UnitedHealth Accused of Using Faulty AI to Deny Coverage to Elderly

A lawsuit claims UnitedHealth used an AI model with a high error rate to deny necessary medical coverage to elderly patients, sparking debates on AI’s role in health insurance.

November 28, 2023

Legislation & Regulation

Life & Health

Litigation

Technology

Minnesota

Glimmers of Good News on Climate (Finally)

Stunning declines in the cost of solar and wind power are rapidly adding renewables to the world’s energy mix.

November 28, 2023

Auto

Catastrophe

Risk Management

Technology

Georgia

New Jersey

The Human Cost of Automated Health Claims: A Struggle for Coverage

Patients and doctors challenge a major insurer’s reliance on technology for processing health claims, highlighting a loss of personal touch and rising legal concerns.

November 28, 2023

Legislation & Regulation

Life & Health

Litigation

Technology

California

Washington

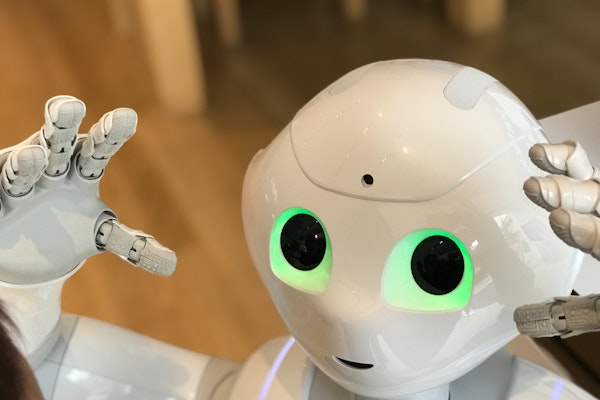

AI Impact in Insurance Balances Efficiency Gain and Employment Concerns

Artificial Intelligence revolutionizes insurance underwriting and processes, raising efficiency but also sparking concerns over job security in the industry.

November 27, 2023

Insurance Industry

Technology

Underwriting

Tech Whistleblower Struggles to Find Work Amid Hiring Discrimination Allegations

In the shadow of labor activism, a former Apple employee faces a career impasse, spotlighting the potential repercussions of speaking out in the tech industry.

November 27, 2023

Education & Training

Litigation

Technology

AI Impact on Insurance Jobs: A Deeper Look Beyond Recent Layoffs

Recent layoffs in the insurance sector prompt discussions on AI’s role, with experts suggesting AI is reshaping jobs rather than being the primary cause of job losses.

November 20, 2023

Education & Training

Insurance Industry

Risk Management

Technology

Whole Foods Executive Shares Insights on Career Transition and Risk Management Evolution

From culinary dreams to a leading role in risk management, a Whole Foods executive shares her journey and insights on the evolving landscape of workers’ compensation and technology’s role.

November 20, 2023

Education & Training

Risk Management

Technology

Workers' Compensation

Vegas Casinos Hit by Major Cyberattacks: MGM and Caesars Face Severe Consequences

MGM Resorts and Caesars Entertainment face severe fallout from major cyberattacks, highlighting the critical importance of cybersecurity in today’s digital age.

November 17, 2023

Fraud

Liability

Risk Management

Technology

Nevada

Rising ESG and Cyber Risks Transform the Landscape of Professional Liability Insurance

Environmental, social, governance risks and escalating cyber threats are redefining professional liability insurance, influencing rates and litigation trends.

November 17, 2023

Legislation & Regulation

Liability

Risk Management

Technology

Illinois

Use of Onboard Cameras in Fleet Vehicles Touted as Key to Mitigating Liability Risks

In the face of rising nuclear verdicts, risk experts from Crum & Forster advocate the use of cameras in fleet vehicles to minimize liability and enhance safety.

November 17, 2023

Auto

Liability

Risk Management

Technology

Ohio

Health Insurance Shifts Pave Way for Dramatic Changes in Employee Benefits and Insurance Carriers

Rising health insurance costs are driving employers to rethink benefits, paving the way for a more personalized approach to employee insurance and wellness.

November 16, 2023

Legislation & Regulation

Life & Health

Risk Management

Technology

Insurance Industry Shifts Focus from Repair to Predict and Prevent Model

In a significant industry shift, insurance moves towards a predict and prevent model, emphasizing consumer education and engagement.

November 16, 2023

Auto

Education & Training

Risk Management

Technology

Generative AI in Legal and Insurance Fields: A Balancing Act of Trust and Caution

AI’s growing presence in law and insurance raises questions of reliability and the balance of technology and human judgment.

November 16, 2023

Education & Training

Liability

Litigation

Technology

New York

Revolutionizing Auto Insurance Claims with Advanced Crash Detection Technology

Crash detection technology is set to revolutionize the auto insurance claims process, offering real-time accident alerts and improving the efficiency of claims handling.

November 15, 2023

Auto

Risk Management

Technology

Underwriting

Wearable Tech Transforms Worker Safety and Insurance Costs

Ergonomic wearables emerge as a key solution in reducing workplace injuries and workers’ compensation costs.

November 15, 2023

Education & Training

Risk Management

Technology

Workers' Compensation