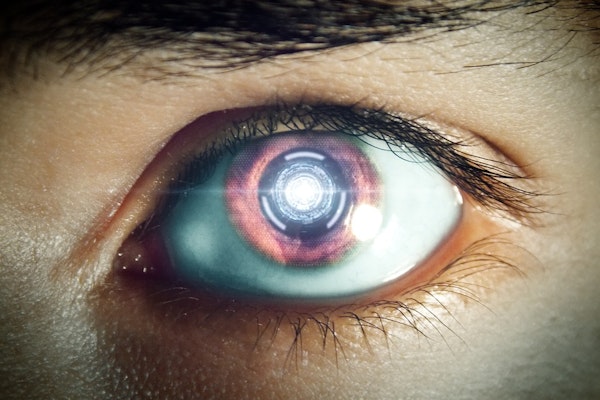

Small Businesses Face Rising Threats from AI-Driven Scams

A survey reveals that a quarter of small business owners have been targeted by AI-generated scams, using tactics like email, voice, and video impersonation, exposing them to significant fraud risks.

October 1, 2024

Fraud

Insurance Industry

Risk Management

Technology

Hurricane Helene Signals Emerging Inland Threat as Storms Retain Strength

Hurricane Helene’s unprecedented inland devastation highlights the growing danger of the "brown-ocean effect," a phenomenon that may allow future hurricanes to retain strength as they move further inland.

October 1, 2024

Catastrophe

Legislation & Regulation

Property

Risk Management

Florida

Georgia

North Carolina

Hurricane Helene’s Economic Impact Could Reach $160 Billion Due to Infrastructure Destruction and Business Losses

Economic estimates for Hurricane Helene project up to $160 billion in damage, driven by widespread infrastructure failure, property loss, business disruption, and long-term recovery costs.

September 30, 2024

Catastrophe

Insurance Industry

Property

Risk Management

Florida

Georgia

Kentucky

North Carolina

Ohio

Key Restaurant Insurance Claims Insights to Help Adjusters Minimize Payouts

Understand the most frequent and costly insurance claims in the restaurant industry, from equipment breakdown to employee injury, and how claims adjusters can help mitigate risks.

September 30, 2024

Liability

Property

Risk Management

Workers' Compensation

California

Florida

Michigan

Mississippi

New Jersey

Helene Hits Florida as Category 4 Hurricane, Unveils Critical Flood Insurance Gap

Hurricane Helene’s catastrophic flooding from Florida to North Carolina exposes the serious lack of flood insurance coverage among homeowners, especially in inland areas, highlighting the increasing risks from extreme weather events.

September 30, 2024

Catastrophe

Legislation & Regulation

Property

Risk Management

Florida

Georgia

Kentucky

North Carolina

South Carolina

Hurricane Helene’s Impact Pressures Florida’s Struggling Insurance Market

Hurricane Helene’s destructive force on Florida’s properties highlights the fragility of the state’s insurance market, with rising premiums, reinsurance challenges, and climate change amplifying risks.

September 30, 2024

Catastrophe

Legislation & Regulation

Property

Risk Management

Florida

Hurricane Helene Causes Up to $34 Billion in Total Economic Impact, Moody’s Reports

Hurricane Helene made landfall as a Category 4 storm, leading to widespread property damage, power outages, and disruptions. Analysts predict total costs ranging from $20 billion to $34 billion, with insurance losses still being assessed.

September 30, 2024

Catastrophe

Insurance Industry

Property

Risk Management

Florida

Navigating the Complexities of Alcohol and Marijuana in Life Insurance Claims

Alcohol and marijuana present unique challenges in life and AD&D claims. While alcohol regulations are uniform, marijuana’s state-by-state legality and unpredictable effects complicate claim decisions and risk management.

September 30, 2024

Legislation & Regulation

Liability

Life & Health

Risk Management

Strategies to Reduce the Impact of Wildfires: Lessons from the Lahaina Fire

Experts urge adopting fire-resistant building practices, fuel breaks, and structure spacing to minimize damage and loss in future wildfires, following the devastating Lahaina fire in Hawaii.

September 30, 2024

Catastrophe

Insurance Industry

Property

Risk Management

Hawaii

AI’s Impact on Insurance Pricing: New Strategies for Risk and Profitability

Artificial intelligence is revolutionizing insurance pricing by enhancing risk assessment, personalizing premiums, and improving operational efficiency, though significant challenges remain in infrastructure, data quality, and compliance.

September 30, 2024

Auto

Insurance Industry

Risk Management

Technology

Hurricane Helene Set to Hit Florida Tonight with Life-Threatening Storm Surge and 40 Million Under Warnings

Hurricane Helene, a rapidly intensifying Category 2 storm, is expected to make landfall as a Category 4 hurricane in Florida, bringing 15-20 foot storm surges and affecting millions across the Gulf Coast.

September 26, 2024

Catastrophe

Legislation & Regulation

Property

Risk Management

Alabama

Florida

Georgia

Florida’s Insurance Market Faces Uncertainty as Hurricane Helene Approaches

As Hurricane Helene threatens Florida’s Gulf Coast, concerns rise over the stability of the state’s recovering insurance market. Despite progress, losses could still reach billions.

September 26, 2024

Catastrophe

Legislation & Regulation

Property

Risk Management

Florida

Hurricane Helene Targets Florida with Powerful Storm Surge and Inland Flooding Threats

Hurricane Helene is intensifying as it heads toward Florida’s Gulf Coast, threatening life-threatening storm surges, widespread flooding, and strong winds that will reach far inland across the Southeast.

September 25, 2024

Catastrophe

Litigation

Property

Risk Management

Alabama

Florida

Georgia

Kentucky

North Carolina

Why Hurricane Helene Could Be One of the Most Dangerous Storms in Years

Hurricane Helene is forecast to intensify rapidly as it nears Florida, with major impacts expected across the Southeast, including extreme winds, flooding, and widespread storm surge.

September 25, 2024

Catastrophe

Litigation

Property

Risk Management

Florida

Georgia

North Carolina

South Carolina

California Wildfire Season Intensifies Without Key Factor, Raising Concerns for the Coming Months

California has faced a severe wildfire season fueled by heat and dried-out vegetation, even without the seasonal winds that typically escalate fire risks. Experts warn that conditions could worsen as fall progresses.

September 24, 2024

Catastrophe

Legislation & Regulation

Property

Risk Management

California