St. Petersburg Reduced Insurance Coverage for Tropicana Field Months Before Major Hurricane Damage

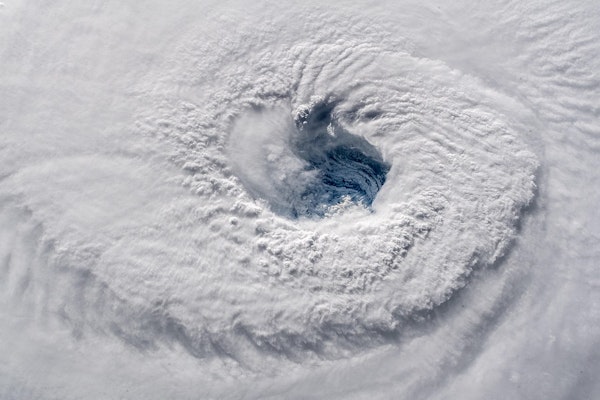

Ahead of the 2024 hurricane season, St. Petersburg reduced Tropicana Field’s wind and flood coverage from $100 million to $25 million, exposing the city to significant risk. After Hurricane Milton destroyed the stadium’s roof, officials now face uncertainties about potential coverage shortfalls.

November 5, 2024

Insurance Industry

Litigation

Property

Risk Management

Florida

NFIP Introduces Monthly Payment Option for Flood Insurance Policies

The National Flood Insurance Program (NFIP) will allow policyholders to pay flood insurance premiums monthly starting December 31, aiming to ease financial pressure on households and broaden access to flood coverage.

November 5, 2024

Insurance Industry

Legislation & Regulation

Property

Risk Management

2024 Hurricanes Leave Nearly 350,000 Cars Flood-Damaged, CARFAX Warns

In 2024, hurricanes have left an estimated 347,000 vehicles with flood damage across the U.S., CARFAX reports. Experts caution that many may be resold, potentially concealing dangerous and costly water damage.

November 5, 2024

Auto

Catastrophe

Fraud

Risk Management

Florida

California’s Firefighting Crisis Highlights Need for Industry Support

California faces a severe shortage of wildfire firefighters, as low pay, mental strain, and challenging conditions drive workers away. Could the insurance industry help ease the burden on those protecting at-risk properties?

November 5, 2024

Catastrophe

Insurance Industry

Legislation & Regulation

Risk Management

California

Insurers Navigate Risks and Opportunities in 2024 Global Report

The 2024 Global Insurance Report explores key shifts in the insurance sector, including market volatility, regulatory risks, low-carbon investments, and expanding private market exposure across various regions.

November 5, 2024

Life & Health

Property

Risk Management

Technology

Innovative AI Solution Takes Aim at Gun Violence Prevention

ZeroEyes, a tech company backed by The Institutes’ Predict & Prevent podcast, has developed AI-powered gun detection technology that combines human verification to curb gun violence. Through partnerships with schools and businesses, this system aims to protect communities, delivering alerts and minimizing bias by focusing solely on weapon detection.

November 5, 2024

Education & Training

Insurance Industry

Liability

Risk Management

Technology

Hailstorms Drive Record Insurance Losses as Experts Push for Better Detection and Prediction

Severe hailstorms in the U.S. have led to record insurance losses, with hail damage growing due to rising urbanization, climate change, and frequent severe convective storms. Enhanced monitoring projects promise insights to mitigate future risks.

November 5, 2024

Catastrophe

Insurance Industry

Risk Management

Technology

Colorado

Texas

Supreme Court Rejects Emergency Challenge to EPA Greenhouse Gas Standards for Power Plants

The U.S. Supreme Court recently declined to stay the EPA’s greenhouse gas emissions standards for coal-fired power plants, requiring plants expected to operate beyond 2039 to meet emission targets by 2032 or close by 2039. Legal challenges continue in lower courts.

November 5, 2024

Legislation & Regulation

Litigation

Risk Management

Parametric Reputation Risk Insurance Expands to Cover "Metaphorical" Catastrophes

The 4-M parametric model, widely used for natural disaster insurance, is now being adapted to cover reputation risks, allowing businesses to mitigate financial impacts from reputational crises as effectively as from physical catastrophes.

October 30, 2024

Insurance Industry

Liability

Risk Management

Technology

Colorado

Embedded Insurance: The Key to Seamless Coverage for On-Demand Drivers

The on-demand economy is booming, yet drivers still face challenges accessing tailored auto insurance. Embedded insurance offers a seamless solution, streamlining coverage for the modern gig workforce.

October 30, 2024

Auto

Insurance Industry

Risk Management

Technology

NFIP Flood Insurance Claims Surge to 54,000 After Hurricane Helene, FEMA Reports

Following Hurricane Helene’s landfall in Florida, over 54,000 NFIP flood insurance claims have been filed, with FEMA reporting $480 million in early claims payments. This storm, among the most significant for NFIP, may see more claims as impacted areas become accessible.

October 28, 2024

Catastrophe

Legislation & Regulation

Property

Risk Management

Florida

Texas A&M Research Links Climate Change to Increased Hurricane Rainfall in the Southeast

A Texas A&M study shows a nearly 20% increase in extreme rainfall during storms like Hurricane Helene, linking climate change to intensified flooding risks across the southeastern United States.

October 28, 2024

Catastrophe

Property

Risk Management

Florida

Georgia

North Carolina

Texas

Widespread Flooding from Hurricane Helene Spotlights Inland Insurance Gaps

The devastation from Hurricane Helene reveals a significant inland flood-protection gap, particularly in flood-prone communities without sufficient insurance coverage, where misinformation and funding challenges further slow recovery efforts.

October 28, 2024

Catastrophe

Insurance Industry

Legislation & Regulation

Risk Management

Florida

Georgia

Kentucky

New Jersey

New York

Expanding Long-Term Care Insurance to Support Aging Americans

With premiums on the rise and limited access to long-term care insurance, the industry is exploring innovative solutions to expand coverage, reduce costs, and better prepare Americans for the high cost of senior care.

October 28, 2024

Education & Training

Insurance Industry

Life & Health

Risk Management

New Cyber Risk Management Certification by The Institutes Aims to Strengthen Cyber Security Expertise

The Institutes have introduced the Associate in Cyber Risk Management (ACRM) designation to equip risk managers, underwriters, and brokers with advanced knowledge and skills in managing cyber risks, a top concern for modern businesses.

October 28, 2024

Education & Training

Insurance Industry

Risk Management

Technology