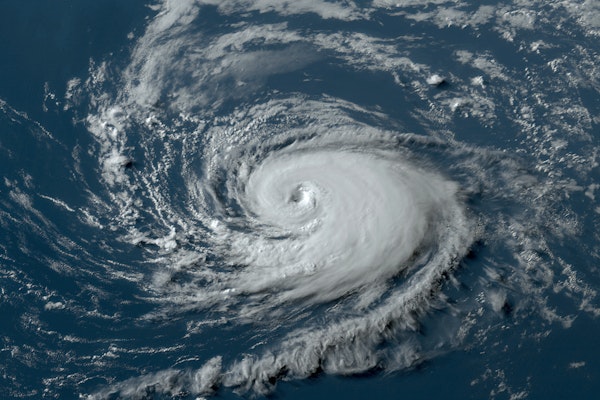

Why the Atlantic Hurricane Season Has Suddenly Gone Quiet in September

Despite reaching the statistical peak of hurricane season, the Atlantic basin is unusually quiet this September, with no active storms and limited tropical development expected.

September 10

Catastrophe

Insurance Industry

Property

Risk Management

Florida

Georgia

North Carolina

Tennessee

Texas

How Construction Companies Can Prevent Common Builders Risk Claims

Construction projects face risks from theft, weather, fire, and more. Proactive site safety measures can reduce losses and keep projects on track.

September 9

Catastrophe

Insurance Industry

Property

Risk Management

High Insurance Costs and Climate Risks Push Homeowners in Vulnerable Areas to the Brink

A new Realtor.com report reveals that 1 in 4 U.S. homes face extreme climate risk, with surging insurance costs disproportionately impacting low-value, high-risk markets.

September 9

Catastrophe

Insurance Industry

Property

Risk Management

Pennsylvania Man Accused of Running $400 Million ATM Investment Scam

Federal authorities charged a Pennsylvania man with securities and wire fraud after allegedly defrauding investors through a fake ATM investment scheme worth over $400 million.

September 4

Fraud

Legislation & Regulation

Litigation

Risk Management

New Jersey

Pennsylvania

Underwriting Profit Triples for U.S. Property/Casualty Insurers in Early 2025 Despite Mixed Income

The U.S. P/C insurance industry posted a $11.5B underwriting gain in H1 2025, aided by fewer Q2 catastrophes, despite a sharp decline in investment-driven net income.

September 4

Catastrophe

Insurance Industry

Property

Underwriting

California

Georgia

Texas

NOAA Launches First Hourly Wildfire Risk Model to Improve Forecasting and Response

NOAA’s new Hourly Wildfire Potential Index offers hourly wildfire hazard forecasts, helping responders and forecasters better track fire activity and smoke emissions in real time.

September 2

Catastrophe

Property

Risk Management

Technology

Younger Adults More Likely to Commit Insurance Fraud, Study Finds

A University of Georgia study finds Americans under 34 are significantly more willing to commit insurance fraud, often without realizing the legal or financial consequences.

September 2

Auto

Education & Training

Fraud

Insurance Industry

Insurers Seek to Void Marine Policy After Yacht Crash Off California Coast

Specialty insurers are asking a California court to void a yacht policy after a collision, alleging the insured failed to meet critical warranty and disclosure terms.

September 2

Excess & Surplus Lines

Insurance Industry

Litigation

Marine

California

Texas

Arkansas Builder Sues Zurich Over Denied Collapse Claim on Unfinished Home

A $420,000 dispute over a collapsed Arkansas home under construction challenges Zurich’s interpretation of "collapse" coverage in commercial property policies.

September 2

Litigation

Property

Risk Management

Arkansas

Verisk Projects $152 Billion in Annual Global Property Losses from Natural Disasters

Verisk’s 2025 report reveals global insured property losses from natural catastrophes have surged to $152B annually, driven by more frequent storms and wildfires.

September 2

Catastrophe

Insurance Industry

Property

Risk Management

Why Food Companies Must Treat Recall Preparedness as a Business Essential

Food recalls can escalate into costly crises without proper planning. Learn how supply chain mapping, business continuity, and mock drills can make or break your response.

September 2

Insurance Industry

Liability

Property

Risk Management

How Warehouse Technology is Reshaping Risk Models in Insurance

Connected automation in warehouses is forcing insurers to replace outdated models with dynamic, real-time risk assessments based on sensor data and machine performance.

September 2

Property

Risk Management

Technology

Underwriting

How a $100 Billion Hurricane Could Strike the US and What Insurers Need to Know

Major U.S. metro areas are increasingly vulnerable to $100 billion hurricane losses. This KCC report shows where it’s most likely and how insurers can prepare for the next big one.

August 29

Catastrophe

Insurance Industry

Property

Risk Management

Connecticut

Florida

Louisiana

Massachusetts

New Jersey

Wyndham Hotel Owner Accused of Orchestrating Vandalism Amid Insurance Dispute

The Wyndham Hotel owner is facing accusations of staging vandalism to claim $12.2 million in insurance damages, prompting a federal fraud countersuit by the insurer.

August 29

Fraud

Insurance Industry

Litigation

Property

Illinois

Detroit Couple to Face Trial over Alleged $150K Disability Insurance Fraud Scheme

A Detroit couple will stand trial on multiple felony charges after allegedly filing fraudulent disability insurance claims totaling $150,000, officials say.

August 29

Fraud

Insurance Industry

Litigation

Michigan