Cyber Risk and Technology Trends Reshaping Business Resilience in 2025

Executives’ cyber risk awareness is climbing, yet a misplaced confidence in cyber resilience persists amid escalating threats and geopolitical instability.

June 30

Legislation & Regulation

Liability

Risk Management

Technology

California

Modernizing Insurance Claims Payment Infrastructure for Greater Efficiency and Trust

Research reveals that fragmented back-end financial systems hinder timely claims payments and increase risks, highlighting the need for integrated, real-time solutions.

June 30

Education & Training

Insurance Industry

Risk Management

Technology

Federal Judge Rules Anthropic’s Book Use Fair but Piracy Still Faces Penalty

A San Francisco federal judge declares Anthropic’s AI book training fair use, yet rules storing millions of pirated copies illegal, setting stage for potential damages.

June 25

Legislation & Regulation

Litigation

Risk Management

Technology

California

How PFAS Influence Environmental Liability Risks in Construction Projects

Westfield Specialty’s Dennis Willette explores how PFAS contaminants shape environmental liability coverage in construction and why contractors need this insurance.

June 25

Legislation & Regulation

Liability

Property

Risk Management

Wildfires and Storms Drive Record Claim Severity in Early 2025 as Volume Hits Five-Year Low

Despite costly California wildfires and severe storms in Texas and the Midwest, property claim volume in Q1 2025 dropped to its lowest level in five years, Verisk reports.

June 24

Catastrophe

Insurance Industry

Property

Risk Management

AI and Value-Based Care Are Transforming Workers’ Comp Claims Management

Artificial intelligence and outcome-focused care models are streamlining workers’ compensation by improving triage, reducing costs, and prioritizing long-term recovery outcomes.

June 24

Life & Health

Risk Management

Technology

Workers' Compensation

Ohio

Why Florida, Texas, and California Lead the Nation in Lightning Insurance Claims

Florida, Texas, and California consistently rank highest for lightning-related insurance claims due to storm frequency, surge damage, and wildfire-triggered losses.

June 24

Catastrophe

Insurance Industry

Property

Risk Management

California

Florida

Texas

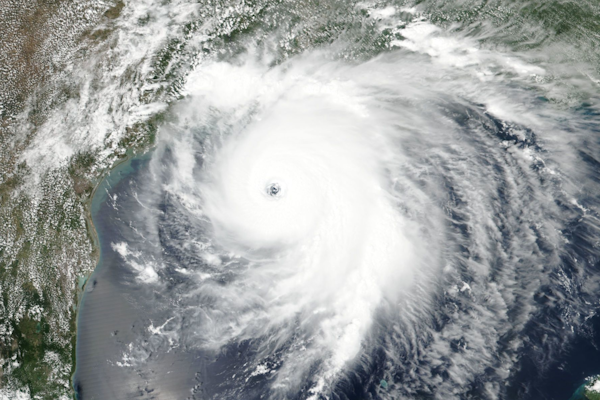

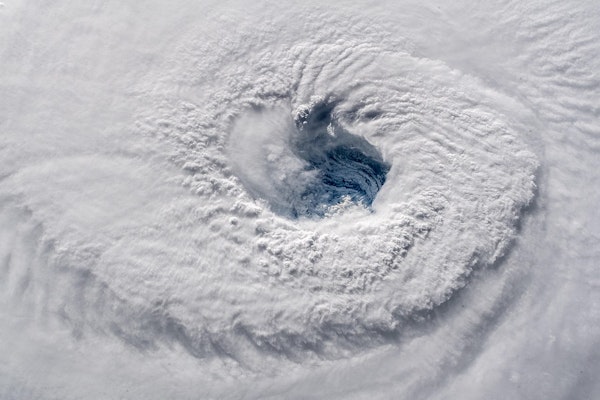

Colorado State University Predicts Above Normal 2025 Atlantic Hurricane Season

The 2025 Atlantic hurricane season is projected to be above-average with 17 named storms, nine hurricanes and four major hurricanes, increasing landfall risks along U.S. and Caribbean coasts.

June 19

Catastrophe

Insurance Industry

Property

Risk Management

Florida

Texas

Revolutionizing Catastrophe Modeling with AI for Insurers

Insurers can modernize CAT modeling by integrating AI-driven data capture, cleansing, enrichment, and analysis to deliver dynamic, real-time risk assessments that enhance underwriting and portfolio decisions.

June 19

Catastrophe

Insurance Industry

Risk Management

Technology

Claims Decline as Replacement Costs Skyrocket in Q1 2025

In Q1 2025, U.S. and Canadian property claims hit a five-year low even as average replacement costs surged 46 percent year-over-year, led by California wildfire losses and rising reconstruction expenses.

June 19

Catastrophe

Legislation & Regulation

Property

Risk Management

Insurance Industry Pushes Back on Federal AI Regulation Moratorium

The PIA, NAIC, AITC and NCOIL all warn that a proposed 10-year federal ban on state AI regulation would undermine consumer protections, stifle innovation and disrupt insurance markets.

June 19

Insurance Industry

Legislation & Regulation

Risk Management

Technology

Unlocking Underwriting Efficiency with Agentic AI Solutions

Agentic AI empowers carriers to tackle operational underwriting bottlenecks—streamlining risk analysis, fraud detection, and workflow automation to boost capacity in today’s talent-scarce market.

June 19

Insurance Industry

Risk Management

Technology

Underwriting

Finding Common Ground in Professional Liability Defense Strategies

Early collaboration between carriers, insureds, and panel counsel in professional liability claims reduces defense costs, preserves policy limits, and strengthens renewal prospects through faster settlements.

June 19

Insurance Industry

Litigation

Risk Management

Underwriting

Louisiana

New York

Texas

Hurricane Erick Pounds Mexican Coast with Fierce Winds and Flood Threat

Upgraded to ‘extremely dangerous’ Cat 4 before landfall, Erick made shore near Punta Maldonado with 125 mph winds, heavy rain and storm surge poised to trigger floods and mudslides.

June 19

Catastrophe

Insurance Industry

Property

Risk Management

Washington Post Cyberattack Targets Journalists Covering China and National Security

A targeted cyberattack compromised Microsoft accounts of Washington Post reporters covering China and national security, prompting a sweeping internal investigation.

June 16

Insurance Industry

Litigation

Risk Management

Technology