The U.S. alleges that National General Holdings Corp. improperly force-placed insurance on vehicles financed through Wells Fargo for over a decade, causing financial harm to borrowers.

July 26

Auto

Fraud

Insurance Industry

Legislation & Regulation

Litigation

Arizona

California

Delaware

Missouri

New Hampshire

Fourteen NBA teams are accused of using copyrighted music in social media promotional videos without proper licensing, leading to multiple lawsuits by Kobalt and other music companies.

July 23

Insurance Industry

Legislation & Regulation

Litigation

Technology

Arizona

California

Colorado

Florida

Georgia

Pennsylvania’s latest insurance regulations allow surplus line licensees to charge service fees and offer enhanced nonmonetary gifts to policyholders, improving transparency and market dynamics.

July 22

Excess & Surplus Lines

Insurance Industry

Legislation & Regulation

Risk Management

Pennsylvania

An administrative assistant admitted to stealing over $35,000 from an Adams County dentist’s office, forging insurance claims, and depositing checks into her personal account, according to court documents.

July 19

Fraud

Insurance Industry

Litigation

Risk Management

Pennsylvania

Recent research from the FIRST Center highlights significant differences in state workers’ compensation laws for first responders with mental health conditions, emphasizing the need for uniform presumption laws.

July 16

Legislation & Regulation

Life & Health

Risk Management

Workers' Compensation

Alaska

Arizona

California

Colorado

Connecticut

A Pennsylvania solicitor was arrested for an insurance fraud scheme that caused nearly $20k in roof damage to a homeowner’s property in 2023.

July 8

Fraud

Insurance Industry

Litigation

Property

Pennsylvania

The Insurance Information Institute (Triple-I) reported a 30% increase in total claims value from 2022, highlighting the financial impact of severe convective storms.

June 19

Catastrophe

Insurance Industry

Property

Risk Management

Alabama

California

Florida

Georgia

Louisiana

The rise in cable thefts is occurring amidst significant efforts by major U.S. automakers to promote electric vehicles as a key strategy to combat climate change.

June 19

Insurance Industry

Property

Risk Management

Technology

Arizona

California

Colorado

Illinois

Nevada

The USPS concluded its 2024 National Dog Bite Awareness Campaign amid a rise in dog attacks on postal workers, emphasizing safe mail delivery and responsible pet ownership.

June 10

Education & Training

Insurance Industry

Risk Management

Weird

California

Florida

Illinois

Michigan

Missouri

A comprehensive study from the U.S. Chamber of Commerce Institute for Legal Reform highlights the rising trend of nuclear verdicts, their causes, and potential solutions over a ten-year period ending in 2022.

June 10

Legislation & Regulation

Litigation

Property

Risk Management

California

Florida

Georgia

Illinois

Missouri

Rhode Island’s new law, effective January 2025, prevents auto insurers from charging widows and widowers higher rates, treating them the same as married policyholders.

June 6

Auto

Insurance Industry

Legislation & Regulation

Liability

Delaware

Pennsylvania

Rhode Island

A West Virginia appellate court ruled that a worker injured while assisting an accident victim during a work-related trip is entitled to workers’ compensation benefits, overturning previous decisions.

May 31

Insurance Industry

Liability

Litigation

Workers' Compensation

Pennsylvania

West Virginia

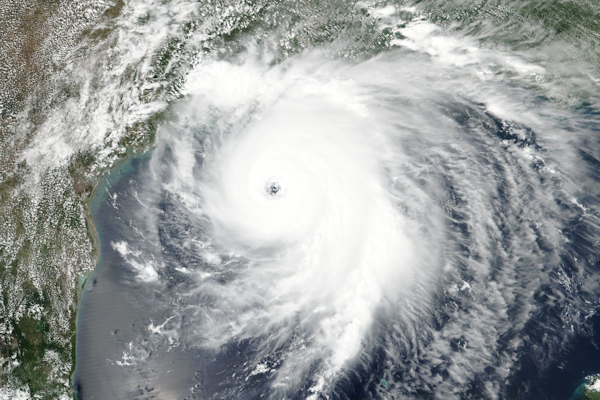

CoreLogic’s 2024 Hurricane Risk Report details the potential impact of hurricanes on U.S. Gulf and Atlantic states, emphasizing the need for updated risk assessments to ensure effective preparation and mitigation.

May 30

Catastrophe

Insurance Industry

Property

Risk Management

Florida

Maine

New Jersey

New York

Pennsylvania

The National Transportation Safety Board has urged federal and state authorities to review inspection reports and address maintenance issues for bridges made of uncoated weathering steel, following the 2022 Fern Hollow Bridge collapse in Pittsburgh.

May 28

Legislation & Regulation

Liability

Risk Management

Technology

Pennsylvania

U.S. Postal Service to compensate an Oregon mail carrier for wrongful termination and emotional distress following a workplace injury report.

May 23

Legislation & Regulation

Litigation

Risk Management

Workers' Compensation

California

Florida

Illinois

New Jersey

Oregon

Recent Provider Listings

Serving the US

National

Adjusters

Emergency Disaster Response Services

Third Party Administrators Tpa