How Insurers Can Win Back Consumer Trust in AI-Driven Claims

As AI transforms P/C insurance, many consumers remain wary. Insurers must clearly explain how AI improves claims, pricing, and service to earn customer confidence.

May 7, 2025

Auto

Insurance Industry

Property

Technology

Solving the Adjuster Shortage with Agentic AI and Digital Coworkers

As the insurance industry faces a wave of retirements among claims adjusters, Agentic AI offers a scalable, efficient solution to maintain service levels and preserve expertise.

May 6, 2025

Insurance Industry

Property

Technology

Workers' Compensation

Florida Senate Blocks Attempt to Roll Back Property Insurance Reforms

Florida’s Senate rejected a House effort to reinstate one-way attorney fees, preserving reforms that have reduced lawsuits and stabilized the state’s property insurance market.

May 5, 2025

Insurance Industry

Legislation & Regulation

Litigation

Property

Florida

Georgia

Aaron Judge Lawsuit Highlights Why Contractors Must Prioritize Transparency and Fair Billing

Aaron Judge’s fraud lawsuit against a Florida interior designer reveals the importance of transparent pricing, detailed invoices, and written approvals in construction contracts.

May 1, 2025

Insurance Industry

Litigation

Property

Risk Management

Florida

New York

Western Pennsylvania Slammed by Derecho-Level Storms as Deaths, Power Outages Mount

Severe storms packing 95 mph winds swept through Western Pennsylvania, killing three people, toppling trees, and knocking out power for over 400,000 residents.

April 30, 2025

Catastrophe

Insurance Industry

Property

Risk Management

Ohio

Pennsylvania

Woman Sentenced to Prison for $650,000 Crop Insurance Fraud Scheme

Jatinderjeet ‘Jyoti’ Sihota will serve one year in prison for orchestrating a crop insurance fraud scheme that led to over $650,000 in fraudulent payouts in California.

April 29, 2025

Fraud

Insurance Industry

Litigation

Property

California

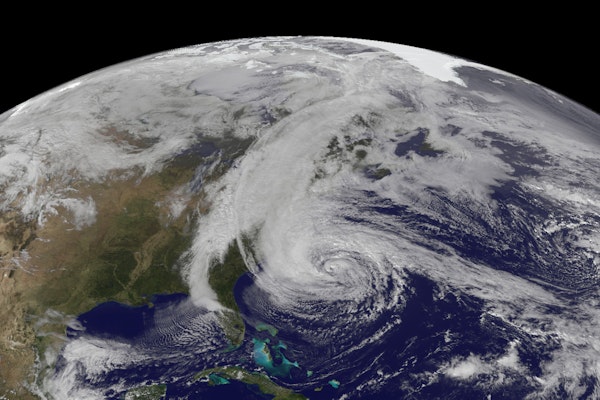

Natural Catastrophe Insurance Losses Could Hit $145 Billion in 2025 as Peak Loss Risk Grows

Global catastrophe insurance losses are projected to grow steadily, with a 1-in-10 chance of topping $300 billion in 2025, driven by climate change, urbanization, and rising exposure values.

April 29, 2025

Catastrophe

Insurance Industry

Property

Risk Management

2025 Southeast Texas Hurricane Guide Released for Upcoming Season

The National Weather Service Houston/Galveston office has published the 2025 Hurricane and Severe Weather Guide, offering Southeast Texas residents crucial preparedness tips for the season ahead.

April 28, 2025

Catastrophe

Insurance Industry

Property

Risk Management

Texas

States in Hurricane Zones Face Bigger Disaster Costs as Federal Support Shrinks

States like Maryland are preparing for a busier hurricane season with fewer FEMA resources after nationwide cuts to disaster mitigation funding and staffing.

April 28, 2025

Catastrophe

Legislation & Regulation

Property

Risk Management

Maryland

How Property and Casualty Insurers Can Combat Fraud with AI-Driven Multimodal Technologies

Property and casualty insurers can leverage AI-powered multimodal fraud detection to protect their bottom lines, lower costs for policyholders, and reduce fraudulent claims.

April 28, 2025

Fraud

Insurance Industry

Property

Technology

Vehicle Thefts Drop to Historic Low in 2024

The U.S. saw fewer than one million vehicle thefts in 2024—a 16.7% drop from 2023 and the biggest decline in four decades, with Kia and Hyundai models leading theft stats.

April 23, 2025

Auto

Fraud

Property

Risk Management

New Jersey Wildfire Grows to 8,500 Acres as Evacuations and Power Outages Mount

The Jones Road Wildfire near Toms River has burned 8,500 acres with less than 10% containment, prompting evacuations and threatening over 1,000 structures in Ocean County, New Jersey.

April 23, 2025

Catastrophe

Insurance Industry

Property

Risk Management

New Jersey

Neutral Pacific Waters Signal Potential Spike in Atlantic Hurricanes

With La Niña officially over and El Niño unlikely, the Atlantic may face an active hurricane season as neutral Pacific conditions remove key storm barriers.

April 21, 2025

Catastrophe

Insurance Industry

Property

Risk Management

Alabama

Florida

Louisiana

Mississippi

Texas

How Agentic AI Is Transforming Insurance and Financial Services with Next Best Action Technology

Agentic AI is reshaping insurance and financial services by empowering digital coworkers to drive timely, compliant, and actionable decisions at scale.

April 18, 2025

Property

Risk Management

Technology

California

Homeowners Crowdsource Toxic Smoke Data After Eaton Fire Insurance Disputes

After insurers refused to pay for contamination testing, Eaton Fire survivors shared private test results online, exposing widespread toxic exposure and coverage gaps.

April 18, 2025

Catastrophe

Insurance Industry

Legislation & Regulation

Property

California