Information Overload

The pandemic has accelerated the adoption of collaboration platforms in the workplace such as Slack, Microsoft Teams, Meta’s Workplace and Zoom. Between 2019 and 2021, the use of collaboration tools increased by 44% and the average Slack user sent roughly 110 messages a day.

June 7, 2022

Risk Management

The Way To Address Climate Change

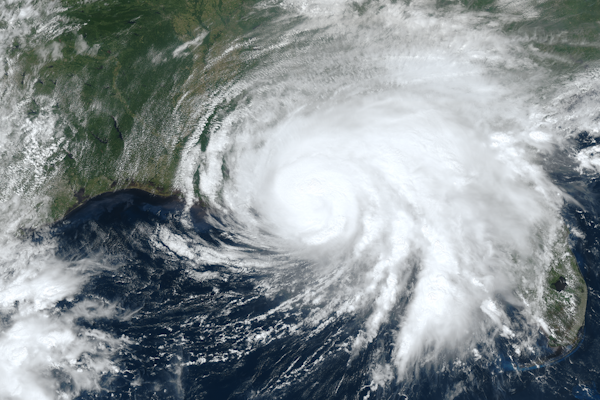

With the spring season known to bring the most dangerous storms and damaging tornados, the next few months are likely to see continual and damaging weather events across the U.S.

Earthquakes, storms, floods and droughts -- the number of recorded loss events resulting from natural disasters has been increasing for some years now. However, some insurers that are using more traditional risk assessment methods are finding the emerging risk landscape too unpredictable.

Climate change is one of the most pressing issues in the insurance industry today, but forward-thinking insurers have found the way to combat it: AI.

May 31, 2022

Property

Risk Management

Technology

Earthquakes, storms, floods and droughts -- the number of recorded loss events resulting from natural disasters has been increasing for some years now. However, some insurers that are using more traditional risk assessment methods are finding the emerging risk landscape too unpredictable.

Climate change is one of the most pressing issues in the insurance industry today, but forward-thinking insurers have found the way to combat it: AI.

These Two Towers Are Vital, Why Are We Letting Them Crumble?

The title of this column is not a reference to the second book of J.R.R. Tolkien’s Lord of the Rings series, nor does it refer to the terrorist attack that cost so many insurance professionals, and others, their lives on Sept. 11, 2001.

May 20, 2022

Liability

Risk Management

Workers' Compensation

CPCU Society Raised The Bar On Insurance Leadership At Las Vegas Conference

Las Vegas may seem an unlikely place to learn about leadership, but risk management education thrives there better than you might think.

May 18, 2022

Risk Management

Underwriting

How Inflation, Supply Chain, Energy Costs And Property Valuations Amplify Hurricane Risk

The ability to prepare, respond and recover from a disruptive event, like a hurricane, may be correlated to a company’s bottom line and their business resiliency.

May 18, 2022

Risk Management

Widening And Deepening The Conversation On Climate Risk And Resilience

With climate-related risks driving ever-increasing losses and generating daily headlines, it’s more important than ever for government, the private sector, and academia to engage with each other publicly in ways that shed light on these challenges to illuminate a path forward.

May 2, 2022

Education & Training

Risk Management

Electric Vehicles: What Risks Do They Pose To Homes?

Global electric vehicle (EV) sales increased by 108% from 3.24 million in 2020 to 6.75 million in 2021, according to EV Volumes, and that number is expected to jump again in 2022 as more EV options enter the marketplace and drivers seek relief from soaring prices.

April 12, 2022

Auto

Risk Management

Product Liability Claims: A Pocket Guide To Risk Prevention

Whether it’s a car, candy bar, toy, or television, most products will usually have undergone several rounds of development and testing to ensure they meet quality standards before entering the hands of consumers. While product safety certifications and quality assurance seals play a vital role in reducing the risk of faulty and/or dangerous products entering the market, claims do still arise.

April 7, 2022

Liability

Risk Management

Avoiding Coverage Denials Based on ‘Other Insurance’

‘Other insurance’ clauses are found in first-party and third-party liability policies and establish how loss is to be apportioned among insurance companies when more than one policy covers the same loss.

April 6, 2022

Risk Management

Electric Vehicles: What Risks Do They Pose To Homes?

Global electric vehicle (EV) sales increased by 108% from 3.24 million in 2020 to 6.75 million in 2021, according to EV Volumes, and that number is expected to jump again in 2022 as more EV options enter the marketplace and drivers seek relief from soaring prices.

April 1, 2022

Auto

Risk Management

Shields Up: Cyber Concerns In The Wake Of Russia’s Invasion Of Ukraine

Cybercriminals love pandemics, natural disasters, and wars. Global distractions are good for their business. Russia’s invasion of Ukraine elevates cybersecurity risks, which already weighed on the minds of global business leaders.

April 1, 2022

Risk Management

Here’s What You Missed At The CPCU Society Reinsurance And Excess And Surplus Symposium

Members of the risk and insurance industry recently convened for the annual Reinsurance & Excess Surplus Lines Symposium held virtually on March 9-10.

March 30, 2022

Education & Training

Insurance Industry

Risk Management

Coalition’s Cyber Claims Report Shows "No-one is Immune" to Attacks

Coalition released its cyber claims report in March, analyzing data from active cyber insurance companies in Canada and the United States throughout 2021.

March 10, 2022

Risk Management

Technology

What The 6th International Climate Report Says To Insurers

The Intergovernmental Panel on Climate Change (IPCC) has been publishing assessment reports describing expected climate change impacts and risks since 1990 and has warned of the growing risks from climate change in each report.

March 4, 2022

Catastrophe

Risk Management

NFTs Are Disrupting Fine Arts: Here’s What Risk Professionals Should Know

When Adrienne Reid heard that Mike Winkelmann, the digital artist known as Beeple, sold a piece of his work at the art auction house Christie’s for $69 million, she didn’t think much of it.

February 28, 2022

Education & Training

Risk Management

Technology