Florida’s Insurance Market Faces Shake-Up as Lawmakers Tackle Rising Costs

With soaring premiums and industry instability, Florida lawmakers are pushing for reforms in home and auto insurance. Transparency, incentives, and technology may offer relief, but challenges remain.

March 5

Auto

Legislation & Regulation

Property

Technology

Florida

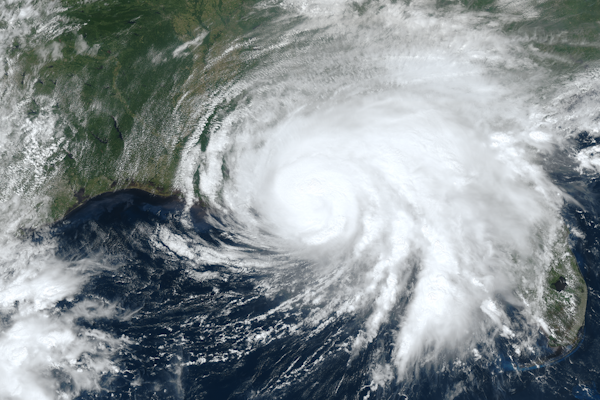

Insurance Industry Grapples with Escalating Natural Disaster Risks

As extreme weather events grow in frequency and severity, insurers must adapt through innovation, risk modeling, and new risk transfer strategies to remain viable.

March 5

Catastrophe

Legislation & Regulation

Property

Risk Management

California

Georgia Court Rules in Favor of Injured Worker Despite Prior Medical Misrepresentation

A Georgia appellate court ruled that an employer cannot use a worker’s prior undisclosed injury against them if the employer knowingly continued their employment before a subsequent workplace injury occurred.

March 4

Legislation & Regulation

Litigation

Risk Management

Workers' Compensation

Georgia

Firefighter Indicted for Alleged Workers’ Compensation Fraud

An Ohio firefighter has been indicted on charges of workers’ compensation fraud and theft, accused of unlawfully obtaining benefits between January and February 2022.

March 4

Fraud

Insurance Industry

Litigation

Workers' Compensation

Ohio

Insurance Fraud Surges in Canada, Hitting Auto Repair Shops Hard

Fraud investigations in Canada jumped 76% in 2024, with auto-related scams making up 67% of cases. Staged crashes, AI-powered fraud, and stolen vehicle scams are straining repair shops.

March 4

Auto

Fraud

Insurance Industry

Risk Management

Florida Insurance Market Strengthens as Legal Reforms Curb Costs

Legislative reforms targeting legal system abuse and claim fraud are improving Florida’s insurance market, reducing litigation, attracting insurers, and slowing premium increases.

March 4

Insurance Industry

Legislation & Regulation

Litigation

Property

Florida

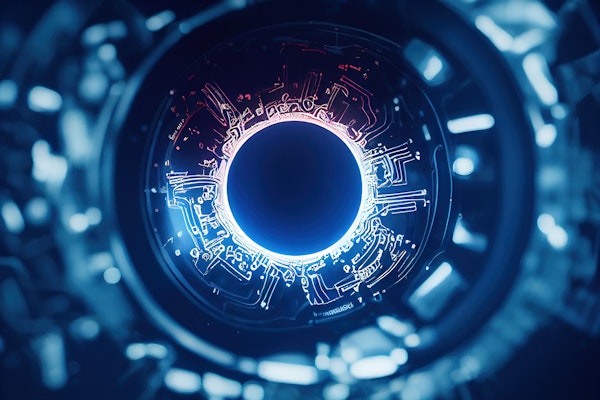

AI-Powered Fraud Is Reshaping Insurance—Are Insurers Keeping Up?

Artificial intelligence is revolutionizing fraud detection in insurance, but as fraudsters adopt AI-driven tactics, the industry faces an escalating arms race. Insurers that fail to invest in AI risk being outpaced by increasingly sophisticated fraud schemes.

March 3

Fraud

Insurance Industry

Litigation

Technology

Former New Orleans Officer and Nevada Attorney Accused in Insurance Fraud Scheme

A former police officer and current attorney is accused of orchestrating an insurance fraud scheme involving inflated art valuations and false police reports.

March 3

Fraud

Insurance Industry

Liability

Litigation

California

Louisiana

Nevada

Insurance Industry Trends and Challenges Through 2040

A global survey of over 500 insurance executives reveals how AI, climate risks, cybersecurity, and evolving market dynamics are shaping the industry’s future through 2040.

March 3

Insurance Industry

Risk Management

Technology

AI Analysis Reveals $2.15 Trillion in US Property at Risk from Wildfires

A new AI-driven study by ZestyAI finds that $2.15 trillion worth of U.S. residential property is at high risk of wildfire damage, affecting millions of homes beyond historically fire-prone regions.

February 27

Catastrophe

Insurance Industry

Property

Underwriting

California

Colorado

Kentucky

North Carolina

South Dakota

How AI and IoT Are Transforming Risk Management

AI, IoT, and blockchain are revolutionizing risk management by enabling insurers to predict and prevent losses, reducing costs and improving safety through real-time data analysis.

February 26

Catastrophe

Insurance Industry

Risk Management

Technology

Maine Stands Out as Home Insurance Rates Hold Steady Amid National Spikes

While home insurance premiums rise across the U.S., Maine has maintained stability, experiencing a rate decrease in 2024. Geography and low disaster risk contribute to its resilience.

February 25

Insurance Industry

Legislation & Regulation

Property

Risk Management

Maine

Massachusetts

New Hampshire

Vermont

Chegg Sues Google Over AI Overviews, Claims It Hurts Publishers and Students

Chegg, an online education company, has sued Google, alleging that its AI-generated search overviews undermine publishers by reducing traffic and profits, harming digital content creators.

February 25

Arkansas

California

District Of Columbia

California Lawsuit Targets Apple Over PFAS in Watch Bands

Two California residents filed a class action lawsuit against Apple, alleging the company misrepresented the health risks of PFAS chemicals used in its Apple Watch bands.

February 25

Insurance Industry

Legislation & Regulation

Litigation

Risk Management

California

Woman Sentenced for Insurance Fraud After Claim Photos Found Online

Rhonda Keisha Powell of Upper Marlboro, Maryland, has been sentenced to 45 days in jail for felony insurance fraud after investigators discovered that photos she submitted with her claim were easily found on the internet.

February 25

Fraud

Insurance Industry

Litigation

Risk Management

Maryland