Maryland Couple Sentenced for $20 Million Life Insurance Scam Involving Dozens of Fraudulent Policies

James and Maureen Wilson of Owings Mills, Maryland, received prison time and must repay over $18.7 million after orchestrating a massive life insurance fraud scheme.

July 10

Fraud

Insurance Industry

Life & Health

Litigation

Maryland

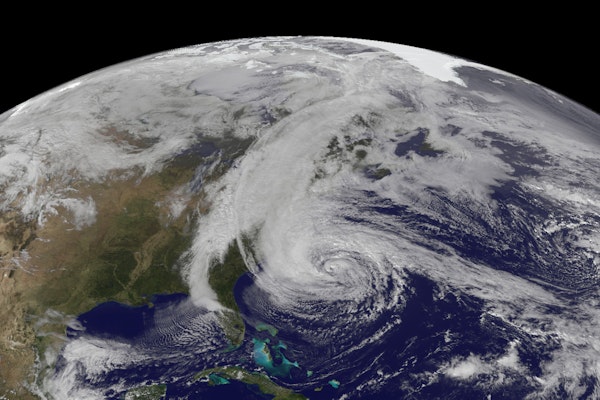

Natural Disasters and Legal Pressures Are Driving Up Homeowners Insurance Costs Nationwide

Homeowners insurance is becoming less affordable nationwide as natural disasters, legal system strain, and rising repair costs drive premiums higher, especially in disaster-prone states.

June 11

Catastrophe

Insurance Industry

Litigation

Property

Alaska

Florida

Louisiana

Maryland

Mississippi

Storm Surge Risk Threatens Billions in Coastal Property Value Across 20 States

Over 6.4 million homes in coastal U.S. states face moderate or greater storm surge risk, with $2.2 trillion in potential reconstruction costs, according to 2025 Cotality data.

June 2

Catastrophe

Legislation & Regulation

Property

Risk Management

Alabama

Connecticut

Delaware

District Of Columbia

Florida

Climate Change Drives Rising Home Insurance Costs and Coverage Gaps

As climate disasters increase, insurers are hiking premiums, reducing coverage, or exiting markets—leaving homeowners, states, and federal programs to fill the gap.

May 20

Catastrophe

Legislation & Regulation

Property

Risk Management

California

Florida

Maryland

Amtrak Health Plan Defrauded of $12 Million by Over 100 Employees and Medical Providers

Over 100 Amtrak employees joined forces with medical providers in a fraudulent health insurance scheme that cost the company more than $12 million, a new report finds.

May 12

Fraud

Insurance Industry

Legislation & Regulation

Risk Management

Connecticut

Delaware

District Of Columbia

Maryland

New Jersey

States in Hurricane Zones Face Bigger Disaster Costs as Federal Support Shrinks

States like Maryland are preparing for a busier hurricane season with fewer FEMA resources after nationwide cuts to disaster mitigation funding and staffing.

April 28

Catastrophe

Legislation & Regulation

Property

Risk Management

Maryland

Baltimore Bridge Collapse Shows Why Marine Liability Claims Demand Flexibility and Foresight

One year after the Baltimore Bridge collapse, Howden highlights the marine insurance sector’s need for adaptability amid complex claims and a competitive market environment.

April 7

Catastrophe

Insurance Industry

Liability

Marine

Maryland

Maryland Wildfires Decline in 2024, Falling Below Recent Averages

Maryland saw 165 wildfires in 2024, burning 953.4 acres. Arson was the leading cause, while the Eastern region had the most fires and acres burned. Learn more about key trends.

March 7

Catastrophe

Legislation & Regulation

Property

Risk Management

Maryland

Woman Sentenced for Insurance Fraud After Claim Photos Found Online

Rhonda Keisha Powell of Upper Marlboro, Maryland, has been sentenced to 45 days in jail for felony insurance fraud after investigators discovered that photos she submitted with her claim were easily found on the internet.

February 25

Fraud

Insurance Industry

Litigation

Risk Management

Maryland

Maryland’s Crackdown on Workplace Fraud Uncovers Thousands of Misclassified Workers

Maryland’s Joint Enforcement Task Force on Workplace Fraud identified over 5,500 misclassified workers in 2024, recovering millions in lost wages and tax revenue while proposing stronger enforcement measures.

February 24

Legislation & Regulation

Litigation

Risk Management

Workers' Compensation

Maryland

Detroit Man Sentenced to Over Four Years for $1M Unemployment Fraud Scheme

A Detroit man has been sentenced to 51 months in prison and ordered to pay over $900,000 in restitution for his role in a multi-state unemployment fraud scheme targeting COVID-19 relief funds.

February 21

Fraud

Insurance Industry

Legislation & Regulation

Litigation

Maryland

Michigan

Pennsylvania

Maryland Insurance Administration Recovers Over $33 Million for Policyholders in 2024

The Maryland Insurance Administration recovered nearly $33.3 million in 2024 by assisting consumers with insurance disputes, fraud investigations, and regulatory enforcement efforts.

January 30

Fraud

Insurance Industry

Legislation & Regulation

Property

Maryland

Cyber Risks Dominate Global Business Concerns as Climate Change Climbs Rankings

Cyber incidents, including ransomware and IT disruptions, top the global risk list for the fourth consecutive year, while climate change rises to its highest position ever in the Allianz Risk Barometer.

January 20

Insurance Industry

Risk Management

Maryland

Dockworkers Reach Tentative Deal, Strike Suspended Until January

U.S. dockworkers have suspended their strike after reaching a tentative agreement with terminal operators, securing a wage increase and agreeing to continue negotiations in January.

October 4, 2024

Legislation & Regulation

Litigation

Risk Management

Alabama

Florida

Georgia

Louisiana

Maryland

Justice Department Accuses Cargo Ship Owner of Negligence in Baltimore Bridge Collapse Lawsuit

The Justice Department is seeking to recover over $100 million, alleging that the owner and manager of the cargo ship responsible for the Baltimore bridge collapse ignored critical electrical issues and cut safety corners, leading to the fatal disaster.

September 18, 2024

Catastrophe

Liability

Litigation

Marine

Maryland