AI Transformation in Workers’ Compensation: Benefits and Roadblocks

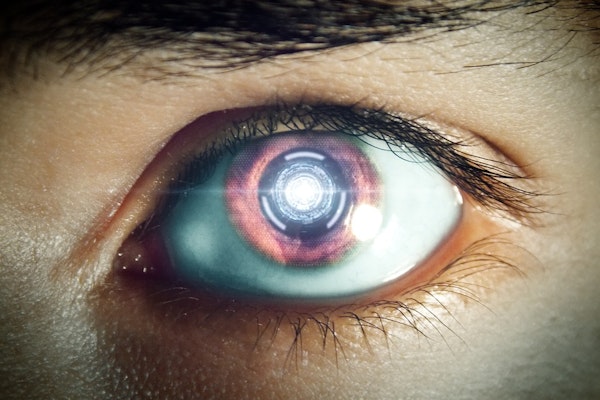

Artificial intelligence is set to revolutionize workers’ compensation by enhancing decision-making, streamlining claims processes, and predicting outcomes. However, challenges like data quality, transparency, and standardization must be addressed for successful integration.

October 4, 2024

Litigation

Risk Management

Technology

Workers' Compensation

California

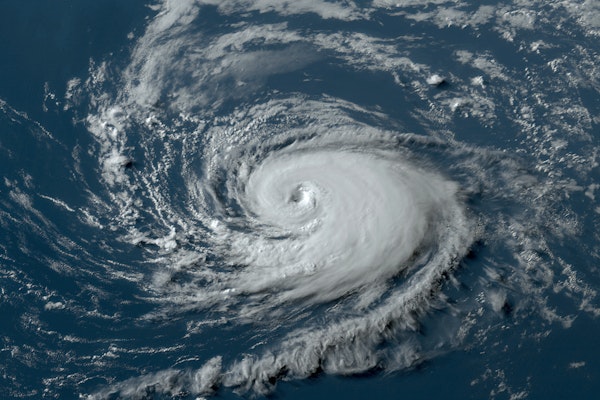

FEMA Faces Funding Shortage as Hurricane Helene Devastates the Southeast

FEMA is running low on disaster relief funds as it responds to Hurricane Helene, which caused severe damage across several Southeastern states. Congress may need to pass additional funding to sustain relief efforts.

October 4, 2024

Catastrophe

Legislation & Regulation

Property

Risk Management

Florida

Georgia

Louisiana

North Carolina

South Carolina

Dockworkers Reach Tentative Deal, Strike Suspended Until January

U.S. dockworkers have suspended their strike after reaching a tentative agreement with terminal operators, securing a wage increase and agreeing to continue negotiations in January.

October 4, 2024

Legislation & Regulation

Litigation

Risk Management

Alabama

Florida

Georgia

Louisiana

Maryland

Antarctic Sea Ice Reaches Second Lowest Maximum Extent on Record in 2024

In 2024, Antarctic sea ice reached its second lowest maximum extent in recorded history at 17.16 million square kilometers, just above the 2023 record low, highlighting ongoing concerns about sea ice trends.

October 4, 2024

Catastrophe

Legislation & Regulation

Risk Management

Technology

Digital Payment Trust Eroded by Cyber Scams Amid Growing Global Transactions

As digital payments grow globally, cyber scams are increasingly undermining trust in the system. Chubb’s survey reveals how fraud affects user confidence and how insurance can help restore it.

October 4, 2024

Fraud

Insurance Industry

Risk Management

Technology

Atlantic Hurricane Activity Predicted to Surge Through Mid-October 2024

Colorado State University forecasters predict above-normal hurricane activity from October 1-14, 2024, with an extremely high likelihood of major storms in the Atlantic and Caribbean regions.

October 4, 2024

Catastrophe

Insurance Industry

Property

Risk Management

Solar Energy Growth Sparks Surge in Construction Claims

The rapid growth of solar energy is driving an increase in construction-defect claims, as industry experts highlight risks such as fire, environmental concerns, and insurance coverage issues.

October 4, 2024

Insurance Industry

Legislation & Regulation

Property

Risk Management

Arizona

California

Colorado

Florida

Texas

How to Address Three Common Mental Health Concerns in Workers’ Comp Claims

Workers’ comp claims involving mental health conditions can be costly and complex. Understanding the three main types of concerns can help adjusters mitigate risks and reduce claim costs.

October 4, 2024

Risk Management

Technology

Workers' Compensation

Carolina Residents and Agents Shocked by Inland Damage from Hurricane Helene

Insurance agents in Asheville, North Carolina, report unprecedented inland damage from Hurricane Helene, with widespread flooding, fallen trees, and road closures hampering recovery efforts.

October 1, 2024

Catastrophe

Insurance Industry

Property

Risk Management

North Carolina

Tennessee

Small Businesses Face Rising Threats from AI-Driven Scams

A survey reveals that a quarter of small business owners have been targeted by AI-generated scams, using tactics like email, voice, and video impersonation, exposing them to significant fraud risks.

October 1, 2024

Fraud

Insurance Industry

Risk Management

Technology

Hurricane Helene Signals Emerging Inland Threat as Storms Retain Strength

Hurricane Helene’s unprecedented inland devastation highlights the growing danger of the "brown-ocean effect," a phenomenon that may allow future hurricanes to retain strength as they move further inland.

October 1, 2024

Catastrophe

Legislation & Regulation

Property

Risk Management

Florida

Georgia

North Carolina

Hurricane Helene’s Economic Impact Could Reach $160 Billion Due to Infrastructure Destruction and Business Losses

Economic estimates for Hurricane Helene project up to $160 billion in damage, driven by widespread infrastructure failure, property loss, business disruption, and long-term recovery costs.

September 30, 2024

Catastrophe

Insurance Industry

Property

Risk Management

Florida

Georgia

Kentucky

North Carolina

Ohio

Key Restaurant Insurance Claims Insights to Help Adjusters Minimize Payouts

Understand the most frequent and costly insurance claims in the restaurant industry, from equipment breakdown to employee injury, and how claims adjusters can help mitigate risks.

September 30, 2024

Liability

Property

Risk Management

Workers' Compensation

California

Florida

Michigan

Mississippi

New Jersey

Helene Hits Florida as Category 4 Hurricane, Unveils Critical Flood Insurance Gap

Hurricane Helene’s catastrophic flooding from Florida to North Carolina exposes the serious lack of flood insurance coverage among homeowners, especially in inland areas, highlighting the increasing risks from extreme weather events.

September 30, 2024

Catastrophe

Legislation & Regulation

Property

Risk Management

Florida

Georgia

Kentucky

North Carolina

South Carolina

Hurricane Helene’s Impact Pressures Florida’s Struggling Insurance Market

Hurricane Helene’s destructive force on Florida’s properties highlights the fragility of the state’s insurance market, with rising premiums, reinsurance challenges, and climate change amplifying risks.

September 30, 2024

Catastrophe

Legislation & Regulation

Property

Risk Management

Florida