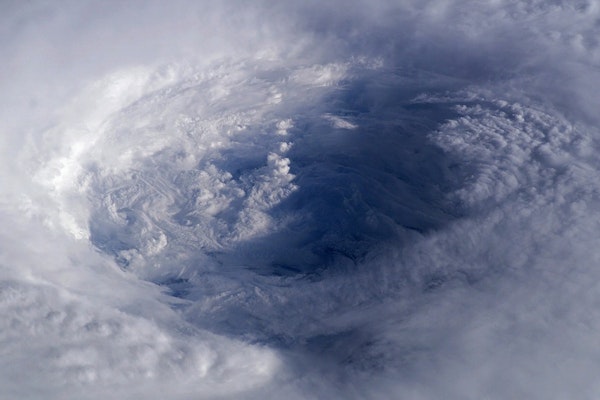

Hurricane Milton’s Winds Top 120 mph, Damage Roofs and Power Lines in St. Petersburg Area

Hurricane Milton brought intense winds, widespread destruction, and left millions without power in Florida. While storm surge impacts were less severe than anticipated, damage to homes, power lines, and infrastructure is widespread.

October 11, 2024

Catastrophe

Legislation & Regulation

Property

Risk Management

Florida

Florida’s Property Insurance Market Strengthens After Major Hurricanes

Despite recent hurricane challenges, Florida’s property insurance market is showing resilience, with reforms leading to rate reductions, new insurer entries, and declining reinsurance costs in 2024.

October 11, 2024

Insurance Industry

Legislation & Regulation

Property

Risk Management

Florida

Climate Change Intensifies Hurricane Helene’s Impact on Coastal and Inland Communities

Hurricane Helene, a Category 4 storm, caused catastrophic flooding and destruction from Florida’s coast to the Southern Appalachians. Research shows climate change intensified its rainfall, winds, and flooding risks.

October 11, 2024

Catastrophe

Legislation & Regulation

Property

Risk Management

Florida

Georgia

North Carolina

South Carolina

Tennessee

Perrier Faces Contamination Crisis as Water Source Suffers Fecal and Pesticide Pollution

Perrier, a leading luxury water brand, faces a contamination crisis after fecal matter and banned pesticides were found in its wells. With production halted and millions of bottles destroyed, Nestlé’s management of the iconic brand is under scrutiny.

October 11, 2024

Insurance Industry

Legislation & Regulation

Property

Risk Management

Cyberattack on American Water Highlights Urgency of Infrastructure Security

A cyberattack on American Water, the largest U.S. regulated water utility, has paused billing services and renewed concerns over the security of critical infrastructure.

October 11, 2024

Legislation & Regulation

Property

Risk Management

Technology

New Jersey

Outdoor Work Faces New Dangers from Rising Heat and Air Pollution

As heatwaves and air pollution intensify, employers must adopt protective measures to ensure the health and safety of outdoor workers, reducing accidents and costly business interruptions.

October 11, 2024

Property

Risk Management

Technology

Workers' Compensation

California Supreme Court Exempts Public Employers from PAGA Claims on Wage and Break Laws

The California Supreme Court ruled that public employers are not subject to civil penalties under the Private Attorneys General Act (PAGA) and are exempt from certain wage and break laws unless explicitly stated.

October 11, 2024

Legislation & Regulation

Litigation

Risk Management

Workers' Compensation

California

Personal Lines Underwriting Sees Gains, Narrowing the Gap with Commercial Lines

Improved underwriting results for personal lines in the first half of 2024 have reduced the performance gap with commercial lines, driven by premium growth in personal auto and homeowners insurance.

October 11, 2024

Auto

Property

Risk Management

Underwriting

Rethinking Hurricane Risk: Why a Wind-Focused Approach Misses the Real Threat

As climate change fuels stronger storms, the Saffir-Simpson scale’s wind-only focus is outdated. A refined system accounting for flooding, storm surge, and storm duration could improve safety and insurance coverage.

October 10, 2024

Catastrophe

Legislation & Regulation

Property

Risk Management

Florida

Hurricane Milton Could Deplete U.S. Insurers’ Catastrophe Budgets, Global Reinsurers Likely to Endure

Hurricane Milton, a Category 5 storm expected to strike Florida, threatens to deplete U.S. property/casualty insurers’ catastrophe budgets and test global reinsurers’ limits, though most are expected to weather the storm without significant capital impacts.

October 10, 2024

Catastrophe

Insurance Industry

Property

Risk Management

Florida

Georgia

North Carolina

South Carolina

Waffle House Index Signals Severe Impact from Hurricane Milton in Florida

The Waffle House Index, a quirky yet reliable gauge of storm severity, shows widespread closures across Florida as Hurricane Milton approaches, warning of significant damage and disruption.

October 9, 2024

Catastrophe

Property

Risk Management

Technology

Florida

Georgia

North Carolina

South Carolina

Florida Urges EV Owners to Prepare for Fire Hazards as Hurricane Milton Approaches

Florida officials are cautioning residents about the potential fire hazards posed by lithium-ion batteries in EVs and other devices, urging proactive steps to prevent accidents as Hurricane Milton approaches.

October 9, 2024

Auto

Catastrophe

Property

Risk Management

Technology

Florida

Federal Flood Maps Lag Behind Climate Disasters, Leaving Millions at Risk

As climate-intensified storms expose the limitations of FEMA’s outdated flood maps, millions of Americans may face flood risks without adequate insurance protection, especially in areas prone to heavy rainfall.

October 9, 2024

Catastrophe

Legislation & Regulation

Property

Risk Management

Florida

Georgia

North Carolina

South Carolina

Hurricane Milton Insurance Loss Projections Range from $15B to $150B, Says Icosa Investments

Icosa Investments forecasts insurance losses from Hurricane Milton could span from $15 billion to over $150 billion, depending on the storm’s intensity and landfall, with significant implications for the cat bond market.

October 9, 2024

Catastrophe

Insurance Industry

Property

Risk Management

Florida

Hurricane Helene Losses Climb to $17.5 Billion in CoreLogic’s Final Estimate

CoreLogic’s latest estimate puts insured losses from Hurricane Helene between $10.5 billion and $17.5 billion, with total economic losses reaching up to $47.5 billion due to widespread wind and flood damage.

October 9, 2024

Catastrophe

Insurance Industry

Property

Risk Management