New Risks for Adjusters: Hempcrete Homes, Mobile Nuclear Reactors, and High-Tech Farms

Biogenic building materials, mobile nuclear reactors, and AI-powered farms introduce new risks and opportunities for claims adjusters.

October 9, 2025

Insurance Industry

Property

Risk Management

Technology

Colorado

Michigan

Texas

AI in Claims Handling Under Scrutiny, But Florida Insurers Say Laws Already Provide Oversight

Florida insurance officials argue existing laws already prevent AI-related discrimination or errors, even as lawmakers consider stricter oversight.

October 9, 2025

Insurance Industry

Legislation & Regulation

Property

Technology

Florida

Wildfire Models Miss Conflagration Risks That Drove $40B in Losses

Cotality’s analysis of the Eaton and Palisades fires shows that many homes labeled "low wildfire risk" were actually highly vulnerable to structure-to-structure fire spread.

October 9, 2025

Catastrophe

Insurance Industry

Property

Technology

Underwriting

Mold, Disabilities, and the Fair Housing Act: Legal Risks for Landlords and Insurers

Mold-related health complaints tied to disability claims are putting landlords and insurers under legal scrutiny, with courts evaluating accommodation requests, tenant medical evidence, and habitability concerns.

October 8, 2025

Insurance Industry

Legislation & Regulation

Life & Health

Property

Connecticut

Iowa

New York

Virginia

Race to the Bottom in P&C Insurance Threatens Claims Quality and Market Stability

Slashing costs and chasing market share are destabilizing the claims ecosystem. Will adjusters bear the brunt of this industry-wide shift?

October 8, 2025

Auto

Catastrophe

Insurance Industry

Legislation & Regulation

Property

California

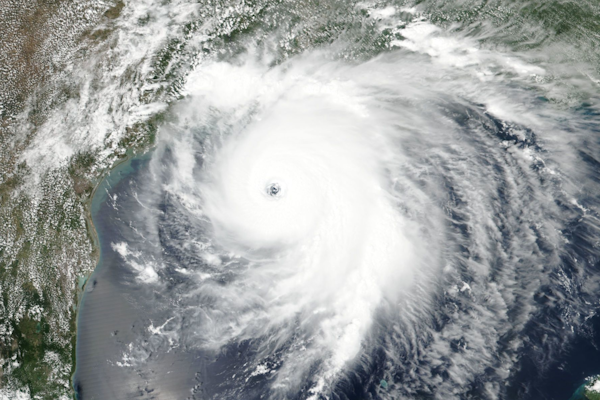

Tropical Storm Jerry Forms in Atlantic

Tropical Storm Jerry, the 10th named storm of the 2025 Atlantic hurricane season, has formed in the open Atlantic and is expected to reach Category 1 hurricane strength as it nears the northern Leeward Islands on Thursday.

October 7, 2025

Catastrophe

Insurance Industry

Marine

Property

Risk Management

Cat Bond Market Sets New Pace in Q3 2025 as Annual Issuance Nears $20 Billion

Q3 2025 saw $1.036B in cat bond issuance across 23 deals, pushing total year-to-date issuance to $18.6B and positioning the market for its first-ever $20B+ year.

October 2, 2025

Catastrophe

Insurance Industry

Property

Risk Management

Atlantic Hurricane Season Begins with Rare Trio of Major Storms

Hurricanes Humberto, Erin, and Gabrielle have all reached major hurricane status, marking the first time since 1935 that the season’s first three storms hit Category 3 or higher.

September 29, 2025

Catastrophe

Insurance Industry

Property

Risk Management

Flood Insurance Program Faces Expiration Again as Hurricane Season Peaks

The National Flood Insurance Program is set to expire by month’s end unless Congress acts, potentially disrupting home closings and leaving policyholders at risk.

September 29, 2025

Catastrophe

Insurance Industry

Legislation & Regulation

Property

New York

Hanover Ordered to Pay Rock Singer $2 Million After Memphis Studio Fire Dispute

A federal court ruled Hanover must pay $2 million to rocker John Falls, finding the insurer wrongly denied coverage after a 2015 Memphis studio arson and policy dispute.

September 29, 2025

Fraud

Insurance Industry

Litigation

Property

Tennessee

California Wildfire Devastates Communities and Strains Insurance Market

One of California’s worst wildfires of 2025 highlights growing challenges in the state’s insurance market, sparking debate over reforms and recovery efforts.

September 29, 2025

Catastrophe

Insurance Industry

Legislation & Regulation

Property

California

Wildfire Study Finds Structure Spacing and Home Hardening Significantly Reduce Losses

New research analyzing five major California wildfires finds that defensible space and home hardening measures can reduce structural losses by up to 48 percent.

September 26, 2025

Catastrophe

Insurance Industry

Property

Risk Management

California

Execution-First Risk Management Elevates Commercial Property Protection

Discover how execution-first risk strategies help commercial property owners prevent losses, preserve capital, and improve portfolio performance through proactive planning.

September 26, 2025

Insurance Industry

Property

Risk Management

Technology

How PFAS Risk and Green Policies Are Shaping the Future of Environmental Insurance

Environmental insurers are rethinking PFAS risk, navigating fallout from green policies, and adapting to a shifting market shaped by redevelopment and climate disclosure pressures.

September 22, 2025

Legislation & Regulation

Property

Risk Management

California

Why Climate Adaptation Is Becoming a Strategic Priority for Risk Managers in 2025

Marsh’s 2025 Climate Adaptation Survey reveals that while most businesses are assessing future climate risks, many still lack funding, strategy, or data to drive resilient action.

September 22, 2025

Catastrophe

Insurance Industry

Property

Risk Management