Why NFIP Flood Insurance Rates Still Fall Short Despite Risk Rating 2.0

Despite modest increases and Risk Rating 2.0 reforms, NFIP flood insurance rates remain significantly below break-even levels, risking billions in future taxpayer debt.

May 7, 2025

Catastrophe

Insurance Industry

Legislation & Regulation

Property

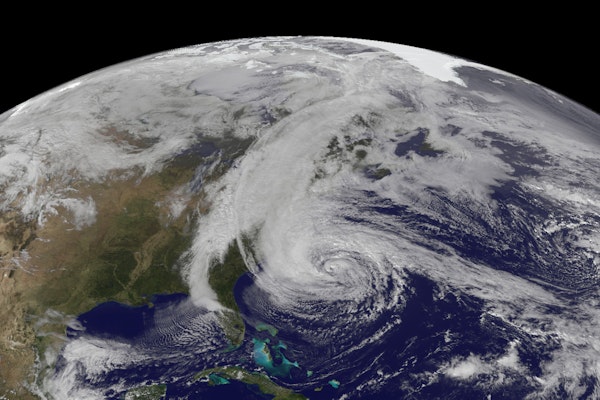

Hurricane Forecasting Breakthroughs at Risk as NOAA Faces Budget Cuts

Despite record-setting accuracy in 2024 hurricane forecasts, funding and staff cuts at NOAA threaten future storm tracking capabilities and public safety nationwide.

May 7, 2025

Catastrophe

Legislation & Regulation

Risk Management

Technology

Colorado

Florida

Nebraska

South Dakota

Wyoming

How Global Shipping Fuels Climate Change and What We Can Do About It

As maritime shipping drives global trade, it also drives emissions and climate disruption. Solutions like slow steaming and wind propulsion may help chart a cleaner course.

May 6, 2025

Catastrophe

Marine

Risk Management

Technology

Western Pennsylvania Slammed by Derecho-Level Storms as Deaths, Power Outages Mount

Severe storms packing 95 mph winds swept through Western Pennsylvania, killing three people, toppling trees, and knocking out power for over 400,000 residents.

April 30, 2025

Catastrophe

Insurance Industry

Property

Risk Management

Ohio

Pennsylvania

Weather Balloon Cuts Challenge Forecasting Capabilities and Emergency Readiness

NOAA staffing shortages have forced a pause in weather balloon launches at key U.S. locations, raising concerns about storm forecasting and community resilience.

April 30, 2025

Catastrophe

Insurance Industry

Risk Management

Technology

Nebraska

South Dakota

Natural Catastrophe Insurance Losses Could Hit $145 Billion in 2025 as Peak Loss Risk Grows

Global catastrophe insurance losses are projected to grow steadily, with a 1-in-10 chance of topping $300 billion in 2025, driven by climate change, urbanization, and rising exposure values.

April 29, 2025

Catastrophe

Insurance Industry

Property

Risk Management

2025 Southeast Texas Hurricane Guide Released for Upcoming Season

The National Weather Service Houston/Galveston office has published the 2025 Hurricane and Severe Weather Guide, offering Southeast Texas residents crucial preparedness tips for the season ahead.

April 28, 2025

Catastrophe

Insurance Industry

Property

Risk Management

Texas

States in Hurricane Zones Face Bigger Disaster Costs as Federal Support Shrinks

States like Maryland are preparing for a busier hurricane season with fewer FEMA resources after nationwide cuts to disaster mitigation funding and staffing.

April 28, 2025

Catastrophe

Legislation & Regulation

Property

Risk Management

Maryland

New Jersey Wildfire Grows to 8,500 Acres as Evacuations and Power Outages Mount

The Jones Road Wildfire near Toms River has burned 8,500 acres with less than 10% containment, prompting evacuations and threatening over 1,000 structures in Ocean County, New Jersey.

April 23, 2025

Catastrophe

Insurance Industry

Property

Risk Management

New Jersey

Neutral Pacific Waters Signal Potential Spike in Atlantic Hurricanes

With La Niña officially over and El Niño unlikely, the Atlantic may face an active hurricane season as neutral Pacific conditions remove key storm barriers.

April 21, 2025

Catastrophe

Insurance Industry

Property

Risk Management

Alabama

Florida

Louisiana

Mississippi

Texas

Homeowners Crowdsource Toxic Smoke Data After Eaton Fire Insurance Disputes

After insurers refused to pay for contamination testing, Eaton Fire survivors shared private test results online, exposing widespread toxic exposure and coverage gaps.

April 18, 2025

Catastrophe

Insurance Industry

Legislation & Regulation

Property

California

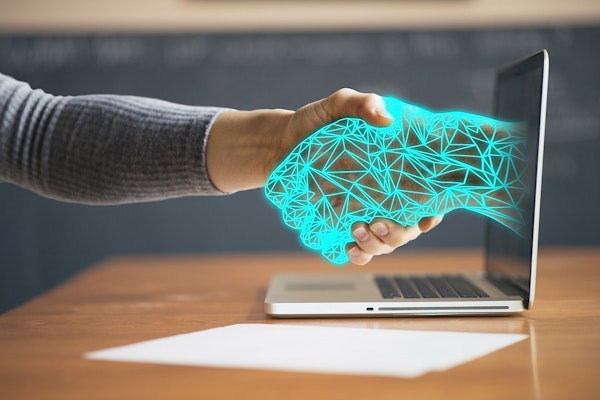

How Agentic AI is Transforming Property Claims and Empowering Adjusters with Digital Coworkers

Agentic AI agents are reshaping property claims handling by helping adjusters automate routine tasks, reduce cycle times, and focus on customer-centric problem-solving.

April 15, 2025

Catastrophe

Insurance Industry

Property

Technology

How Rising Climate Risks Are Reshaping Insurance for Renewable Energy Projects Worldwide

As natural catastrophe and extreme weather losses escalate globally, insurers, developers, and financiers must rethink risk management to keep renewable energy projects insurable and bankable.

April 15, 2025

Catastrophe

Insurance Industry

Property

Risk Management

Buffalo Trace Distillery Begins Recovery Efforts After Kentucky River Flooding

Buffalo Trace Distillery in Kentucky is cleaning up and inspecting barrels after severe flooding, with plans to resume bottling and reopen its visitor center soon.

April 15, 2025

Catastrophe

Insurance Industry

Property

Risk Management

Kentucky

Why Climate Resilience Requires Both Parametric and Traditional Insurance Solutions

As billion-dollar weather disasters escalate, combining parametric and traditional insurance offers a faster, more adaptive recovery solution for policyholders across the U.S.

April 15, 2025

Catastrophe

Insurance Industry

Property

Technology

California

Florida

Louisiana

Mississippi