Scientists Chase Extreme Hailstorms Across the Plains to Uncover the Costliest Weather Threat

Researchers are diving into hailstorms across Texas, Oklahoma, and Kansas to better understand one of the U.S.’s costliest but most overlooked weather risks.

June 9, 2025

Catastrophe

Insurance Industry

Property

Risk Management

Colorado

Kansas

New Mexico

Oklahoma

Texas

Colorado Advances Wildfire Insurance with Predictive Tech Models

Starting July 2026, Colorado will let insurers use advanced risk models for wildfire coverage, aiming to price policies more accurately amid rising climate threats.

June 9, 2025

Catastrophe

Legislation & Regulation

Property

Technology

California

Colorado

How Georgia Can Tackle Rising Insurance Premiums and Loss Ratios

Georgia homeowners face surging premiums after back-to-back hurricanes. Lawmakers and insurers are exploring solutions to stabilize the market and protect consumers.

June 9, 2025

Catastrophe

Legislation & Regulation

Property

Risk Management

Alabama

Arkansas

Florida

Georgia

Louisiana

Severe Storms in US and Europe Trigger Massive Insured Losses

Severe storms across the US and Europe from late May to early June caused extensive hail, flood, and wind damage, with insured losses reaching into the billions.

June 9, 2025

Catastrophe

Insurance Industry

Property

Risk Management

Illinois

Iowa

Kansas

Missouri

Texas

Philadelphia Transit Lot Fire Destroys 40 Decommissioned Buses

A fire at a SEPTA bus lot in Philadelphia destroyed 40 decommissioned vehicles but caused no injuries or disruptions to commuter service, officials said.

June 9, 2025

Catastrophe

Insurance Industry

Property

Risk Management

Pennsylvania

Florida Property Insurers Return to Profit in 2024 After Eight-Year Losing Streak

Following legislative reforms and shifting market dynamics, Florida’s personal property insurers posted underwriting profits in 2024 for the first time in nearly a decade.

June 4, 2025

Catastrophe

Insurance Industry

Legislation & Regulation

Property

Florida

Investigators Say Central California Carjacking Was Staged as Insurance Fraud

A reported van theft involving $60,000 in merchandise near Madera, California was revealed to be a staged event for insurance money, authorities say.

June 4, 2025

Auto

Fraud

Insurance Industry

Property

California

Victoria’s Secret Temporarily Shuts Down Website After Cybersecurity Breach

Victoria’s Secret shut down its website and systems on May 26 following a cyber incident, restoring services by May 29. Some in-store functions were also briefly disrupted.

June 4, 2025

Insurance Industry

Property

Risk Management

Technology

AI Uncovers Insurance Fraud Weeks Ahead of Traditional Detection Methods

New research shows AI tools can flag potentially fraudulent property and casualty claims just two weeks after filing, outperforming traditional investigation methods.

June 4, 2025

Fraud

Insurance Industry

Property

Technology

Arizona

Michigan

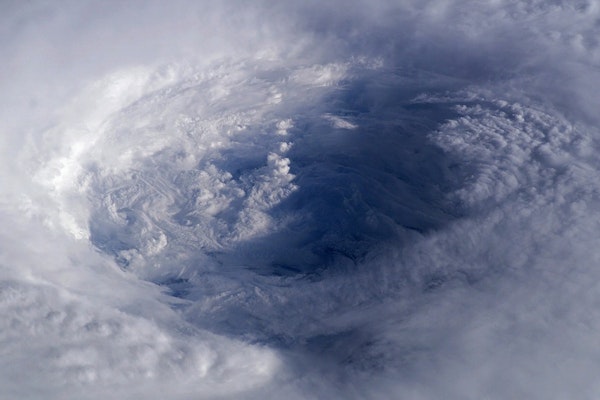

Slightly Stronger 2025 Hurricane Season Expected Amid Climate Uncertainty

Forecasters anticipate a slightly above-average 2025 hurricane season in the Atlantic, though key uncertainties in ENSO and sea temperatures complicate predictions.

June 4, 2025

Catastrophe

Insurance Industry

Property

Risk Management

Florida

Roof Resilience Is the Key to Lower Claims and Safer Homes

With 70-90% of storm-related claims involving roof damage, the FORTIFIED Roof standard offers a proven, cost-effective way to reduce risk and protect property.

June 4, 2025

Catastrophe

Insurance Industry

Property

Risk Management

Alabama

Mississippi

Oklahoma

Storm Surge Risk Threatens Billions in Coastal Property Value Across 20 States

Over 6.4 million homes in coastal U.S. states face moderate or greater storm surge risk, with $2.2 trillion in potential reconstruction costs, according to 2025 Cotality data.

June 2, 2025

Catastrophe

Legislation & Regulation

Property

Risk Management

Alabama

Connecticut

Delaware

District Of Columbia

Florida

How P&C Carriers Can Successfully Modernize Core Systems in Today’s Digital Environment

Modernization of core systems is crucial for P&C insurers to reduce costs, improve customer experience, and keep pace with digital innovation—but success demands a strategic, business-led approach.

June 2, 2025

Insurance Industry

Property

Risk Management

Technology

Early-Season Hurricanes: Where June Storms Typically Form and Why Activity Has Increased

Although June is typically a quiet start to Atlantic hurricane season, recent years show a rise in early storm activity, especially near the Gulf and Southeast U.S. coasts.

May 28, 2025

Catastrophe

Insurance Industry

Property

Risk Management

Alabama

Louisiana

Texas

Frustrating Claims Processes Drive Policyholders to Avoid Filing and Consider Switching Insurers

A new survey finds 22% of consumers skip filing claims due to complex processes, while 64% would switch insurers for a smoother digital experience.

May 28, 2025

Insurance Industry

Property

Risk Management

Technology