Historic Flooding Threat Intensifies Across Central US After Devastating Storms and Tornadoes

Following deadly tornadoes and widespread storm damage, central US states now face a rare high-risk flood event that could bring once-in-a-generation impacts.

April 4, 2025

Catastrophe

Property

Arkansas

Indiana

Kentucky

Mississippi

Missouri

Kentucky Farmer Admits to Multi-Year Crop Insurance Fraud Using Family Names

A Taylor County farmer has pleaded guilty to falsifying crop loss claims for over $1.4 million in insurance payments, using relatives’ names to hide actual production.

April 2, 2025

Fraud

Insurance Industry

Legislation & Regulation

Property

Kentucky

California Raises FAIR Plan Coverage Limits to Address Insurance Gaps in Wildfire Zones

California has more than doubled commercial coverage limits under its FAIR Plan, offering relief to property owners amid insurer withdrawals and increasing wildfire threats.

March 31, 2025

Catastrophe

Insurance Industry

Legislation & Regulation

Property

California

Texas Adjuster Admits to Multi-Million Dollar Insurance Fraud Targeting Georgia Church

A Texas public adjuster already serving time for insurance fraud in Louisiana and Texas has pleaded guilty to defrauding a Georgia church and its insurer after Hurricane Michael.

March 31, 2025

Catastrophe

Fraud

Legislation & Regulation

Property

Georgia

State Farm Defeats Class Action Claim Over Xactimate Estimates in Pennsylvania

A Pennsylvania federal judge ruled that State Farm did not breach policy terms or act in bad faith by using its preferred loss estimation method, dismissing the homeowners’ lawsuit.

March 27, 2025

Insurance Industry

Litigation

Property

Technology

California

Indiana

Pennsylvania

Why Homeowners Aren’t Buying Personal Cyber Insurance Despite Growing Risks

Despite rising cyber threats in connected homes, consumer adoption of personal cyber insurance remains low due to knowledge gaps, communication issues, and pricing concerns.

March 26, 2025

Education & Training

Property

Risk Management

Technology

Oregon Court Overturns Six-Figure Contingency Fee in Hartford Insurance Case

An Oregon appellate court has ruled against awarding attorney fees based on a percentage of recovery in an insurance settlement, emphasizing the importance of hourly rates.

March 25, 2025

Insurance Industry

Legislation & Regulation

Litigation

Property

Oregon

Gen Z’s Mortgage Risk: Climate Change & Insurance Costs

Rising insurance premiums and climate-related disasters are forcing Gen Z to scrutinize weather patterns before buying homes, reshaping the American Dream.

March 25, 2025

Catastrophe

Insurance Industry

Property

Risk Management

Technology

Florida

Texas

Millions of Homes Across the US Remain Uninsured Despite Growing Disaster Risks

A LendingTree study reveals that over 11 million U.S. homes lack insurance coverage, with the highest rates in disaster-prone states and metros, leaving homeowners financially exposed.

March 24, 2025

Catastrophe

Insurance Industry

Property

Risk Management

How Lithium-Ion Batteries Amplify Risk During Natural Disasters

Lithium-ion batteries pose increasing fire and environmental risks during natural disasters, prompting insurers, governments, and consumers to rethink safety and response strategies.

March 24, 2025

Catastrophe

Property

Risk Management

Technology

California

Florida

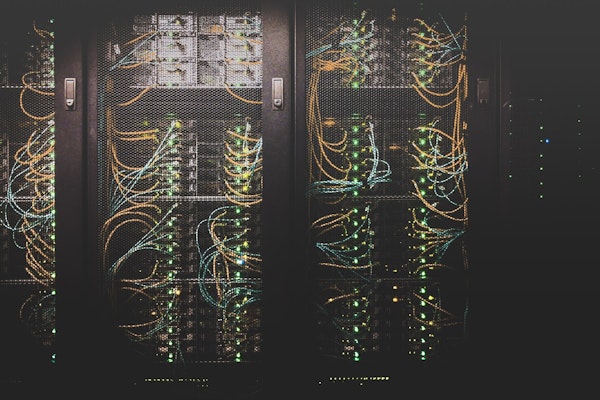

Construction Industry Faces Rising Insurance Risks Amid Data Center Boom and Labor Shortages

Global demand for data centers is driving construction growth, but rising costs, labor shortages, and climate risks are reshaping insurance pricing and underwriting strategies.

March 24, 2025

Catastrophe

Property

Risk Management

Technology

California

Kentucky Grants Temporary Registration for Unlicensed Adjusters After Severe Storms

Following tornadoes and severe storms on March 15, Kentucky is allowing unlicensed emergency adjusters to temporarily register and operate in three affected counties.

March 20, 2025

Catastrophe

Insurance Industry

Legislation & Regulation

Property

Kentucky

Tornado Strikes Florida TV Station During Live Broadcast

A tornado touched down near Orlando, Florida, striking a TV station during a live weather broadcast. Meteorologist Brooks Garner stayed on air as the storm passed over the studio.

March 11, 2025

Catastrophe

Insurance Industry

Property

Risk Management

Florida

Maryland Wildfires Decline in 2024, Falling Below Recent Averages

Maryland saw 165 wildfires in 2024, burning 953.4 acres. Arson was the leading cause, while the Eastern region had the most fires and acres burned. Learn more about key trends.

March 7, 2025

Catastrophe

Legislation & Regulation

Property

Risk Management

Maryland

AI Enhances Storm Risk Assessment for More Accurate Insurance Pricing

Traditional models for assessing severe convective storm risk rely on broad proxies like ZIP codes and roof age. AI-driven property-specific models offer insurers a more precise approach.

March 7, 2025

Insurance Industry

Property

Risk Management

Technology