Unveiling Modern Trial Tactics in Transportation Cases through Expert Roundtable

CLM’s Transportation Community experts discuss virtual mediations and assessing the strength of the plaintiff’s attorney.

October 31, 2023

Auto

Education & Training

Insurance Industry

Liability

Litigation

Illinois

Massachusetts

Pennsylvania

Halloween Drunk Driving: A Frightening Reality of Impaired Drivers Amid Celebrations

The only thing scarier than zombies and witches loose on the streets on Halloween is an impaired driver, according to the U.S. Department of Transportation’s National Highway Traffic Safety Administration.

October 30, 2023

Auto

Legislation & Regulation

Liability

Risk Management

Erie Insurance Faces Accusations of Racial Bias in Underwriting Practices

Erie Insurance defends its practice of telling agents to use subjective factors when judging a potential customer. Maryland regulators say the company sought to exclude Black and Hispanic people.

October 30, 2023

Insurance Industry

Legislation & Regulation

Liability

Litigation

Maryland

New York

Pennsylvania

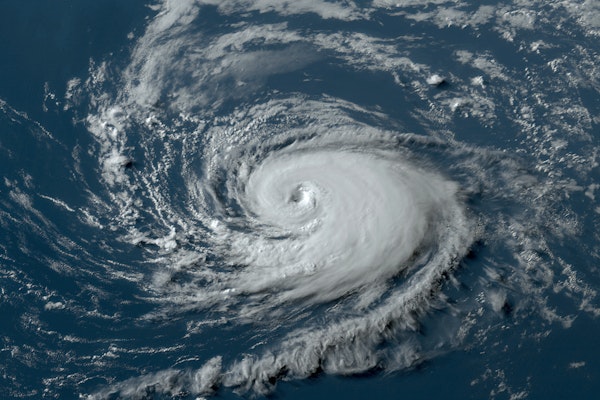

Hurricane Otis Racks Up Billions in Insured Losses, Marks Historic Financial Drain for Mexico’s Insurance Sector

Reinsurance broker Gallagher Re has said that hurricane Otis will be one of the costliest natural catastrophe events in Mexico’s history, with a multi-billion-dollar insurance market loss anticipated.

October 30, 2023

Catastrophe

Insurance Industry

Property

Risk Management

Matthew Perry’s Hot Tub Incident Highlights Insurance Risk Concerns

When it comes to washing away stress and soothing achy joints, it’s hard to beat the warm water and gurgling jets, but the actor’s untimely death serves as a painful reminder of the risks inherent to owning a hot tub.

October 30, 2023

Insurance Industry

Liability

Risk Management

Insurance Claims Spookily Spike as Halloween Nears, Says APCIA

Halloween might be the scariest time of the year in more ways than one. Home and auto insurance claims tend to go up the closer we get to Oct. 31, according to the American Property Casualty Insurance Association.

October 30, 2023

Auto

Liability

Property

Navigating Through the Vines: Assessing the Current State of Winery Insurance Market in California

While certain geographies are experiencing a tightening of P&C capacity, especially in California, wineries in the region are feeling the sting more than most due to extreme weather events.

October 30, 2023

Insurance Industry

Property

California

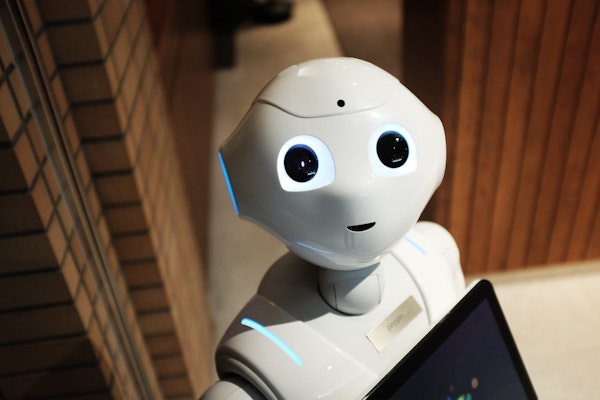

Amazon Taps Robotics to Tackle Repetitive Motion Injuries

New robot technology could help protect Amazon warehouse workers from repetitive motion injuries, robotics company Agility Robotics said this week.

October 27, 2023

Risk Management

Technology

Workers' Compensation

Virginia School Shooting Sparks Legal Dilemma: Workers’ Compensation or $40 Million Lawsuit for Injured Teacher?

A heated debate has emerged about the once-unimaginable shooting of a teacher by her 6-year-old student: How should the school district take care of the teacher?

October 27, 2023

Education & Training

Legislation & Regulation

Liability

Litigation

Workers' Compensation

Virginia

State Farm Sees a Significant Dip in Catalytic Converter Theft Claims in H1 2023

According to the company’s latest data, there were approximately 14,500 claims related to catalytic converter thefts during this period, marking a significant drop from the 23,570 claims made in the same period last year.

October 27, 2023

Auto

Insurance Industry

Legislation & Regulation

Risk Management

Striking a Digital Balance: Insurers Tackling Claims Complexity in a Digital Age

Americans are turning to digital channels for some home and auto insurance needs, but other areas have proven more complicated.

October 27, 2023

Auto

Insurance Industry

Liability

Property

Technology

What is Super Fog? The Mix of Smoke and Dense Fog Caused a Deadly Pileup in Louisiana

The National Weather Service called it ‘super fog’ — a combination of thick smoke from fires in marshy wetlands of south Louisiana and the fog that often hangs thick in the air on cool, windless mornings.

October 27, 2023

Catastrophe

Liability

Louisiana

Risk Managers Beware: Generative AI Spells Serious Concerns for Security

A recent study by cybersecurity consultancy Gemserv warns that the ever-evolving world of artificial intelligence poses new challenges for companies.

October 26, 2023

Risk Management

Technology

Auto Claims Satisfaction Scores Are Up Despite Longer Repairs

An auto parts shortage combined with longer cycle times for repairs has contributed to repairs taking an average of about 23 days in 2023, up an average of a little more than 6 days from 2022.

October 26, 2023

Auto

Insurance Industry

Technology

Kentucky Approves 18th-straight Decrease in Workers’ Comp Loss Costs

Kentucky’s Insurance Commissioner has approved a 6.4% decrease in average workers’ compensation loss costs for the state, making it the 18th consecutive drop in costs for most Kentucky employers.

October 26, 2023

Legislation & Regulation

Workers' Compensation

Florida

Kentucky