Victoria’s Secret Temporarily Shuts Down Website After Cybersecurity Breach

Victoria’s Secret shut down its website and systems on May 26 following a cyber incident, restoring services by May 29. Some in-store functions were also briefly disrupted.

June 4, 2025

Insurance Industry

Property

Risk Management

Technology

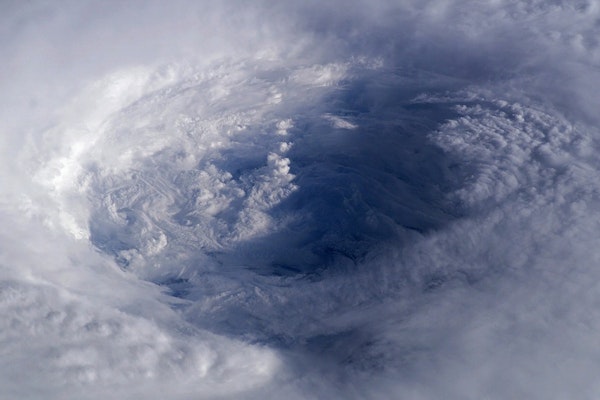

NOAA Pushes to Fill Weather Forecasting Gaps as Staffing Crisis Collides with Hurricane Season

NOAA will post mission-critical weather jobs despite a federal hiring freeze, aiming to stabilize forecasting operations ahead of a hurricane season forecast to be severe.

June 4, 2025

Catastrophe

Legislation & Regulation

Risk Management

Technology

Over 1,000 Former Rugby Players Sue Over Concussion-Related Brain Injuries

A growing group of former professional rugby players now totals over 1,100 in a lawsuit alleging negligence by rugby governing bodies in preventing brain injuries.

June 4, 2025

Legislation & Regulation

Life & Health

Litigation

Risk Management

Slightly Stronger 2025 Hurricane Season Expected Amid Climate Uncertainty

Forecasters anticipate a slightly above-average 2025 hurricane season in the Atlantic, though key uncertainties in ENSO and sea temperatures complicate predictions.

June 4, 2025

Catastrophe

Insurance Industry

Property

Risk Management

Florida

Roof Resilience Is the Key to Lower Claims and Safer Homes

With 70-90% of storm-related claims involving roof damage, the FORTIFIED Roof standard offers a proven, cost-effective way to reduce risk and protect property.

June 4, 2025

Catastrophe

Insurance Industry

Property

Risk Management

Alabama

Mississippi

Oklahoma

Fishermen Face Rising Safety Risks as Federal Training Programs Lose Funding

Federal budget cuts threaten safety training programs for fishing, farming, and logging workers—among the nation’s most dangerous jobs—potentially leaving crews at greater risk.

June 2, 2025

Catastrophe

Education & Training

Legislation & Regulation

Risk Management

Alaska

Florida

Iowa

Maine

Massachusetts

Google Commits $500 Million to Strengthen Compliance in Shareholder Settlement

Google will invest $500 million over 10 years to overhaul its compliance structure, settling shareholder litigation tied to antitrust claims without admitting wrongdoing.

June 2, 2025

Legislation & Regulation

Litigation

Risk Management

Technology

California

District Of Columbia

Michigan

Cyber Threats Hit Home as MSC Antonia Grounding Exposes Maritime Vulnerabilities in MENA

The grounding of the MSC Antonia near Jeddah raises alarm over GPS jamming and cyber-physical threats in the MENA region, urging insurers and operators to reassess risk strategies.

June 2, 2025

Insurance Industry

Marine

Risk Management

Technology

Storm Surge Risk Threatens Billions in Coastal Property Value Across 20 States

Over 6.4 million homes in coastal U.S. states face moderate or greater storm surge risk, with $2.2 trillion in potential reconstruction costs, according to 2025 Cotality data.

June 2, 2025

Catastrophe

Legislation & Regulation

Property

Risk Management

Alabama

Connecticut

Delaware

District Of Columbia

Florida

How P&C Carriers Can Successfully Modernize Core Systems in Today’s Digital Environment

Modernization of core systems is crucial for P&C insurers to reduce costs, improve customer experience, and keep pace with digital innovation—but success demands a strategic, business-led approach.

June 2, 2025

Insurance Industry

Property

Risk Management

Technology

How Artificial Intelligence Enhances Clinical Pharmacists’ Role in Workers’ Comp Care

Clinical pharmacists are using AI to enhance drug therapy oversight, reduce risk, and improve recovery outcomes for injured workers in complex workers’ compensation claims.

June 2, 2025

Life & Health

Risk Management

Technology

Workers' Compensation

CMS Expands Section 111 Reporting to Include Voluntary WCMSA Data for Workers’ Compensation Claims

Beginning April 4, 2025, CMS requires Responsible Reporting Entities to include available WCMSA data in Section 111 reports for workers’ compensation settlements involving Medicare beneficiaries.

June 2, 2025

Insurance Industry

Legislation & Regulation

Risk Management

Workers' Compensation

Early-Season Hurricanes: Where June Storms Typically Form and Why Activity Has Increased

Although June is typically a quiet start to Atlantic hurricane season, recent years show a rise in early storm activity, especially near the Gulf and Southeast U.S. coasts.

May 28, 2025

Catastrophe

Insurance Industry

Property

Risk Management

Alabama

Louisiana

Texas

Frustrating Claims Processes Drive Policyholders to Avoid Filing and Consider Switching Insurers

A new survey finds 22% of consumers skip filing claims due to complex processes, while 64% would switch insurers for a smoother digital experience.

May 28, 2025

Insurance Industry

Property

Risk Management

Technology

How AI Can Help Insurers Detect and Cut Down on Fraud

With advanced analytics and pattern recognition, AI could help P&C insurers save up to $160 billion annually by detecting both soft and hard fraud more effectively.

May 28, 2025

Fraud

Property

Risk Management

Technology