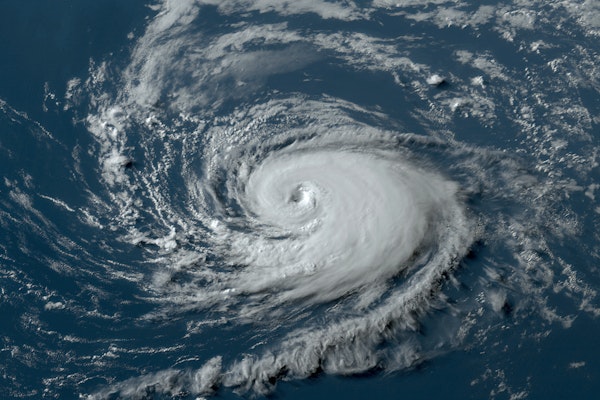

Hurricane Helene Causes Up to $34 Billion in Total Economic Impact, Moody’s Reports

Hurricane Helene made landfall as a Category 4 storm, leading to widespread property damage, power outages, and disruptions. Analysts predict total costs ranging from $20 billion to $34 billion, with insurance losses still being assessed.

September 30, 2024

Catastrophe

Insurance Industry

Property

Risk Management

Florida

Navigating the Complexities of Alcohol and Marijuana in Life Insurance Claims

Alcohol and marijuana present unique challenges in life and AD&D claims. While alcohol regulations are uniform, marijuana’s state-by-state legality and unpredictable effects complicate claim decisions and risk management.

September 30, 2024

Legislation & Regulation

Liability

Life & Health

Risk Management

Strategies to Reduce the Impact of Wildfires: Lessons from the Lahaina Fire

Experts urge adopting fire-resistant building practices, fuel breaks, and structure spacing to minimize damage and loss in future wildfires, following the devastating Lahaina fire in Hawaii.

September 30, 2024

Catastrophe

Insurance Industry

Property

Risk Management

Hawaii

AI’s Impact on Insurance Pricing: New Strategies for Risk and Profitability

Artificial intelligence is revolutionizing insurance pricing by enhancing risk assessment, personalizing premiums, and improving operational efficiency, though significant challenges remain in infrastructure, data quality, and compliance.

September 30, 2024

Auto

Insurance Industry

Risk Management

Technology

Hurricane Helene Set to Hit Florida Tonight with Life-Threatening Storm Surge and 40 Million Under Warnings

Hurricane Helene, a rapidly intensifying Category 2 storm, is expected to make landfall as a Category 4 hurricane in Florida, bringing 15-20 foot storm surges and affecting millions across the Gulf Coast.

September 26, 2024

Catastrophe

Legislation & Regulation

Property

Risk Management

Alabama

Florida

Georgia

Florida’s Insurance Market Faces Uncertainty as Hurricane Helene Approaches

As Hurricane Helene threatens Florida’s Gulf Coast, concerns rise over the stability of the state’s recovering insurance market. Despite progress, losses could still reach billions.

September 26, 2024

Catastrophe

Legislation & Regulation

Property

Risk Management

Florida

Hurricane Helene Targets Florida with Powerful Storm Surge and Inland Flooding Threats

Hurricane Helene is intensifying as it heads toward Florida’s Gulf Coast, threatening life-threatening storm surges, widespread flooding, and strong winds that will reach far inland across the Southeast.

September 25, 2024

Catastrophe

Litigation

Property

Risk Management

Alabama

Florida

Georgia

Kentucky

North Carolina

Why Hurricane Helene Could Be One of the Most Dangerous Storms in Years

Hurricane Helene is forecast to intensify rapidly as it nears Florida, with major impacts expected across the Southeast, including extreme winds, flooding, and widespread storm surge.

September 25, 2024

Catastrophe

Litigation

Property

Risk Management

Florida

Georgia

North Carolina

South Carolina

California Wildfire Season Intensifies Without Key Factor, Raising Concerns for the Coming Months

California has faced a severe wildfire season fueled by heat and dried-out vegetation, even without the seasonal winds that typically escalate fire risks. Experts warn that conditions could worsen as fall progresses.

September 24, 2024

Catastrophe

Legislation & Regulation

Property

Risk Management

California

CEOs Sharpen Focus on Cybersecurity and Generative AI Amid Volatility

The 2024 KPMG CEO Outlook highlights how business leaders are tackling cybersecurity risks, generative AI implementation, and mergers and acquisitions to stay ahead in an era of compound volatility.

September 24, 2024

Risk Management

Technology

Generative AI’s Expanding Role in Insurance: Beyond Efficiency to Product Innovation

Generative AI is moving beyond enhancing efficiency for insurance professionals. It now holds potential for transforming risk management, customer interaction, and even product offerings.

September 24, 2024

Auto

Insurance Industry

Risk Management

Technology

Actuarial Studies Tackle Bias, AI, and Modeling in Insurance Pricing

The Casualty Actuarial Society has released four new reports that explore bias in insurance pricing models, AI usage, and regulatory concerns, aiming to guide actuaries toward fairness and compliance.

September 24, 2024

Auto

Legislation & Regulation

Risk Management

Technology

Hurricane Threat Looms for Gulf Coast as Atlantic Storm Intensifies

A developing Atlantic storm poses a significant hurricane risk to the US Gulf Coast, stretching from Mississippi to Florida. Forecasters predict rapid intensification as it moves north through warm Gulf waters, threatening major landfall.

September 23, 2024

Catastrophe

Litigation

Property

Risk Management

Florida

Mississippi

Evolving Worker Activity Tools Now Powering AI Data Generation in the Insurance Industry

COVID-era worker activity monitoring tools have evolved into sophisticated AI data generators, helping insurers tackle rising repair costs, litigation, and labor shortages while improving operational efficiency.

September 23, 2024

Auto

Litigation

Risk Management

Technology

Workers’ Compensation Outpaces P&C Lines with Sustained Profitability and Low Claims Frequency

Workers’ compensation continues to boost the property and casualty insurance industry with an 88.7 combined ratio in 2023, driven by reduced claims frequency, workplace safety, and competitive market conditions.

September 23, 2024

Insurance Industry

Legislation & Regulation

Risk Management

Workers' Compensation