Wildfires and Storms Drive Record Claim Severity in Early 2025 as Volume Hits Five-Year Low

Despite costly California wildfires and severe storms in Texas and the Midwest, property claim volume in Q1 2025 dropped to its lowest level in five years, Verisk reports.

June 24, 2025

Catastrophe

Insurance Industry

Property

Risk Management

AI and Value-Based Care Are Transforming Workers’ Comp Claims Management

Artificial intelligence and outcome-focused care models are streamlining workers’ compensation by improving triage, reducing costs, and prioritizing long-term recovery outcomes.

June 24, 2025

Life & Health

Risk Management

Technology

Workers' Compensation

Ohio

Why Florida, Texas, and California Lead the Nation in Lightning Insurance Claims

Florida, Texas, and California consistently rank highest for lightning-related insurance claims due to storm frequency, surge damage, and wildfire-triggered losses.

June 24, 2025

Catastrophe

Insurance Industry

Property

Risk Management

California

Florida

Texas

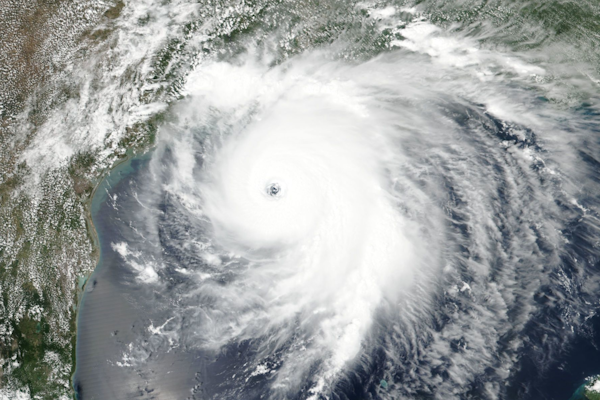

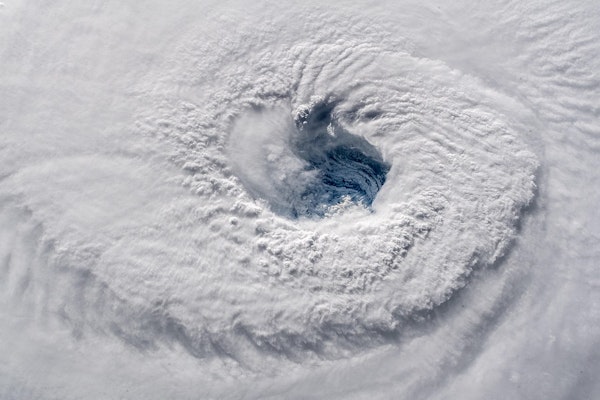

Colorado State University Predicts Above Normal 2025 Atlantic Hurricane Season

The 2025 Atlantic hurricane season is projected to be above-average with 17 named storms, nine hurricanes and four major hurricanes, increasing landfall risks along U.S. and Caribbean coasts.

June 19, 2025

Catastrophe

Insurance Industry

Property

Risk Management

Florida

Texas

Revolutionizing Catastrophe Modeling with AI for Insurers

Insurers can modernize CAT modeling by integrating AI-driven data capture, cleansing, enrichment, and analysis to deliver dynamic, real-time risk assessments that enhance underwriting and portfolio decisions.

June 19, 2025

Catastrophe

Insurance Industry

Risk Management

Technology

Claims Decline as Replacement Costs Skyrocket in Q1 2025

In Q1 2025, U.S. and Canadian property claims hit a five-year low even as average replacement costs surged 46 percent year-over-year, led by California wildfire losses and rising reconstruction expenses.

June 19, 2025

Catastrophe

Legislation & Regulation

Property

Risk Management

Insurance Industry Pushes Back on Federal AI Regulation Moratorium

The PIA, NAIC, AITC and NCOIL all warn that a proposed 10-year federal ban on state AI regulation would undermine consumer protections, stifle innovation and disrupt insurance markets.

June 19, 2025

Insurance Industry

Legislation & Regulation

Risk Management

Technology

Unlocking Underwriting Efficiency with Agentic AI Solutions

Agentic AI empowers carriers to tackle operational underwriting bottlenecks—streamlining risk analysis, fraud detection, and workflow automation to boost capacity in today’s talent-scarce market.

June 19, 2025

Insurance Industry

Risk Management

Technology

Underwriting

Finding Common Ground in Professional Liability Defense Strategies

Early collaboration between carriers, insureds, and panel counsel in professional liability claims reduces defense costs, preserves policy limits, and strengthens renewal prospects through faster settlements.

June 19, 2025

Insurance Industry

Litigation

Risk Management

Underwriting

Louisiana

New York

Texas

Hurricane Erick Pounds Mexican Coast with Fierce Winds and Flood Threat

Upgraded to ‘extremely dangerous’ Cat 4 before landfall, Erick made shore near Punta Maldonado with 125 mph winds, heavy rain and storm surge poised to trigger floods and mudslides.

June 19, 2025

Catastrophe

Insurance Industry

Property

Risk Management

Washington Post Cyberattack Targets Journalists Covering China and National Security

A targeted cyberattack compromised Microsoft accounts of Washington Post reporters covering China and national security, prompting a sweeping internal investigation.

June 16, 2025

Insurance Industry

Litigation

Risk Management

Technology

New Guide Explains How Legal System Abuse Raises Insurance Costs and Threatens Coverage Availability

A new consumer guide from Triple-I and Munich Re US reveals how legal system abuse inflates claim costs, drives premium increases, and limits insurance accessibility.

June 16, 2025

Insurance Industry

Liability

Litigation

Risk Management

States Move to Halt 23andMe Sale Over Privacy Concerns About Genetic Data

Twenty-seven states and D.C. filed suit to block the sale of genetic and medical data in 23andMe’s bankruptcy, citing lack of informed customer consent.

June 12, 2025

Legislation & Regulation

Life & Health

Risk Management

Technology

Utility and AI Apps Dominate as Distracted Driving Habits Shift in 2024

CMT’s 2024 report reveals a shift in distracted driving habits, with fewer drivers using phones but a surge in utility and AI app usage behind the wheel.

June 12, 2025

Auto

Insurance Industry

Risk Management

Technology

Massachusetts

Google Partners with National Hurricane Center for AI-powered Tropical Cyclone Forecasts

Google is working with the National Hurricane Center to evaluate a new AI model that could enhance tropical storm predictions up to 15 days in advance.

June 12, 2025

Catastrophe

Legislation & Regulation

Risk Management

Technology