value.

July 10, 2025

Education & Training

Risk Management

Technology

Corporate Sustainability Strategies Gain Traction as Companies Eye Profitable Climate Resilience

Most companies now view sustainability as a value driver, with 88% recognizing profit potential despite high investment costs and climate-related operational challenges.

July 7, 2025

Insurance Industry

Property

Risk Management

Technology

Lululemon Sues Costco Over Lookalike Apparel Alleging Consumer Confusion

Lululemon claims Costco’s low-cost apparel mimics its trademarked designs, misleading customers and violating trade dress protections under U.S. trademark law.

July 7, 2025

Insurance Industry

Liability

Litigation

Risk Management

California

Louis Vuitton Reports Data Breach Affecting Customer Information

Louis Vuitton Korea disclosed a data breach from unauthorized access to its system, exposing select customer information while assuring no financial data was compromised.

July 7, 2025

Insurance Industry

Liability

Risk Management

Technology

How to Manage Property Risk in 2025 with Smarter Valuation and Technology

As extreme weather events and insurance costs rise, property owners must adopt data-driven valuation, smart tech, and alternative coverage to remain insurable.

July 7, 2025

Catastrophe

Property

Risk Management

Technology

California

Florida

Flood Forecasting Defended by NWS as Critics Question Impact of Staffing Cuts

After deadly Texas floods, the National Weather Service faces scrutiny over Trump-era staffing cuts, though experts say forecasts were timely and accurate despite leadership gaps.

July 7, 2025

Catastrophe

Legislation & Regulation

Risk Management

Technology

Texas

U.S. Cyber Insurance Premiums Experience First-Ever Decline Amid Pricing Adjustments

U.S. cyber insurance premiums declined by 2.3% in 2024, driven by rate reductions even as claims frequency rose, highlighting evolving market risks and pricing trends.

July 2, 2025

Insurance Industry

Liability

Risk Management

Technology

How Water Leak Sensors Are Transforming Insurance Economics

Bolt’s successful integration of IoT water sensors with homeowner policies significantly reduces water damage claims, reshaping insurance profitability.

July 2, 2025

Property

Risk Management

Technology

Underwriting

Scattered Spider Cyber Threat Targets US Airline and Transport Industries

The FBI issues urgent warnings as the Scattered Spider cybercriminal group pivots its attacks from UK retailers to airlines and transport organizations across the US.

June 30, 2025

Education & Training

Liability

Risk Management

Technology

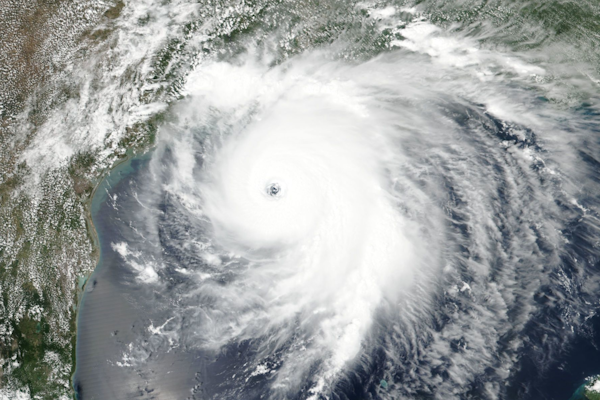

Loss of Military Satellite Data May Affect Hurricane Forecast Accuracy

Critical satellite data used for predicting rapid hurricane intensification will end June 30, potentially complicating forecasts during peak hurricane season.

June 30, 2025

Catastrophe

Property

Risk Management

Technology

Italian Executives Receive Lengthy Prison Terms for PFAS Pollution

Executives of a chemical plant in Italy face significant jail sentences after court finds them responsible for extensive PFAS contamination affecting drinking water.

June 30, 2025

Legislation & Regulation

Liability

Litigation

Risk Management

Cyber Risk and Technology Trends Reshaping Business Resilience in 2025

Executives’ cyber risk awareness is climbing, yet a misplaced confidence in cyber resilience persists amid escalating threats and geopolitical instability.

June 30, 2025

Legislation & Regulation

Liability

Risk Management

Technology

California

Modernizing Insurance Claims Payment Infrastructure for Greater Efficiency and Trust

Research reveals that fragmented back-end financial systems hinder timely claims payments and increase risks, highlighting the need for integrated, real-time solutions.

June 30, 2025

Education & Training

Insurance Industry

Risk Management

Technology

Federal Judge Rules Anthropic’s Book Use Fair but Piracy Still Faces Penalty

A San Francisco federal judge declares Anthropic’s AI book training fair use, yet rules storing millions of pirated copies illegal, setting stage for potential damages.

June 25, 2025

Legislation & Regulation

Litigation

Risk Management

Technology

California

How PFAS Influence Environmental Liability Risks in Construction Projects

Westfield Specialty’s Dennis Willette explores how PFAS contaminants shape environmental liability coverage in construction and why contractors need this insurance.

June 25, 2025

Legislation & Regulation

Liability

Property

Risk Management