Why Outdated Payment Systems Are Holding P&C Insurers Back

Outdated and siloed payment systems are costing P&C insurers in efficiency, customer trust, and compliance—modernizing them is now a strategic necessity.

August 14, 2025

Insurance Industry

Property

Risk Management

Technology

Record-Breaking Insured Losses in 2025 Highlight Growing Impact of U.S. Wildfires and Storms

The first half of 2025 brought $84 billion in insured catastrophe losses, driven by U.S. wildfires and severe convective storms, making it the costliest H1 since 2011.

August 14, 2025

Catastrophe

Insurance Industry

Property

Risk Management

California

Florida

New Jersey

New York

North Carolina

Father and Son Found Guilty of Arson and Insurance Fraud in Michigan Restaurant Fire

A jury convicted the co-owners of Charlie’s Family Grill of arson and insurance fraud after fires destroyed their White Cloud restaurant and garage in early 2023.

August 14, 2025

Fraud

Insurance Industry

Litigation

Property

Michigan

Fake Slip and Fall on Banana Peel at Goodwill Leads to Insurance Fraud Charge

A staged fall in a Goodwill parking lot, falsely blamed on a banana peel and later a broken lighter, has led to an insurance fraud charge following a months-long investigation.

August 14, 2025

Fraud

Insurance Industry

Litigation

Property

Weird

Connecticut

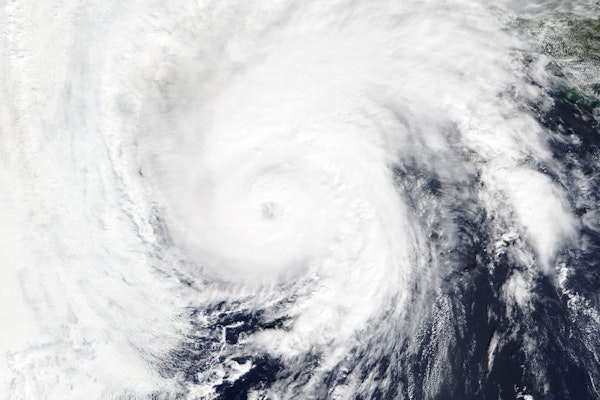

Tropical Storm Erin on Track to Become Hurricane with Impacts Likely in Northern Caribbean

Tropical Storm Erin may strengthen into a hurricane by Friday, with potential impacts including high surf and rip currents in the northern Leeward Islands, Virgin Islands, and Puerto Rico.

August 14, 2025

Catastrophe

Insurance Industry

Property

Risk Management

Florida

Historic Oregon Hotel in Foreclosure After Owners Report Major Fraud Losses

The century-old Prospect Hotel near Crater Lake closed after alleged embezzlement by a trusted associate left owners facing lawsuits, loan defaults, and bank garnishment.

August 11, 2025

Fraud

Insurance Industry

Litigation

Property

Oregon

NOAA Maintains Above-Normal Hurricane Season Outlook With Updated 2025 Forecast

NOAA’s updated 2025 Atlantic hurricane forecast still calls for above-normal activity, with 13-18 named storms expected and up to five major hurricanes possible.

August 8, 2025

Catastrophe

Legislation & Regulation

Property

Risk Management

Why Maryland Has the Highest Car Insurance Rates in the Nation

Maryland drivers pay the highest auto insurance rates in the U.S., with premiums driven by urban congestion, repair costs, extreme weather, and frequent claims.

August 7, 2025

Auto

Property

Risk Management

Technology

Maryland

Mastering Property Claim Investigations with Subject Matter Experts

A guide to working effectively with subject matter experts in property claims—from basic investigations to litigation-ready forensic reports and cost analyses.

August 7, 2025

Education & Training

Litigation

Property

Risk Management

What Golden Retrievers Are Teaching Us About Wildfire Smoke Exposure

A new study on golden retrievers reveals how wildfire smoke impacts pet and human health, with implications for insurance costs, coverage, and long-term risk management.

August 5, 2025

Insurance Industry

Life & Health

Property

Risk Management

California

Colorado

Oregon

Florida Insurance Agent Sentenced for Premium Theft and Civil Misconduct

A former Florida insurance agent is now behind bars after stealing client premiums and facing multiple lawsuits, including a major Hurricane Ian-related judgment.

August 5, 2025

Fraud

Insurance Industry

Litigation

Property

Florida

Truck Crash Spills Thousands of Hot Dogs Across Pennsylvania Interstate

A mechanical failure caused a tractor-trailer to rupture along I-83 in Shrewsbury, Pennsylvania, spilling a load of hot dogs and briefly halting traffic in both directions.

August 4, 2025

Auto

Catastrophe

Property

Risk Management

Pennsylvania

California FAIR Plan Faces Legal Action Over Alleged Smoke Damage Claim Denials

California’s insurance commissioner accuses the FAIR Plan of violating claims laws and misleading regulators over wildfire smoke damage coverage, sparking a rare enforcement case.

August 4, 2025

Catastrophe

Legislation & Regulation

Litigation

Property

California

Colorado

Quiet Start to 2025 Hurricane Season May Be Deceiving as Forecasters Predict Spike in Storms Ahead

Although the Atlantic hurricane season began quietly, meteorologists warn that most tropical activity typically occurs after August 1 and that conditions are ripe for storms ahead.

August 1, 2025

Catastrophe

Insurance Industry

Property

Risk Management

Florida

Louisiana

How Allstate Transformed a $145 Million Loss into a $1.28 Billion Underwriting Win

Allstate reversed massive losses by refining its underwriting strategy, focusing on risk selection, pricing precision, and catastrophe readiness to deliver billion-dollar gains.

August 1, 2025

Catastrophe

Insurance Industry

Property

Risk Management