High Cost of Car Insurance Drives 35% of Parents to Commit Fraud

In a new study, 35% of parents admit to "fronting" on car insurance policies for young drivers to save on rising premiums. Although common, fronting is illegal and can result in fines, policy cancellation, or criminal charges.

November 7, 2024

Auto

Fraud

Legislation & Regulation

Risk Management

Volkswagen to Recall 114,000 U.S. Vehicles Over Airbag Explosion Hazard

Volkswagen is recalling over 114,000 Beetle and Passat vehicles across the U.S. due to a defect that may cause driver-side airbags to explode. The NHTSA cites long-term exposure to heat and humidity as a risk factor.

November 7, 2024

Auto

Legislation & Regulation

Liability

Risk Management

Embedded Insurance Gains Ground as a Key Growth Driver

Embedded insurance is reshaping the insurance industry, bringing coverage to consumers through everyday transactions and bridging the protection gap. With innovations in auto and mobility sectors, this approach aims to reach underserved customers, offering tailored solutions seamlessly integrated into purchases.

November 7, 2024

Auto

Insurance Industry

Risk Management

Technology

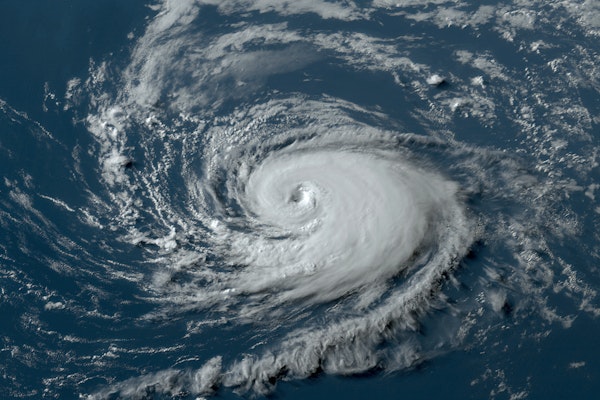

2024 Hurricanes Leave Nearly 350,000 Cars Flood-Damaged, CARFAX Warns

In 2024, hurricanes have left an estimated 347,000 vehicles with flood damage across the U.S., CARFAX reports. Experts caution that many may be resold, potentially concealing dangerous and costly water damage.

November 5, 2024

Auto

Catastrophe

Fraud

Risk Management

Florida

How Attorney Ads May Drive Up Auto Insurance Rates, Per New Survey

A recent IRC survey reveals that attorney advertising may be influencing auto insurance costs, as 60% of respondents link it to higher claims and 52% believe it raises insurance premiums.

October 30, 2024

Auto

Insurance Industry

Legislation & Regulation

Litigation

Florida

Georgia

Louisiana

Embedded Insurance: The Key to Seamless Coverage for On-Demand Drivers

The on-demand economy is booming, yet drivers still face challenges accessing tailored auto insurance. Embedded insurance offers a seamless solution, streamlining coverage for the modern gig workforce.

October 30, 2024

Auto

Insurance Industry

Risk Management

Technology

Caught Red-Handed: Watch This Shocking Insurance Scam Unravel Thanks to a Dash Cam

A brazen insurance fraud attempt on a busy Queens highway was foiled by a dash cam, capturing every moment the scammers realized their scheme was being recorded—proof that a dash cam could save you from a costly setup.

October 21, 2024

Auto

Fraud

Litigation

Technology

New York

Louisiana’s Auto Insurance Affordability Challenges Persist in 2022

Despite rising incomes, Louisiana remains the least affordable state for personal auto coverage across the South and U.S., with premiums nearly 40% above the national average.

October 15, 2024

Auto

Legislation & Regulation

Litigation

Risk Management

Florida

Louisiana

Mississippi

North Carolina

Insured Losses from Hurricane Milton Expected to Hit Both Primary Insurers and Reinsurers

Moody’s reports that Hurricane Milton, which struck Florida as a Category 3 storm, will likely impact both primary insurers and reinsurers, with ceded losses increasing as total damages rise.

October 11, 2024

Auto

Catastrophe

Property

Florida

Personal Lines Underwriting Sees Gains, Narrowing the Gap with Commercial Lines

Improved underwriting results for personal lines in the first half of 2024 have reduced the performance gap with commercial lines, driven by premium growth in personal auto and homeowners insurance.

October 11, 2024

Auto

Property

Risk Management

Underwriting

Florida Urges EV Owners to Prepare for Fire Hazards as Hurricane Milton Approaches

Florida officials are cautioning residents about the potential fire hazards posed by lithium-ion batteries in EVs and other devices, urging proactive steps to prevent accidents as Hurricane Milton approaches.

October 9, 2024

Auto

Catastrophe

Property

Risk Management

Technology

Florida

AI’s Impact on Insurance Pricing: New Strategies for Risk and Profitability

Artificial intelligence is revolutionizing insurance pricing by enhancing risk assessment, personalizing premiums, and improving operational efficiency, though significant challenges remain in infrastructure, data quality, and compliance.

September 30, 2024

Auto

Insurance Industry

Risk Management

Technology

Generative AI’s Expanding Role in Insurance: Beyond Efficiency to Product Innovation

Generative AI is moving beyond enhancing efficiency for insurance professionals. It now holds potential for transforming risk management, customer interaction, and even product offerings.

September 24, 2024

Auto

Insurance Industry

Risk Management

Technology

Actuarial Studies Tackle Bias, AI, and Modeling in Insurance Pricing

The Casualty Actuarial Society has released four new reports that explore bias in insurance pricing models, AI usage, and regulatory concerns, aiming to guide actuaries toward fairness and compliance.

September 24, 2024

Auto

Legislation & Regulation

Risk Management

Technology

Evolving Worker Activity Tools Now Powering AI Data Generation in the Insurance Industry

COVID-era worker activity monitoring tools have evolved into sophisticated AI data generators, helping insurers tackle rising repair costs, litigation, and labor shortages while improving operational efficiency.

September 23, 2024

Auto

Litigation

Risk Management

Technology